Natural gas prices have risen sustainably to levels not seen in nearly 15 years as the war in the Ukraine continues to drag on and Europe attempts to sanction Russia’s energy exports. The EU is attempting to ban Russian crude and natural gas but certain member states, mainly Hungry, have rebuffed these measures.

Russia in turn has vowed to block exports of its critical commodities if unfriendly member states refuse to pay for goods in Roubles. This contentiousness caused commodity prices to skyrocket as future traders have been wary about Russia being blocked from exporting its crude, natural gas, wheat, metals, and other agricultural products to Europe while production is due to drop off due to political pressure from environmentalists and Democrats.

Natural Gas Prices

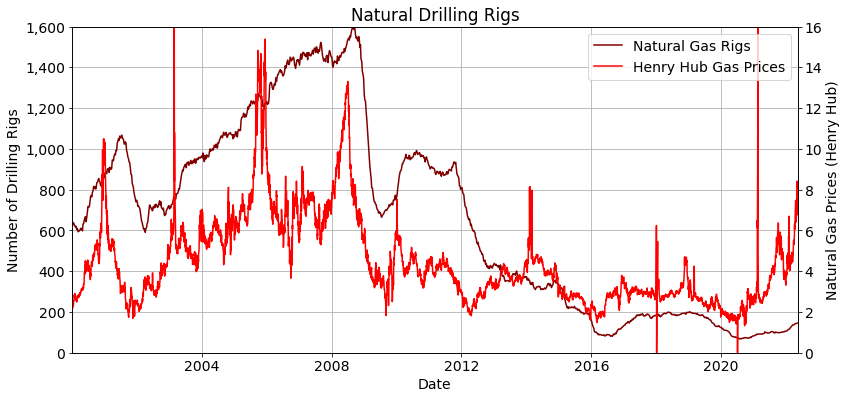

Natural gas has risen to 15-year highs and is unlikely to decline relative to this time of year. Natural gas is primarily used to heat homes in the Northeast and Europe during the winter but prices decline in the spring and fall in the summer as temperatures rise. Prices of natural gas begin to rise in November as nations consume energy to heat their homes.

Apart from the brief spike in natural gas prices during the Texas freeze of 2021, natural gas prices have reached highs not seen since 2008. These high prices during the early summer are caused by tensions with Russia but also due to the unusually low storage of natural gas in the US and Europe.

Natural gas prices fell due to the mass production of oil. Natural gas was a byproduct of oil production as shale drilling produced massive amounts of crude. Natural gas was in such abundance that shale drillers would burn off excess gas. This practice was recently stopped by many oil companies as gas prices have risen.

Natural gas prices continue to rise as tensions with Russia heighten and the number of natural gas drilling rigs struggling to rise. This will change in the long-term as America exports more natural gas to Europe to replace Russian energy exports.

Europe is trying to find other replacements for Russian natural gas but has been struggling to sign deals with large exporters like Qatar. Qatar is one of the largest natural gas exporters and will have more LNG export terminals come online in the next few years but wants to sign long-term contracts that could go on for as long as 20 years.

Natural gas is cheaper to import by pipeline than costly LNG because of the energy required to cool the gas and pricy specialty shipping vessels that are needed to ship the energy. That makes Russian imports exponentially cheaper than imports from the US or Qatar.

Europe is reluctant to sign long-term deals as it sights climate change but the leaders of the EU are likely to mend ties with Russia after the Ukraine war comes to an end and the EU begins rapprochement with President Putin. The EU will likely try to mend ties with Russia whether President Putin remains in the Kremlin or steps down. President Putin has ruled Russia for over 22 years and has become an integral part of the country and its stability. Even if he steps down, his heir will likely be influenced by the president or will have a similar outlook on international affairs. Europe will need to mend ties with Russia because its vast natural reserves and cheap export prices make its relationship with the EU critical to Germany’s economy.

Road to Become the World’s Largest LNG Exporter

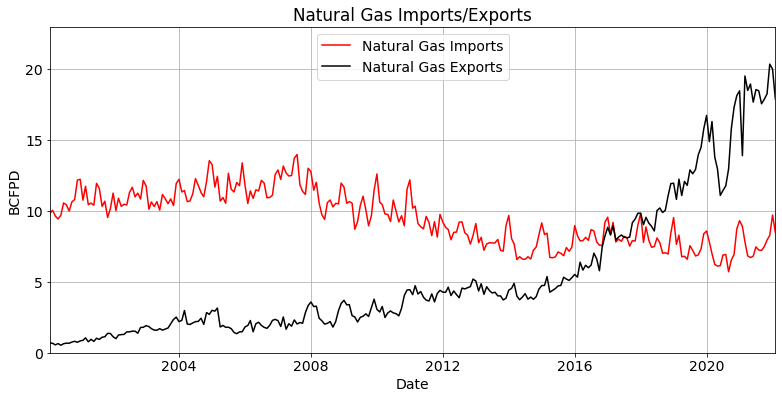

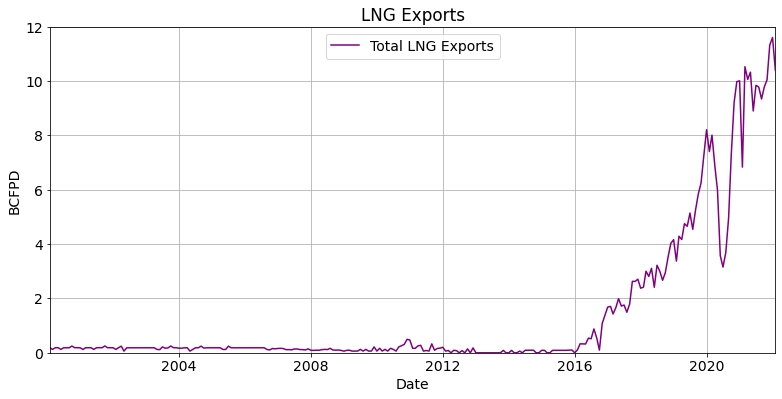

The United States became the world’s largest LNG exporter which is a start turnaround after America was a large importer of natural gas. The US became a net exporter of natural gas in 2017 and has exported billions of dollars of gas to Asia.

Once the US became a net exporter of natural gas, it quickly dominated the LNG market. Its cheaper for countries like China and the EU to import natural gas by pipelines from Russia, Azerbaijan, Uzbekistan, and Turkmenistan but these areas are hungry for cleaner energy and pay a premium.

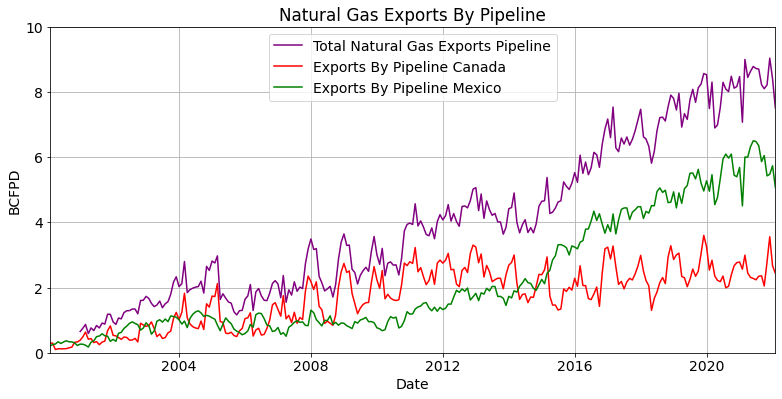

America imported approximately 10 BCFPD of natural gas in 2000 but that imports dropped to 8.5 BCFPD in February 2022. Natural gas imports have decreased slightly in the past 22 years and exports have skyrocketed since 2000. Natural gas exports were less than 1 BCFPD in 2000 but rose to 17.9 BCFPD by February 2022.

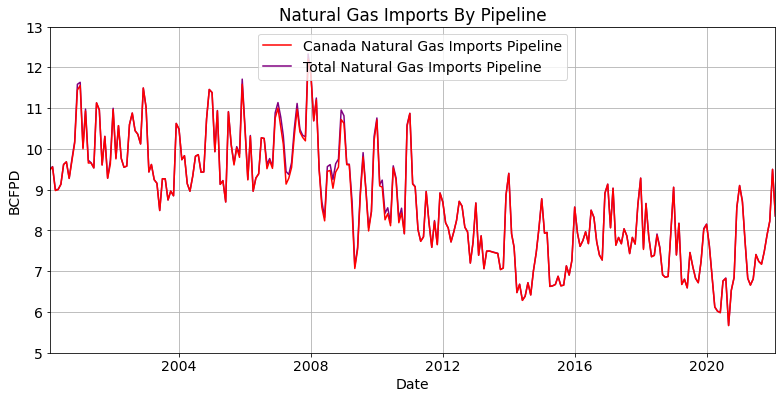

The US imports 8.35 BCFPD by pipeline from Canada which is nearly 98% of all imports. Canada has remained a major exporter of natural gas to the US for years and that number has risen to highs not seen since 2011 when Canadian gas imports were 10.9 BCFPD.

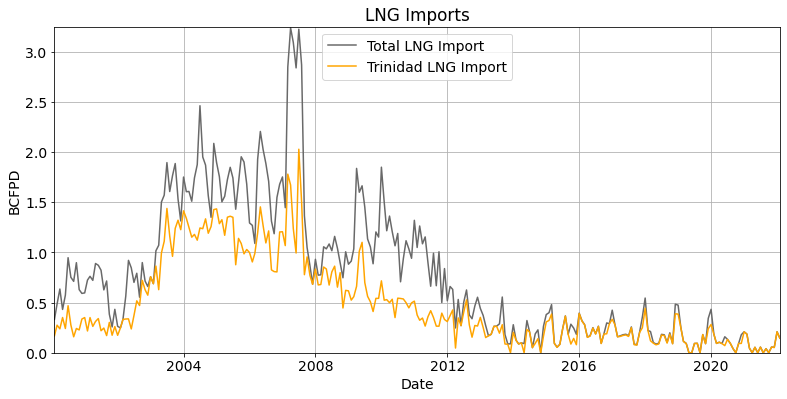

Trinidad makes up the rest of America’s imports. Trinidad is a moderate producer of natural gas and can only export gas via LNG. The country exports approximately 0.15 BCFPD of LNG to the US.

The US exports 7.5 BCFPD of natural gas by pipeline to Mexico and Canada. America is both an importer and exporter of natural gas to Canada as it is cheaper to import natural gas from Alberta into the US and ship gas through America’s infrastructure rather than Canada building its own gas infrastructure.

Mexico is a major importer of energy as Petróleos Mexicanos, or Pemex, continues to weigh on the country’s finances. Pemex is Mexico’s state-run monopoly but struggles to produce oil and natural gas economically. Major oil deposits have been found off the coast of Mexico have been nationalized which reduced overall investment in the offshore industry.

Mexico also has substantial reserves in the Eagle Ford shale that stretch across the border but remains underground due to international companies refusing to cooperate with drug cartels. Drug cartels inhibit oil and gas production due to the violence in the area and criminals tapping into pipelines across the country. Pemex operates in other parts of the country but continued oil thefts, kidnappings, and drug cartels make it uneconomical to produce the country’s vast energy reserves.

America currently exports approximately 10.4 BCFPD of LNG through terminals on the Gulf Coast. Oil and gas companies have attempted to build export terminals on the West Coast but those efforts were rebuffed by West Coast states and Democrats have successfully stopped these efforts by challenging these projects with the EPA.

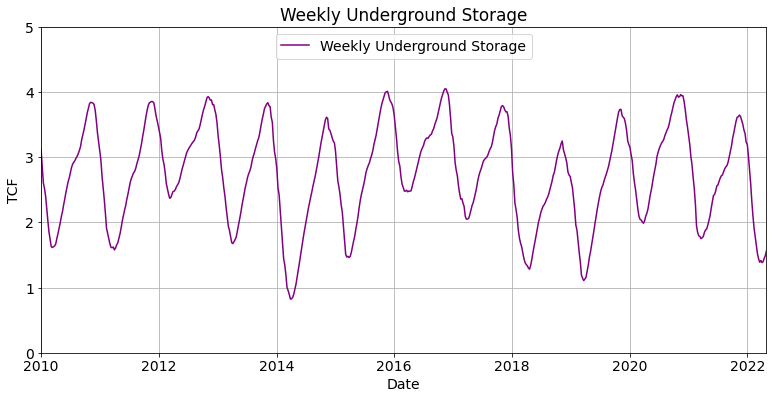

Current underground natural gas storage capacity is at approximately 9.26 TCF which has remained roughly the same since 2013. Underground storage of natural gas varies by the time of year when storage drops in the winter as more natural gas is used for heating and rises in the summer when demand declines.

Underground storage is at 1.57 TCF which is up from 1.49 TCF from the previous week. Natural gas storage will likely rise to 4 TCF as higher prices blunt companies’ desire to store expensive gas and higher prices in Europe encourage companies to ship gas overseas.

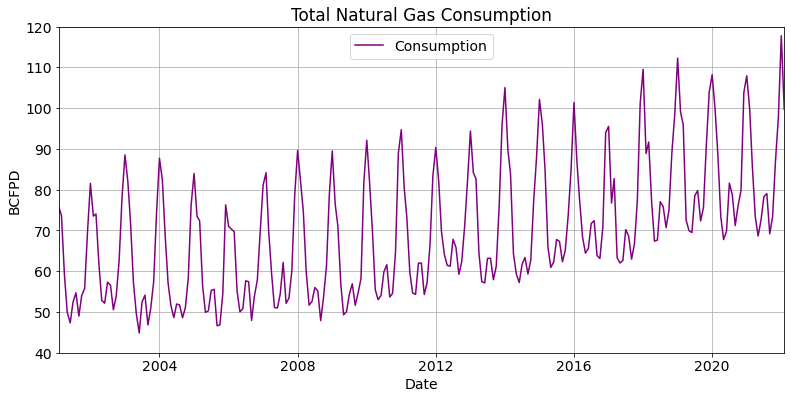

Consumption in the US continues to climb to new heights in the winter of 2021/2022 as demand rose to a new high of nearly 118 BCFPD. Consumption is rising in America as the country diversifies its consumption away from coal to a cleaner source of energy.

Currently, consumption of natural gas is just below 100 BCFPD in Feburay which is down from 117.76 BCFPD in January. Consumption will drop off as temperatures rise but demand for natural gas will rise as Russia is shutting down a pipeline that crosses Poland into Western Europe due to Poland’s support of the Ukraine. The Ukraine may cutoff its Russian pipeline that crosses its borders but if Germany will put pressure to keep gas flowing.