The 2020 election in November is sure to play out in the oil and gas market as Trump and the Republicans support more oil and gas production while Biden and the Democrats would like to transition to a future that focuses on renewable energy. This will reverberate throughout the oil and gas industry as producers will likely cut back on production if Democrats sweep Congress and the White House.

Shale plays have extremely low permeability that prevents the migration of oil and gas from the reservoir to the well. Fracing operations involve pumping sand, water, friction reducer, and possibly other chemicals at high pressures to fracture the reservoir and release trapped oil and gas.

Wells are drilled twice the fracture length from one another to boost the recovery of oil and gas deposits. Frac hits can impact nearby drilling operations and become dangerous for drilling personnel and equipment. Pressure spikes can cause blowouts during drilling operations or sand can migrate into the mud system leading to failures in rig equipment critical in preventing the pressure of the reservoir from coming to the surface. For this reason, several wells are drilled on a lease but are not completed right away. These wells are called DUCs (wells drilled but left uncompleted). Another reason why companies would have DUCs on their lease is that operators have contracts with rig companies to drill for a certain time period or a certain number of wells. It can be more cost-effective for the company to drill the well rather than to pay to break the contract. If prices are in backwardation, the company can wait until prices rise to frac the well and quickly tap into the oil and gas.

Below is a graph that shows the current number of DUCs compared to the current WTI price for crude oil.

The number of DUCs in the US has been rising dramatically in the last few years. The total number of DUCs began to rise after prices crashed at the end of 2014 and rose until 2016. Total DUC inventory declined from 2016 to 2017 as prices rose and producers were confident that prices would rise to $100/bbl again. Price increases did not materialize as producers had hoped so the inventory of DUCs rose until late 2018 when OPEC+ decided to raise output causing the number of DUCs to increase exponentially. Mid 2019 to 2020 saw the total number of DUCs decline as producers completed more wells than they drilled. It is uncertain if DUC inventories will rise substantially in the near future due to the rig count hitting a historic low and the potential for consumption to drop in the next decade.

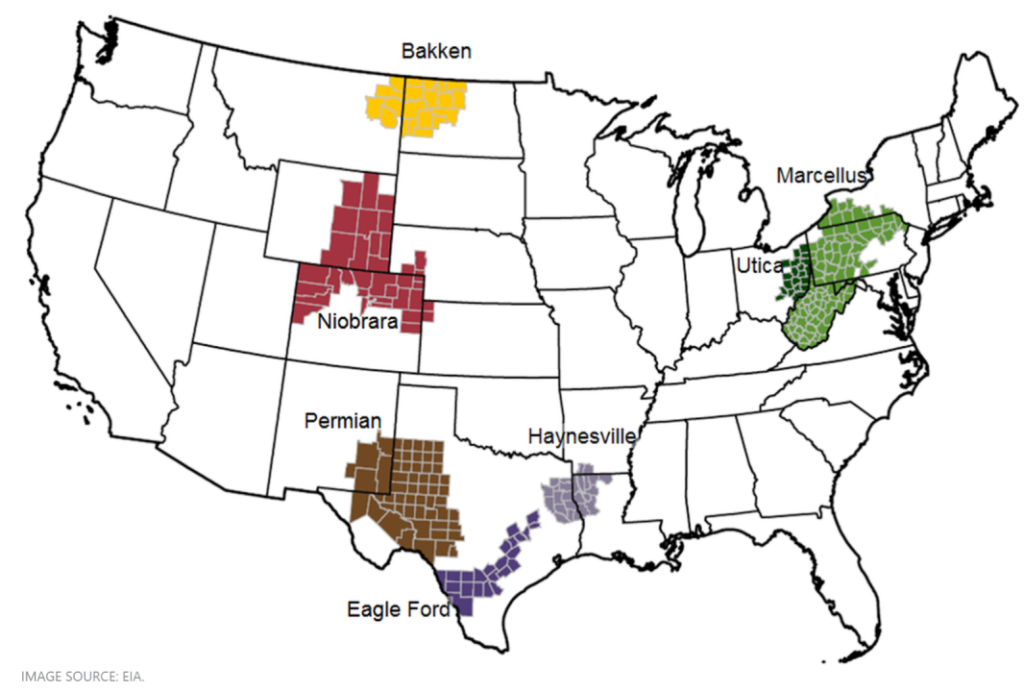

The EIA put the total number of DUCs across the US at approximately 7665 wells in August. Out of the total number of wells, approximately 46% of DUCs are in the Permian Basin, 15% are in the Eagle Ford, 11% are in the Bakken, and the rest are split over several basins in the US. DUC inventory dropped by 77 wells from July to August with the Anadarko Basin accounting for a decrease in 25 wells and the Permian accounting for a decrease in 22 wells.

The Permian accounts for the lion’s share of DUC inventory and has more DUCs than the next two biggest shale plays combined. The Permian Basin is split into several sub-basins with the Midland Basin located in West Texas, the Delaware Basin covers New Mexico and spans the Texas/New Mexico border, and the Central Basin Platform is in-between the Midland and Delaware. The Central Basin Platform is a mature field that is primarily vertical drilling. The Midland Basin has been developed and even though there is always more acreage to be developed, companies have been expanding in the Delaware Basin. The Delaware has federal lands managed by the BLM or state lands that are handled by the NMOCD. Companies that acquired leases on federal or state lands could lose valuable acreage if drilling is banned. If fracing is banned, companies with a high number of DUCs could lose billions in an unprecedented downturn.

Applications for drilling permits are rising as they are relatively cheap to obtain compared to the price of drilling and completing a well. But what will happen after the election is anyone’s guess.

The election is heading into the final weeks and several swing states are heavily contested. The president has rolled back some Obama-era regulations on the oil and gas industry and it is likely that he will continue to support the industry if re-elected. The former vice president has said publicly that he will not ban fracing outright but that he would ban drilling on federal lands. New Mexico, Wyoming, and Colorado will be disproportionately impacted by the ban on drilling on federal lands because the federal government owns a substantial amount of acreage in these states.

President Trump will likely continue to support the industry but will not be able to protect companies from state and local officials in blue states. Colorado proposed prop 112 in 2018 that would have prohibited fracing in large parts of the state. Even though the bill failed by a margin of 7%, local counties and cities will likely enact their own rules to ban the practice through SB19-181. Even Denton, Texas made an attempt to ban the practice at one point before the state stepped in and overruled them. New Mexico’s OCD grants leases and allows drilling and fracing on state lands to provide 40% of the state’s budget but democrats in the state legislature could be unpredictable after the election. President Trump could use his executive authority to help oil companies but local leaders in blue states will likely continue to pass legislation to prohibit the extraction of oil and gas.

If former Vice President Biden wins the election, he has said that he will ban drilling on federal lands to combat climate change but he has said that he will not ban fracing nationwide. Although he seems resolute that he will not pass the Green New Deal there are questions about how much control the former vice president has over the Democratic Party. If the Democrats win the White House, the Senate, and the House, he may be forced to sign legislation that bans the practice all over these United States. He could also make fracing so cost-prohibitive that companies could not economically tap into resources. He could require that companies stop using certain chemicals, use only recycled frac water, or even limit the use of a friction reducer made from a plant. This could be devastating for companies that have planned to tap into their uncompleted wells in the near future.

The progressives in both state and federal houses can impact not only the production of oil and gas but also its consumption. California has announced that they will ban sales of gasoline-powered vehicles in 2035 and several blue states could make similar announcements in the coming years. What will happen in November is anyone’s guess but it is clear that the Democrats and President Trump will continue to be at odds over America’s future energy needs.