Crude prices rose to recent highs of approximately $80 per barrel from historic lows after WTI hit -$40 a barrel at the start of the pandemic. Recently, WTI crude prices have dropped below $70 a barrel after President Biden threatened to flood the market with oil from the Strategic Petroleum Reserve (SPR), OPEC+ announced that they will continue to raise production, and a new Covid variant was announced in Africa.

Initially, President Biden’s announcement of adding approximately 50 million barrels of crude oil into the market did little to soothe high crude prices. Republicans balked at this proposal saying that the US consumes approximately 20 million barrels a day (BPD) and this would only be an extremely short-term solution since drilling is close to historic lows.

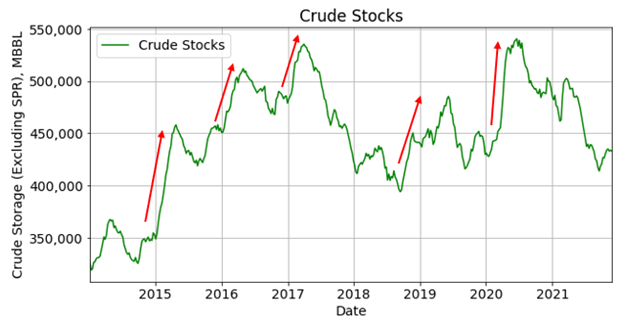

What the Republicans do not realize is that the US does consume a substantial portion of the 90 to 100 million BPD of crude that the world uses but oil stocks rise in the winter after the summer driving season is over. Refiners typically buy a substantial amount of crude in the early winter when prices go down to refine into gasoline as well as other petroleum products that go into everything from food, medicines, and even clothing. After refineries briefly shut down for maintenance in the fall, they draw down crude reserves in the early winter leaving crude stocks (still excluding the SPR) to continue to rise until the spring.

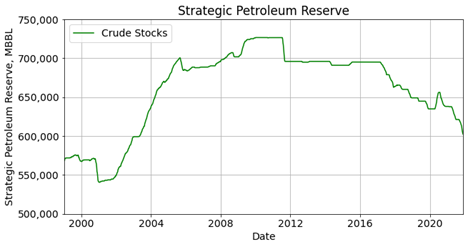

The SPR remained high from President Bush’s second term to President Trump’s first term. We can see that the SPR declined until the start of the pandemic as the US sold off crude oil after President Trump was in office.

The SPR was drawn down under President Trump by approximately 50 million barrels throughout his term before President Biden took office. The small bump after 2020 was because President Trump allowed producers to temporarily fill up the SPR with excess crude after Saudi Arabia sent 12 VLCCs to flood the American market during the beginning of the pandemic when demand essentially dropped to zero.

If President Biden were to draw down the SPR in the winter when crude stocks usually rise then this would have a multiplier effect that would send crude stocks substantially higher and then in turn cause crude prices to plummet in a similar manner to what they did in early 2020.

Below is a graph representing crude stocks in America that do not include the SPR. The axis shows the amount of crude oil in the US in thousands of barrels. Crude stocks have gone up every year except for the winter of 2017/2018. 2014 and 2020 saw the highest jumps in crude stocks as stocks added approximately 100 MMBBLS (100 million barrels) due to flagging demand and over-production.

Americans should be concerned about drawing down the SPR because this could lead to a panic and undermine the public’s faith that they will have enough energy to keep the country going through the next crisis. Since the US has been such a large oil and gas producer and crude stocks are still relatively high there is little to fear about easing the SPR by a few million barrels. This could lead to an energy crisis if drilling does not improve quickly.

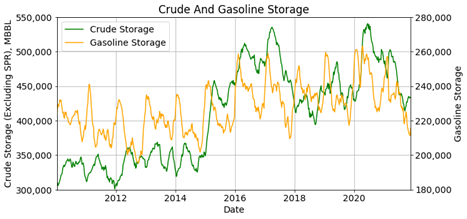

This winter could be similar to the winter of 2017/2018 because drilling has remained subdued and gasoline stocks have touched recent lows. Gasoline storage has fallen below 220 MMBBLS and is close to what it was at $100 a barrel. It will likely rise in the spring but there are a few reasons why there will be less gasoline in the short term. American refiners are hesitant to produce more gasoline than needed due to Covid lockdowns, more electric vehicles are hitting the market and there is less refining capacity available after producers closed refineries due to President Biden’s war on the industry. This could lead to higher gasoline prices even if crude prices drop.

Even if President Biden floods the market over the winter, which is unlikely that he would ever tap the SPR, if drilling remains low into next year then crude stocks will likely drop between 150 MMBBL and 200 MMBBL throughout the rest of 2022 which will put prices squarely in the $100 range. ExxonMobil has said that they plan to curtail their investment in production for years to come because of a variety of factors with the Democrats likely being chiefly among them. Other majors have begun to sell off their assets in the Permian Basin which signals a shift that they plan to either produce overseas or cut back production altogether. Smaller independents will likely react to higher prices and attempt to get every dollar they can by producing as much oil and gas as possible. But an even more critical situation than crude stocks is arising in the gasoline market.

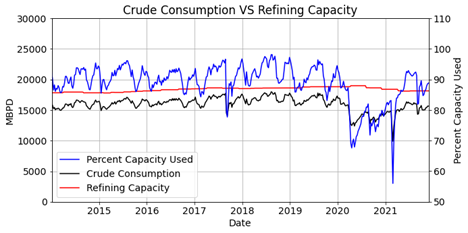

Refining capacity, the red line on the graph below, has dropped slightly to 18.13 MMBBLS, which is still higher than May’s 18.09 MMBBL but close to a 5 year low reached in January of 2016 when it was 18.125 MMBBLS. This is a substantial drop from April of 2020 when refineries had the capacity to run 18.974 MMBBL of crude. This approximate 4.5% drop in capacity might seem insignificant but $100 barrel crude can be caused by a 1% deficit between consumption and production. This deficit in refining capacity means that even if crude stocks rise and crude prices drop, that will not necessarily translate to lower prices at the pump.

US consumption is approximately 20 MMBPD (20 million barrels per day) and refinery input has been below 16 MMBPD for months. There is still plenty of crude left in storage for refiners to tap into but if lower consumption is expected in the future then there will be no incentive for refiners to increase run rates.

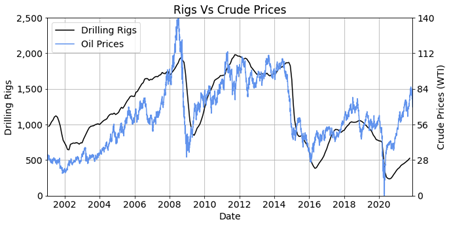

Even if President Biden does follow through with his threat to reduce the SPR it will be like a “band-aid on a bullet wound” as some Republicans have put it. Onshore drilling rigs track the price of WTI crude fairly closely but recently they have not caught up with crude prices. The onshore drilling rig count has remained at approximately 500 rigs which are nearly half of what they were before the pandemic and nearly at 25% of what they were when crude was $100 a barrel.

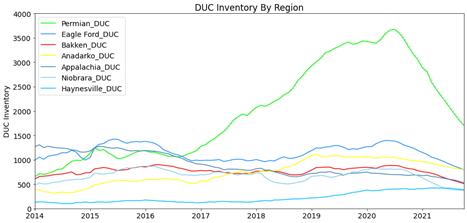

This low onshore rig count has led to a drop in wells that have been drilled but left uncompleted (DUC). This DUC inventory is similar to free underground storage where the well has been drilled and cased but is not fraced. When prices rise, frac crews can come in and complete the wells and flow the oil and gas out of the wells.

The graph below shows the drastic reduction of DUCs in America. The Permian Basin has had the largest reduction of DUCs out of all the regions but it had the most activity before the drop. The Permian Basin is a region that has vast stacked and horizontal shale deposits and was a favorite for majors and minor producers. Producers piled into this region and hoped that they would be able to tap into the thick pay zones and produce large quantities of crude for years to come. One thing that producers did not anticipate is that unconventional reservoirs have a steep decline and production tends to drop to 100 BPD within a year or two. That means that producers have to keep drilling to keep production high and need to keep drilling.

This becomes a problem if President Biden decides to shadow ban fracing or passes unusually high regulatory hurdles for the industry.

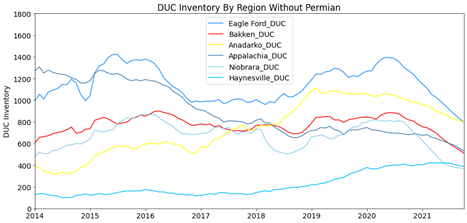

Looking at the rest of the regions we can see that there has been a substantial reduction of DUCs. Most of the smaller regions have a DUC inventory that is near 2014 levels when oil was at $100 a barrel. Regions like the Eagle Ford and the Bakken have dropped substantially lower than prepandemic levels as producers tap into those wells to get more cash revenue.

The DUC inventory can only drop so much because a rig needs to drill every well on a pad before it can move off and let the frac crews work. As the rig completes one well and moves 50 to 100 feet to the second well, the first well becomes a DUC. This happens on a 3 to 5 well pad or even a drill island where there could be hundreds of wells. Also, a rig has to completely drill an area and move away before fracing to avoid frac hits which put the rig in danger. So as long as there is drilling going on in an area this will lead to a minimum base level in the DUC inventory that cannot be reduced right away.

That being said, the DUC inventory will get extremely low as producers are hesitant to invest in production and the drilling rig count stays low. When the DUC inventory hits its minimum point then we will see crude stocks plummet and an energy crisis could occur. If we see the DUC inventory begin to flatten, the rig count remains low, and crude stocks drop then all the oil in the SPR will not be able to save the economy.

President Biden should also be reminded that producers cannot just turn on wells. It takes years of planning, months to get regulations in order, time to find and schedule crews for the rigs and frac fleets, time to drill all the wells in an area then move off for frac crews, the frac crews frac the wells, and finally flow back the wells, produce them, ship the oil to refineries, and then refine the crude oil into gasoline. It is not an underestimate to assume that a company would wait for 2 years minimum before they can produce the first commercial drop of oil from a well.

But oil companies should stop investing in production now if America plans to curtail oil consumption by 2030. There is no reason why majors and minors alike should be investing in exploration of oil and gas deposits if politicians want to shift the country into renewable energy in the next 10 years. But no matter what, America has to understand the situation in the energy market before price shocks begin to hit the economy.