The economy has been overheating since the pandemic started as several industries have been trying to process the vast number of stimmies that the government has rolled out to keep the economy afloat.

The government doled out several personal checks to individuals to help them through the pandemic as small businesses were shut and unemployment skyrocketed. But the government did not stop with just a few individual checks. The government also rolled out ultra-low interest rates, record budget deficits by Congress, PPP loans, and drawing down of over $1.75 trillion in the General Account at the Treasury. As these stimmies were causing inflation to spike, the Federal Reserve denied prices would rise and only now has said that inflation is no longer transitory.

Inflation

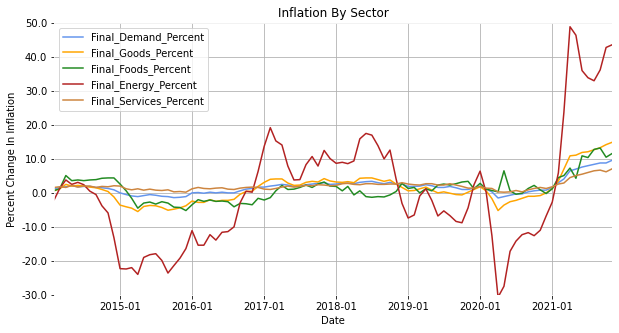

Inflation has been wreaking havoc on the economy even as the Fed kept saying that inflation was transitory. Powell said inflation was transitory because he believed that the supply chain crisis and higher energy prices were the root cause of inflation.

Energy prices have exploded since they went into negative territory during the pandemic. But they are not the only price points that are rising. Final demand on food, goods and even services are seeing prices increases that are not transitory.

Inflation has been spiking because of the sheer amount of money that has been sloshing around the economy as the Fed prints vast amounts of dollars to pump into the housing and stock markets. This has led to sky-high prices for housing, lumber, corn, pork, beef, chicken, and a range of metals. This inflation will be tough for the Fed to tame without raising interest rates substantially to cool off every sector of the economy.

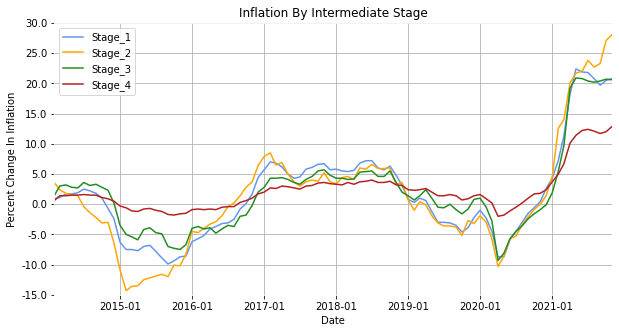

If we look at the different stages of inflation, we can see that Stage 4 is nothing compared to inflation that is coming down the supply chain. Stage 1 inflation impacts the beginning of the manufacturing process and is impacted by raw commodity prices and labor costs in Asia. Stage 4 is closer to final demand inflation that we experience here in the US. Rising labor prices in Asia and commodity prices across the developing world will continue to add to inflation pressures in the early stages and have pushed up Stage 1 inflation. This means that companies will either have to eat inflation costs in the next couple of months or pass that along to consumers.

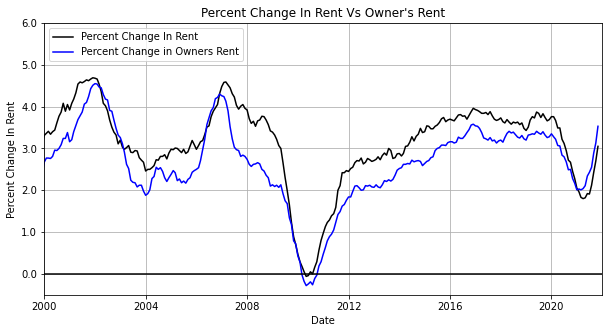

If future inflation indicators were not enough, there is another source of inflation that is expected to hit the economy in the next year. Owner’s Equivalent Rent has overtaken the pace of rent increases and is set to add to inflation in the coming months. This means that people renting out apartments and homes are confident that they can charge more for rent in the coming years which will drive inflation even higher since rent is approximately 1/3 of the calculation for inflation.

There is only one way to reduce inflation and that is by getting rid of the multiple stimmies that are currently being employed throughout the economy. This includes stopping QE which the Fed has already begun, reducing government budget deficits, and even raising interest rates.

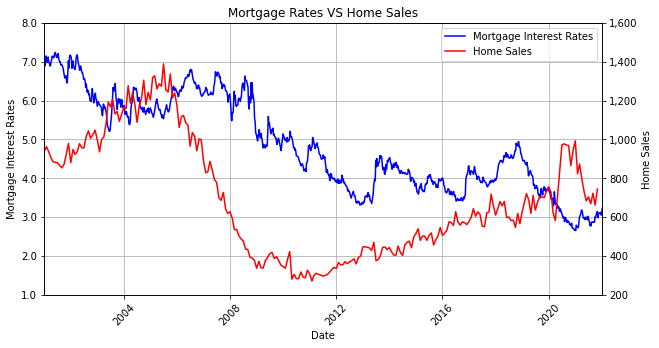

The Fed had to raise rates in the 1980s to get inflation under control and is unlikely to have the political capital to raise interest rates by 2% or 3%. A rate rise of this magnitude will devastate the housing market as potential home buyers will shy away from paying those interest rates. They have a decision to make, either tame inflation that has gotten out of control or stop the housing market in its tracks.

Housing Market

Ultra-low interest rates allowed many Americans to buy their first, second, or third home which has supercharged the housing market. Rising home demand has allowed private equity companies to buy thousands of homes in a single market to drive up prices and manipulate the market. This has driven property prices in several key markets around the country to record highs and the price gains are currently unsustainable.

Many Americans cannot afford to buy a home in some of the biggest US markets right now. Prices are being to crest but are still double compared to only two years ago. This has not prompted the Fed to raise interest rates from historic lows to help cool off the market. Interest rates affect home sales because the psychological effect of having to pay 1% more in interest is worse than over-bidding $50,000 on a home that is already $200,000 over what it should be during normal years.

This psychological effect played out during the 2008 financial crisis when the Fed lowered interest rates by over 2% causing a spike in home sales. These sales began to drop off when the Fed raised interest rates by nearly 2% to cool off the market. The damage was already done as banks made bad loans to Americans that could not afford their homes at sky-high prices. Those loans soured and Americans began to be laid off which triggered a panic in the market.

Once the Fed raised interest rates the number of home sales dropped like a stone and then the meltdown came two years later. Fast forward to 2020 when the Fed lowered interest rates from 5% to below 3%. This caused a spike in housing sales that has driven up home prices. The problem is that the Fed has not raised interest rates and cannot raise them significantly without collapsing the housing market. But the Fed needs to find a way to cool off inflation and the best way is to prevent further borrowing.

The Fed has now said that inflation is a major concern and is no longer transitory. They have started reducing purchases of corporate bonds and mortgage-backed securities and will wrap up QE in March. The Fed is even talking about QT (Quantitative Tightening) by letting maturing bonds roll off their balance sheet rather than reinvesting the money they have pumped into the economy. But the Fed now has to get inflation under control. But how can the Fed get inflation under with ultra-low interest rates that fuel an out-of-control housing market and massive government budget deficits?

Raising Interest Rates

Raising interest rates even by 1% will stop the public from taking out mortgages for fear of overpaying for a house and having to pay a higher interest rate. If the homes coming onto the market do not have buyers, then home values will go down. The number of homes purchased is falling but it’s unclear if declining home sales is because of a lack of supplies or because of lack of interest.

Rising home prices might be the beginning of a small buyers strike for average Americans, but this will not deter home sales in the busiest markets for private equity firms looking to make a quick buck. Zillow got burned by this as they bought too many homes and had to sell some of the 9000+ homes they bought trying to drive up prices. But what happens when home sales begin to decline? As home prices go down then private equity firms and average Americans who overpaid for their homes by approximately $250,000 will be underwater on the homes that they currently own.

Homes Sold

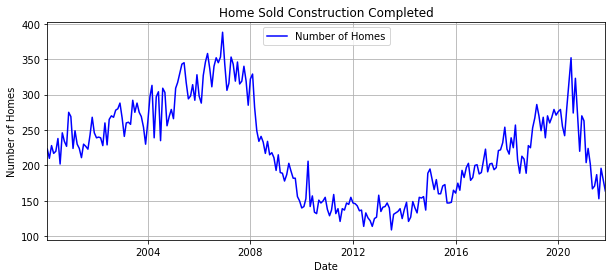

Home sales for houses that have been completed have dropped substantially but this could be because the supply chain prevents homes from being completed. Homes cannot be finished if they don’t have doors, windows, appliances, etc. and this category would naturally drop if this were the case.

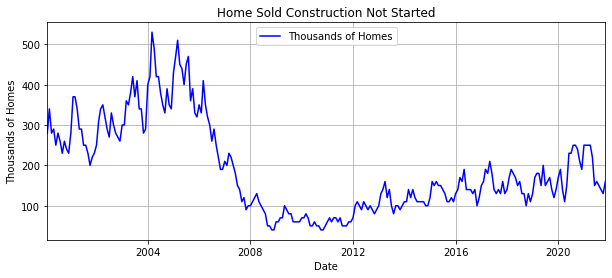

The number of homes that were sold that have not started construction dropped from recent highs. This could be a proxy for private equity firms buying up homes similar to what happened in Conroe, TX as an entire neighborhood was purchased before it was even built. It’s unclear if this is a drop in normal demand or if this is just a lack of inventory as builders struggle to find buildable lots.

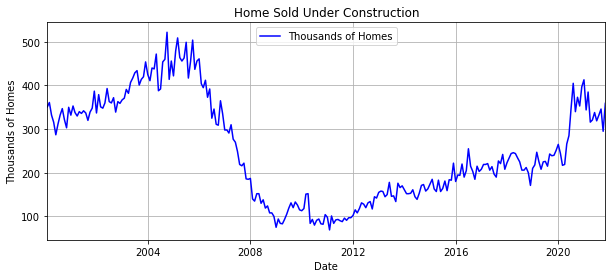

The number of homes sold that are still under construction is substantially higher than before the pandemic. This is because homes are not being completed and Americans are buying homes no matter what condition they are in. Several reports have come out about contractors struggling to source supplies for new homes being built and new buyers moving into homes that have not been completed. This would cause the number of homes sold under construction to be higher than normal.

Home For Sale

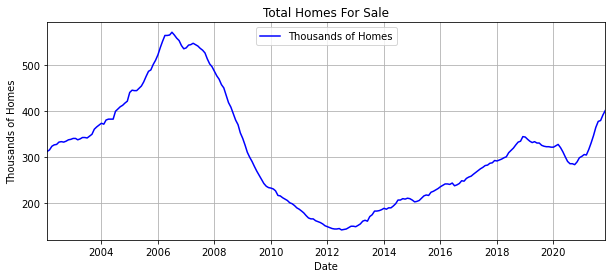

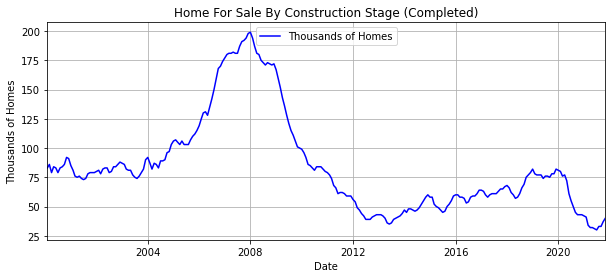

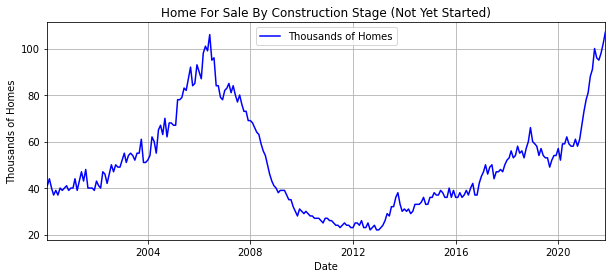

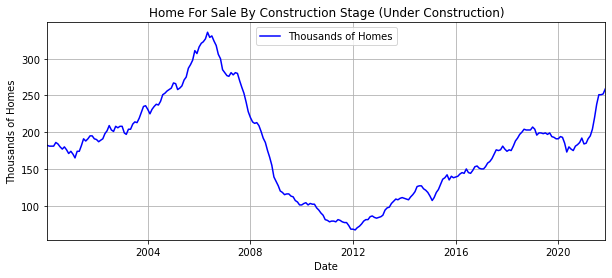

Total homes for sale are rising at a time when the Fed has announced that they will raise interest rates. This number includes homes that are under construction, not yet started, and completed.

Completed homes for sale are quite low but this is not surprising considering the supply chain issues builders are having. Completed homes in hot markets are sold quickly and this number will likely remain low as long as interest rates do not rise quickly.

Homes for sale that have not begun construction show that there will be a lot of supply in the next year or two. Some markets are hotter than others and will likely deal with a backlog of homes, but other markets may have trouble digesting new homes if interest rates rise.

Homes under construction are being sold right now due to a lack of inventory of completed homes. Homes under construction are being bought up and even moved into while they are being finished. These homes that are being built now have the potential to be bought even if mortgage rates rise.

Buyers

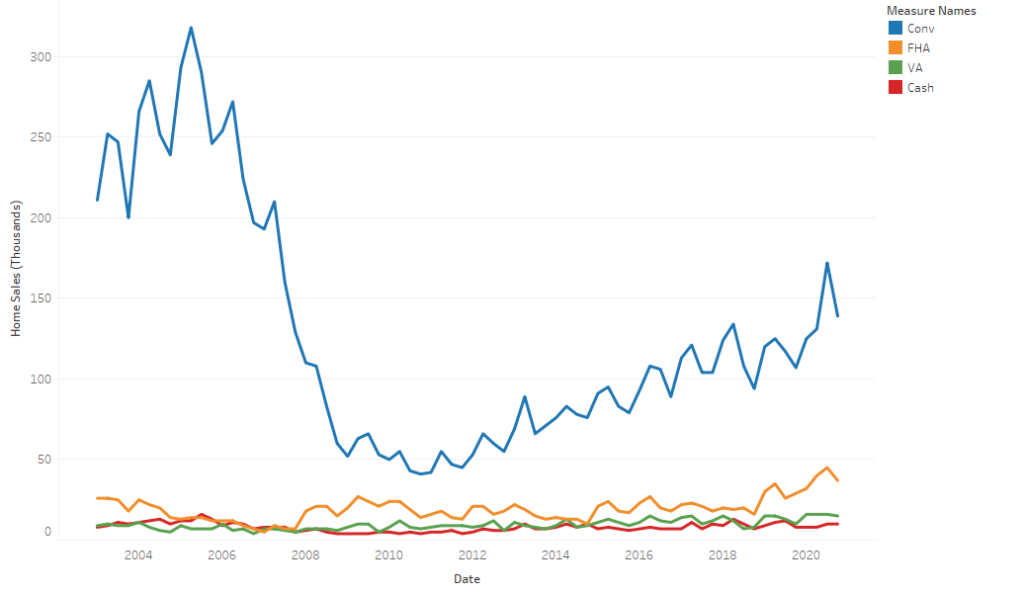

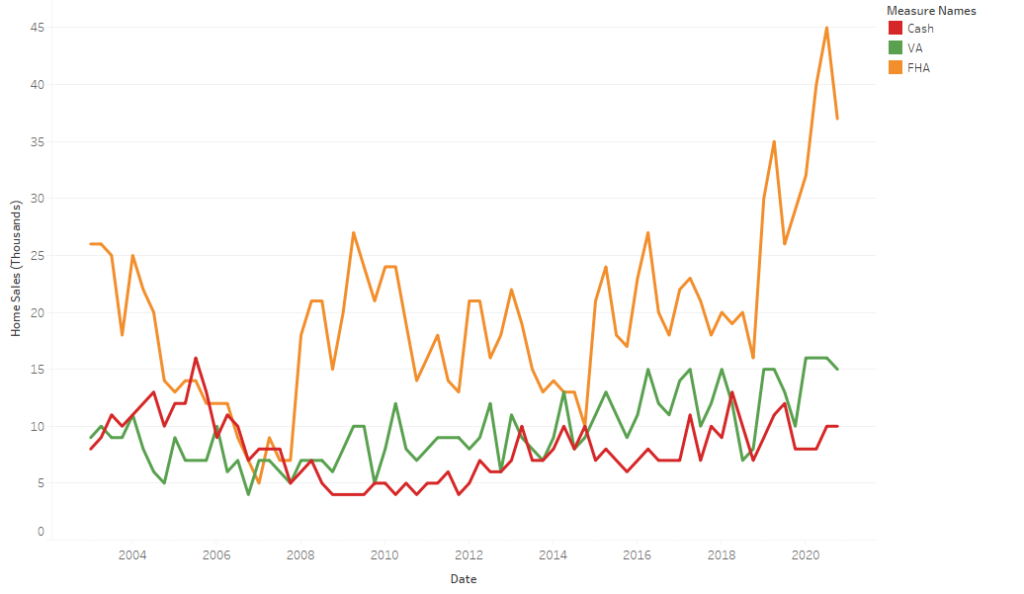

It’s important to look at who is buying the homes right now to determine if it’s average Americans buying homes or if it’s foreign buyers and private equity companies. Cash buyers are usually thought of as foreign buyers but have come to encompass private equity funds that have been purchasing large amounts of homes in cities with high demand.

The largest buyers of homes come from conventional home loans from ordinary Americans. This could be a loan on their first, second, or third home. As interest rates rise this will blunt the demand for conventional loans.

Home sales are nowhere near where they were in 2006 at the height of the financial crisis but FHA loans, a proxy for first-time borrowers that do not have the required 20% needed to buy a home, have come off their recent highs but are still higher than normal. These home loans were rising even before the housing boom, but now first-time borrowers are putting down less than the 20% required for a home they cannot afford.

Federal Reserve

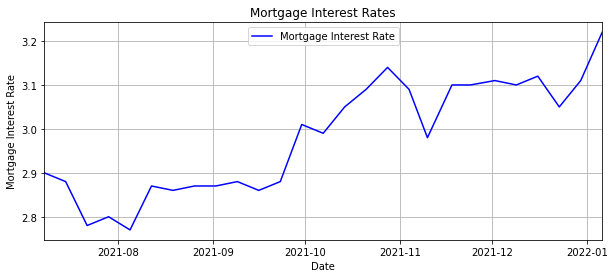

Mortgage rates have begun to rise after the Fed’s minutes where they shifted their conversation from inflation being temporary to QT within a matter of months. Mortgage rates have jumped from below 2.8% to over 3.22% before the Fed has even started to raise rates. The Fed has priced in 3 interest rate rises but it’s unclear how much they will raise rates each time. They could raise rates by 25 basis points each time or just raise them by 10 basis points total.

If the Fed raises rates 3 times in 2022 then mortgage rates could jump over 2% within a year. This would still put mortgage rates low by historical standards but would be a huge leap and a psychological barrier for new home buyers. Buyers may be willing to overbid on a house that is already insanely overvalued but they cannot handle a 2% interest rate rise.

But the Fed needs to raise interest rates even higher than 2% just to keep up with inflation which is officially at 6.8% but likely much higher. An economy cannot function with 6.8% inflation and 3.22% interest rates. Either inflation needs to come down or interest rates need to go up. If future inflation factors are correct then inflation looks like it will pick up in the next 6 months, not slow down.