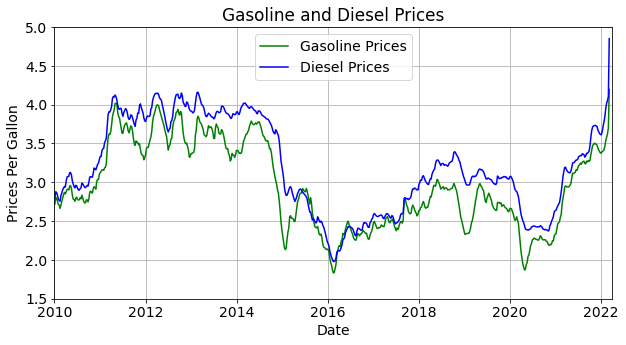

Diesel and gasoline prices have hit record highs as oil prices continue to climb to heights not seen since 2014. Diesel prices rose to a record high of $4.85/gallon from just under $2.5/gallon during the pandemic. These prices have spiked since Russia invaded the Ukraine but were rising well before the military buildup. Gasoline prices have risen to $4.2/gallon from just under $2/gallon during the pandemic. Gasoline and diesel prices are generally a few weeks behind crude prices as it takes time to refine raw crude oil into consumable products. These record highs do not show any sign of slowing down in the near term but will likely slightly decrease.

Prices began to climb in the 4th quarter of 2021 but spiked after Russia invaded the Ukraine. These prices are unlikely to decline sharply in the near term due to a series of factors.

WTI and Brent began to rise after prices reached record lows during the pandemic. Prices fell to -$45/BBL after Saudi Arabia flooded the US. Saudi sent approximately 12 MMBBL of crude oil at one time to push down prices. The 6 VLCCs unloaded almost simultaneously and flooded the market as crude was being shipped by pipeline into Houston. The occurred just as the pandemic was taking place and the economy ground to a halt.

Paper commodity traders were unable to pass on their barrels of crude oil and people began selling a barrel crude for -$45. People on the ground began stashing crude wherever they could and began filling up above-ground swimming pools, the SPR, and any other location that would take crude.

After the collapse of crude prices, WTI and Brent prices struggled to gain traction until Biden was elected in November of 2021. President Biden claimed he would curb oil and gas drilling and as a result, majors exited shale fields across the country. President Biden hit out at oil companies while extolling the virtues of renewable energy and even appointed an oil and gas antagonist as the Interior Secretary. Majors began selling large stakes in the Permian and across the country and switched their slogans from “Lower for Longer” to “Lower Forever”.

This outlook caused the rig count to fall to record lows and crude output to fall. Crude production is set to rise by 500 MPBD to 1 MMBPD in the future but there are headwinds that producers are facing that do not allow them to respond to higher prices similar to what they did in the past.

Energy Independence

Europe will try to reduce its dependency on Russian oil and natural gas but it’s unlikely that they will be able to reduce that dependency. On its own, Russia is a major producer of critical commodities and Europe is unlikely to decouple its dependency on the nation. Russia will likely win the war in the Ukraine and Europe will attempt to normalize relations with its eastern neighbor.

If Russia does secure a favorable government in the Ukraine, then they can put even more pressure on prices of wheat, neon, coal, corn, and several other critical commodities. Even if Russia fails in the Ukraine, they still produce enough precious commodities to influence global politics.

The US banned Russian natural gas and crude products but Europe has said that it is unlikely to do the same. Several European energy companies have said they will unwind their deals with Russian companies but companies like Shell oil have scooped up Russian crude at $28/BBL while the average price was over $130/BBL. This netted them a hefty profit but it shows just how much Europe depends on Russian crude.

Parts of the US are also dependent on Russian energy exports as some states have refused to build pipelines that allow US energy to enter their area. New England and New York have rebuffed calls to develop their shale reserves or to build pipelines that connect shale fields in Pennsylvania and West Virginia so producers can ship natural gas and crude oil across their state lines.

California is also a large importer of energy even though they have vast reserves of crude oil. The state is navigating high gasoline prices that are approximately $6/gallon while many places throughout the country are paying less than $4/gallon. California has also refused to allow producers to ship energy through their state. California petitioned the EPA to block export terminals that would allow producers to efficiently ship crude and natural gas to Asia. Currently, producers have to ship energy through the Panama Canal, which has extremely long wait times, or to go around South America which can inflate shipping costs.

These policies allow countries like Russia, Saudi Arabia, and Venezuela to ship crude to the US and Europe. If Europe wants to reduce dependence on Russia they would have to have decided to expand their import terminals years ago. These terminals take years to plan and execute before they are ready to operate. Since the West decided to shift to renewable energy and rare earth minerals it makes them reliant on crude products and commodities from some of the world’s worst actors.

Supply Chain

Europe’s relationship with Russia is not the only thing that is impacting crude prices. The supply chain crisis impacts the ability of companies to drill for oil and gas. Producers struggle to source things like steel casing and critical supplies that make it almost impossible to operate a drilling rig. China reduced steel production due to environmental concern as well as a fear that demand would subside due to China’s property market meltdown. Producers also likely face shortfalls in critical items like Barite, equipment, and chemicals that are used throughout the drilling process.

Without these key critical components, its unlikely majors and independents will be able to safely drill wells. A drilling rig cannot operate without Barite to weight up the mud, or if things like soda ash and lime are in short supply. Manufacturers need steel and rubber to make things like packers to get cement to surface for cement jobs.

Companies all over the oil field need to hire more employees after they laid off massive amounts of their staff. Some majors just bit the bullet and just finished laying off 10% of their workforce 6 months ago. Now they are expected to hire thousands of those old employees back for possibly a few months while prices are high just to lay them off again if prices collapse in the next few months. Majors and independents have to be able to plan for a reliable future and Democrats have said they will continue to raise fuel standards, make it tougher for companies to frac wells, and will increase regulatory burdens on producers. Producers should wait to invest their capital to see if the current rally in prices is sustainable in the long-term market or if this is just a temporary rally.

Drilling Process

Companies cannot just decide to drill a well, frac the well, and then move on to the next location on a whim. Oil and gas leases take years to negotiate complex legal issues with the federal government and landowners. After the lease is chosen, geology analyzes the field to find a place to drill. This can lead to SEVERAL dry holes where companies invest anywhere from $2 million to $4 million per land-based well or up to $100 million for an offshore well.

After a good location is found, companies have to prep the pad, build infrastructure to produce the oil and gas, schedule a rig, drill multiple wells on a land-based pad, then schedule a frac crew to come out and frac the well when the drilling rigs are done in that area of that lease.

Once a lease is negotiated and the pad is ready, it takes a minimum of 6 months to go from the planning stage to successfully drill a well. Also, drilling is a complicated process. Months can be added to the drilling process if a wellbore fails or drilling equipment get stuck in hole. These complications are quite common and can potentially tie up a rig for an extended period of time.

The drilling process can be complicated and should only be entered into if companies know there will be demand for their product. Consumers are clamoring for more investment in domestic production but if the current administration is dead set in stifling crude demand and restricting exports then producers have a responsibility to their stockholders to reduce capital investment.

Storage

There is another component to the current price environment that is driving up prices. Storage in the US has been dropping steadily as companies have refused to invest capital in production. Storage can include above-ground storage, the Strategic Petroleum Reserve, or wells that have not been completed.

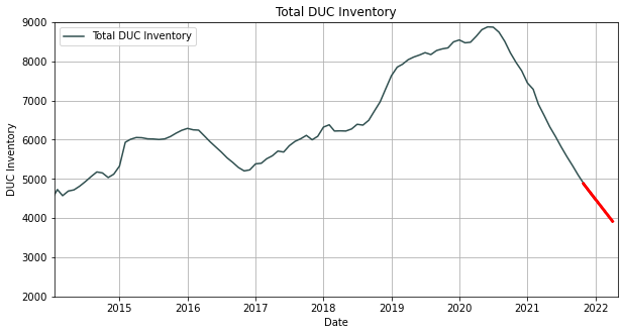

Wells that were drilled but have been left uncompleted are referred to as DUCs. The DUC inventory ballooned as wells were drilled but left uncompleted when prices dropped. These wells can be fraced at a later time when prices rise, when the drilling rig moves away from the lease, or when all the wells on a pad are drilled. The wells that were left to be completed at a later date act as a kind of underground storage.

DUC inventory began to decline even before prices rose at the beginning of 2022. This signaled that companies needed to tap into their underground storage to increase their cash flow as prices struggled to gain traction in the market. They also needed reserves to maintain production but were reluctant to devote capital to future production.

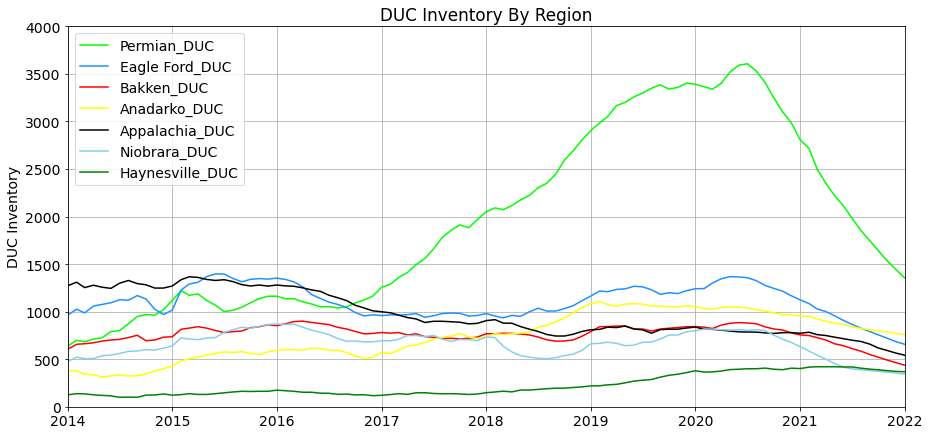

The graph above shows the outsized influence that the Permian has versus other regions in the US. The Permian DUC inventory has declined rapidly since it rose right after the start of the pandemic. The number of drilling rigs in the US climbed to approximately 610 from just over 230 rigs during the middle of the pandemic.

This means that producers have drawn down inventory to maintain production. This marks a turning point in the industry when producers would stop at nothing to drill more wells. Now the slogan “Lower Forever” has taken hold of the industry as President Biden tries to shift the entire economy to renewable energy. But underground storage is not the only type of storage that has declined.

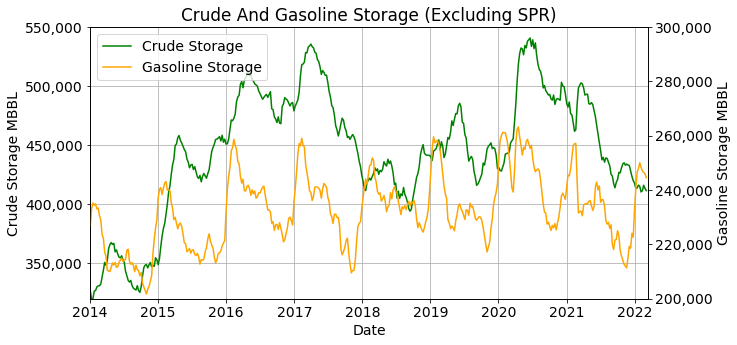

Above ground crude storage, in green, has declined dramatically since record highs at the beginning of the pandemic. Currently, crude storage sits at approximately 411 MMBBL which is down from the peak of 540 MMBBL of crude in June of 2020. Storage was at just over 300 MMBBL of crude in 2014 when prices were over $100/BBL but DUC inventory was also higher at that time. If President Biden had not released 50 MMBBL of crude, then current crude storage estimates would be just above lows not seen since before the collapse of crude oil in 2015.

Gasoline storage, in yellow, has risen in line with this time of year but remains slightly lower compared to other years. Gasoline storage is currently sitting at 244 MMBBL. This is down from a high of 263 MMBBL during the middle of the pandemic but there is very little variation between the highs and lows of gasoline storage. Refiners typically don’t flood the market and judge the market’s needs fairly well. Gasoline storage rises at the end of the winter before refiners have their scheduled maintenance and decline throughout the rest of the year as prices rise. Some years they may need to produce more gasoline as prices run low but for the most part, it’s relatively stable.

The Strategic Petroleum Reserve is located on the Gulf Coast and consists of a series of caverns that store crude oil. The SPR can be tapped in case of an emergency but has already been drawn down once this fiscal year. President Trump began drawing down the SPR right after crude collapsed at the beginning of the pandemic when he let producers store crude in these caverns. Since taking office, President Biden has drawn down the SPR even further. He released 50 MMBBL in an attempt to restrain crude prices but this had very little effect on the market. He even committed a further reduction of 30 MMBBL in conjunction with several countries around the world.

This added reduction of the SPR will most likely have a negative effect on the market as investors begin to grow concerned that the US will not have enough reserves in case of an emergency. The President will continue to draw down the SPR as prices will likely remain high but producers remain reluctant to invest capital in future production.

The political situation in the US will be the biggest factor in the reduction of crude oil storage in the future. Companies will be reluctant to invest serious capital even if prices are higher than normal. This reluctance was probably brought on by plans from different states to remove gasoline-powered vehicles from US roads and President Biden’s appointment of Interior Secretary.

Also, the current administration campaigned to reduce dependence on fossil fuels in favor of renewable energy. It’s unclear if this shift in the economy will continue in the future. America will likely try and crackdown on Russia which is a major supplier of commodities used in renewable energy but this will be difficult if Russia decides to stop sending its resources to the West. Also, Ukraine is a major producer of neon, food, and grains which may blunt America’s appetite for more sanctions.

Imports

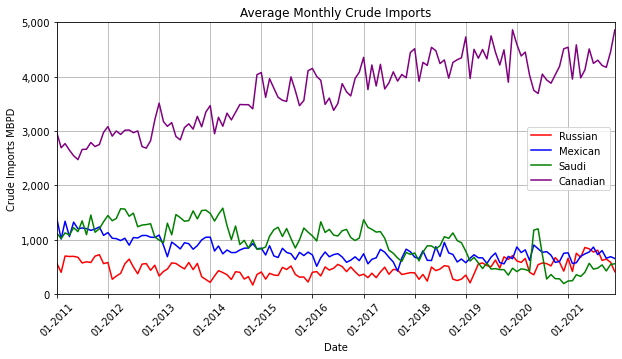

President Biden announced that the US will ban Russian crude oil, crude products, and natural gas imports due to the war with Ukraine. The US has ample supplies to cover Russia’s 412 MBOEPD of crude imports and not suffer any supply constraints. Russia only exports approximately 4% of US crude imports and these supplies are unlikely to impact the US market. Russia is also likely struggling to export crude oil since Shell picked up a cargo for $28/BBL. Banning Russian crude oil will not allow Russia to take advantage of any price increases and it will not drive up prices in the long run.

Canada, in purple, exports vast amounts of crude to the US through rail and pipelines. The US recently canceled the Keystone XL pipeline over environmental concerts and this pipeline would have shipped even more crude from Canada to the US. WCS from Canada is typically heavy oil which is harder to convert into gasoline and diesel but is still a bargain at current prices.

The US is also the number one LNG exporter in the world right now and can easily overcome any ban on Russian LNG imports. The Jones Act could complicate crude and natural gas shipments to areas that have refused to install new pipeline capacity. New England and California put up barriers to import US energy supplies by land while purchasing supplies from the Middle East and Russia. This could complicate energy supplies in these areas because they will have to pay more for natural gas and crude products in the future from the Middle East or South America.

The US imports approximately 6.53 MMBPD of crude oil and a total of 8.7 MMBPD crude oil and crude products. The US is a net importer of crude oil but is a net exporter of crude oil plus petroleum products. As prices in Europe skyrocketed due to their reliance on Russia, prices in the US have to rise with them to remain competitive.

Exports

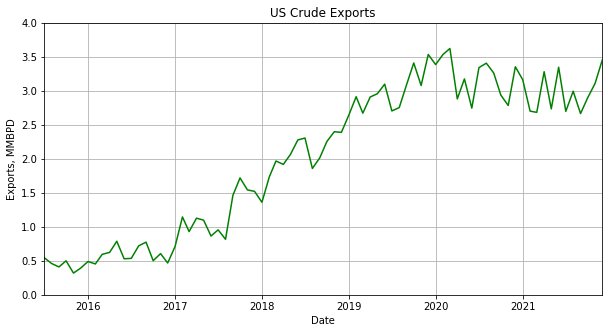

US is also a major crude exporter and these exports, coupled with US imports, ensure that prices in America remain similar to prices overseas. Prices will rise in the US as prices rise in Europe and Asia due to conflict with Russia.

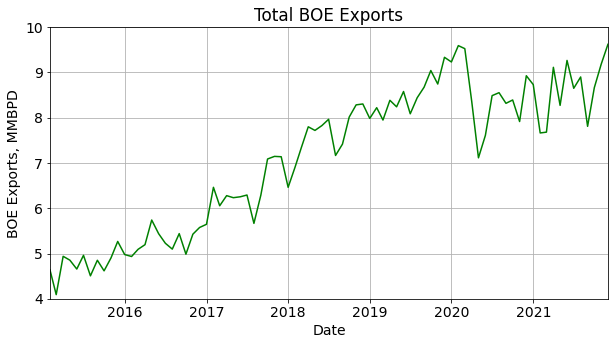

Crude oil exports are near pre-pandemic highs but may decline unless producers invest capital in future production. Crude exports hit a high of 3.62 MMBPD in December of 2021 after falling slightly to just above 2.5 MMBPD at the start of the pandemic. Currently, crude exports are 3.46 MMBPD and will likely reach record highs as Europe tries to diversify supplies away from Europe.

US exports a record high of 9.62 BOEPD of crude and petroleum products as of December 2021. This is up from just over 7 MMBOEPD from the beginning of the pandemic.

Exports will begin to decline in a few years as production declines from rapidly depleting shale wells. Production from shale wells depletes rapidly and with little investment in shale fields and the draw of DUC inventories means that exports may begin to decline in the future.

President Biden has signaled that he wants the country to diversify away from fossil fuels like coal, oil, and natural gas into what he considers cleaner energy like solar panels, wind, and electric vehicles. He wants to make this move quickly and push car companies to want to go fully electric by 2030. It’s unclear what his short-term goals are for the oil and gas industry but it’s clear from his choice of Interior Secretary that he will increase regulations that will impede oil and gas extraction. Transitioning a complex economy like the United States into a new type of energy over the course of two decades can lead to complex problems.