Markets have been struggling with volatility in the Forex market since the beginning of the pandemic as countries have struggled to balance the protection of citizens’ safety with the economic consequences of shutting down their countries. Countries are struggling to contain currency fluctuations as they balance political factors and slow economic growth. As these factors weigh on economic growth the shifts in their currencies can have monumental impacts on GDP growth.

Russia

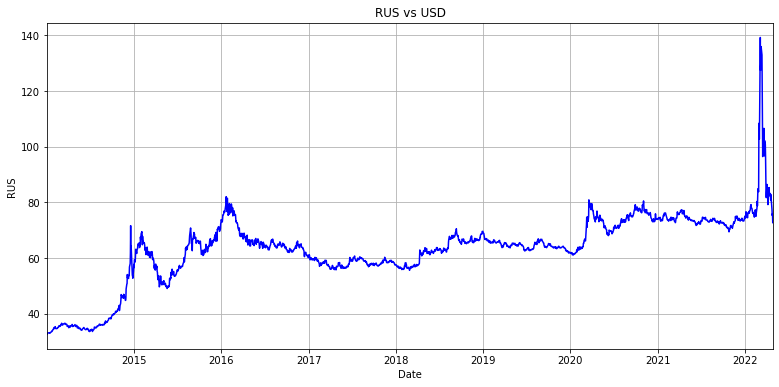

Russia has struggled with stabilizing its currency well before the pandemic but has strived to insulate the economy from outside forces. Russia experienced a drop in its currency during its 2014 financial crisis as oil prices dropped and the country struggled to deal with the fallout of its takeover of Crimea and Eastern Ukraine. Russia was able to mitigate the damage its devaluated currency did to some of its all-weather allies.

Kazakhstan, Tajikistan, and Belarus have a beneficial trade relationship with Russia but were impacted by the collapse of the Russian Rouble. The devaluation of the Russian Rouble was detrimental to Central Asia because it makes imports more expensive. Russia was able to stabilize its currency and arrested its declining economy which improved its trade relations with its all-weather allies.

Since the 2014 crisis, Russia has insulated its economy and has become one of the world’s largest commodity exporters. It is well known for its oil and natural gas exports to China and Europe but the country has positioned itself as large wheat, gold, nickel, and steel producer. In fact, China and Russia make up the number 1 and 3 largest gold producers in the world.

From 2017 onward, Russia has kept its currency relatively stable until the beginning of the pandemic. Even after the initial shock of the pandemic wore off Russia was able to arrest the decline of its currency as investors realized how critical Russian exports were to Europe.

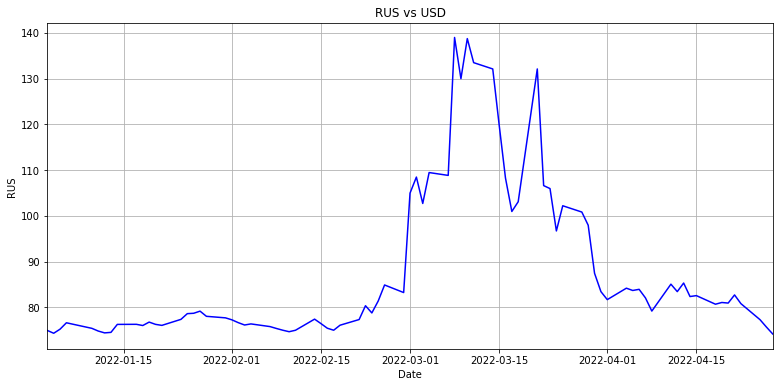

The currency was steady until Russian troops crossed into the Ukraine in February 2022. This unleashed a torrent of European and American sanctions on the country as Eastern European countries pushed Germany to adopt a hard line against Moscow. This had the effect of collapsing the Rouble as international investors and Russian citizens diversified their currency holdings.

After the initial shock of the pandemic wore off, Russian citizens were emboldened by President Putin’s ability to leverage the country’s commodity exports in exchange for Roubles. If President Putin can successfully leverage the billions of dollars in oil, natural gas, agriculture, and metal exports to support the Rouble then the currency will continue to appreciate.

The dollar-denominated exchange rate for the Rouble hit a high of R140 but is already below R74 per dollar. The Rouble has erased any losses experienced since the start of the war and has even strengthened to 2020 highs.

The country will continue to leverage its exports to support its currency as it has threatened to cut off Europe if they do not pay for these commodities in Roubles. Europe has pushed back against this request but will likely capitulate if Russia applies pressure. Germany is hungry for natural gas and the threat of Russia cutting them off from oil as well will be enough to dent their GDP. Germany finally mentioned that they would be on board with banning Russian oil, 2 months into the Ukrainian war, but has been reserved about expanding sanctions on other commodities.

Russia has even cut off natural gas flows to Poland and Bulgaria. This will have little impact on Poland as it has enough natural gas in reserve and is a heavy user of coal. Poland can even import natural gas through Germany or an LNG terminal on the border with Germany. The embargo on Bulgaria will probably have little impact as the country has the Nabucco pipeline that runs from Azerbaijan to Europe but it is unclear what its natural gas reserves are now that winter is over.

China

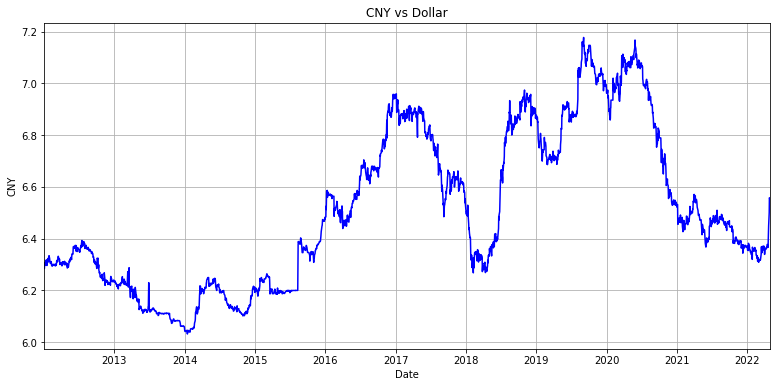

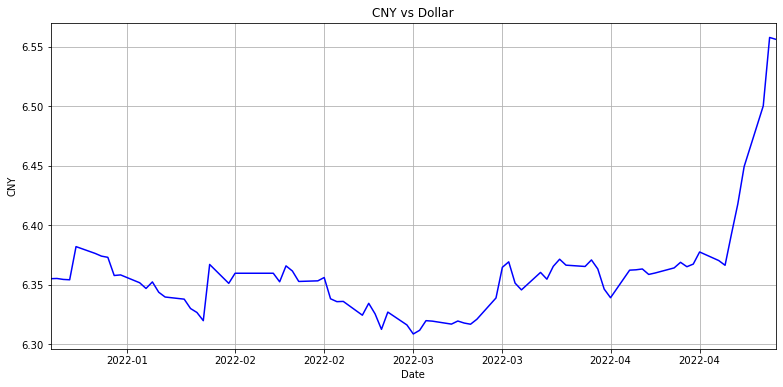

Russia is not the only country that is dealing with issues in the Forex market. China has been dealing with its own issues as its currency has strengthened. The Chinese RMB (Yuan) does not see large changes in its value as its pegged to the US Dollar through its previous purchases of American debt and assets.

The RMB strengthened at the start of the pandemic which is interesting. This is interesting because the RMB could already be a reserve currency if investors flock to the currency during hard times. If there are more shocks to the global financial system and the market continues to see the RMB strengthen then this could mean that investors feel safe enough to invest in the country during a financial crisis.

After the initial shock of the pandemic subsided, the RMB weakened slighting before strengthening by nearly 10%. It is interesting that the RMB strengthened to 3-year highs as the Chinese economy has struggled with several economic hardships. The country is experiencing its own version of the 2008 financial crisis as most developers in the country has seen home prices plummet and construction halted as they struggle to pay down debt.

Residential construction has begun again but this crisis is even worse than what happened in the US because the Chinese invest their savings in the real estate sector versus the stock market. Chinese citizens prefer to invest their money in something more tangible like the real estate sector as the country has seen many shocks to its economy and the stock market is relatively new. This means that when the real estate sector collapsed, so did the savings and retirement accounts of many Chinese citizens.

But the real estate sector is not the only issue the Chinese economy is struggling to support. The manufacturing sector is also struggling with a stronger RMB. The stronger a country’s currency is, the harder it is to export goods and services. This means that China can import goods cheaper but it is harder for manufacturers to ship goods overseas.

Shipping prices are another hit to the manufacturing sector. Shipping prices have risen from $2,500 to nearly $20,000 per TEU during the height of the pandemic due to increased demand and supply chain issues. These higher shipping prices combined with higher commodity and labor prices impact manufacturing which makes up a substantial sector of the economy.

Although a stronger currency makes it harder to export, a sharp fall in a currency can be just as detrimental to an economy. The Chinese RMB has fallen approximately 3% in a few weeks which can mean that the economic headwinds could be blowing the economy off course. If the RMB continues to fall at the same rate over the next few months, investors that had faith in the RMB could rethink their choice of safe-haven currencies.

Japanese Yen

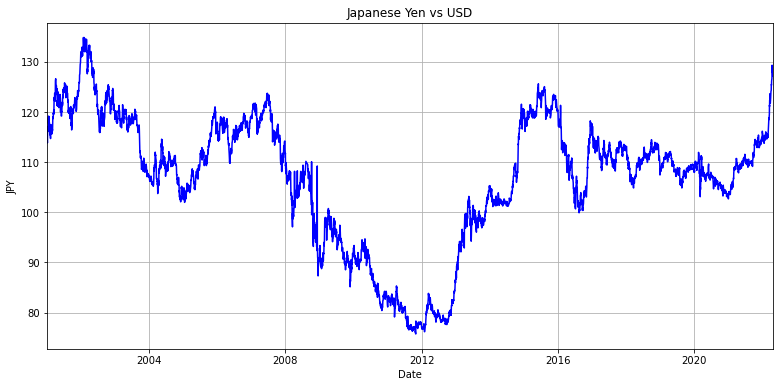

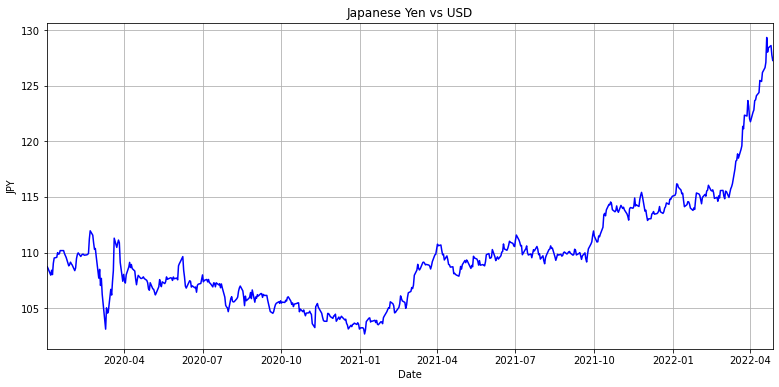

The Japanese Yen is another safe-haven currency that has seen its currency weaken rapidly. During the early days of the pandemic, the Yen strengthened as investors sought out their currency as a safe-haven currency. Japan is a strong exporter of electronics and vehicles which were both hit hard due to the lack of computer chips during the pandemic. Toyota had the foresight to pre-order thousands of computer chips before the pandemic began which allowed it to gain the number 1 spot in the US for sales in 2021.

Other electronic makers were not as lucky as they struggled to produce goods and ship those goods as ports in California had wait times that stretched for months. This backlog grew to such proportions that President Biden moved these ships further offshore to reduce the official backlog in a bid to improve poll numbers.

The Yen gradually strengthened by nearly 10% before gradually weakening. A gradually weakening currency means that exports become cheaper which is good for an export economy.

The Yen gradually weakened until the beginning of 2022 when the Yen began to weaken at a faster pace. The Yen fell by nearly 15% in a matter of weeks which has begun to shake investors’ confidence in the global economy. The Yen has dropped to a 20-year low and investors are betting that it will keep falling. Japanese investors have been trimming their purchases of foreign bonds as the strengthening Dollar and weakening Yen makes the differential between interest rates negligible. If the Yen continues to weaken this could spell trouble for the global economy at a time when US stocks are in decline and Chinese cities are put under lockdown.

European Union

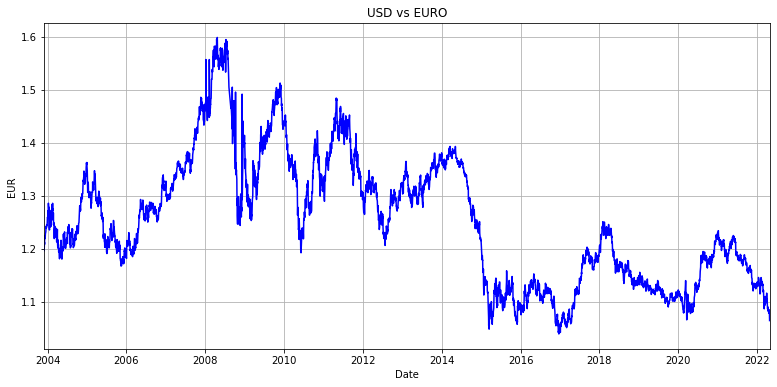

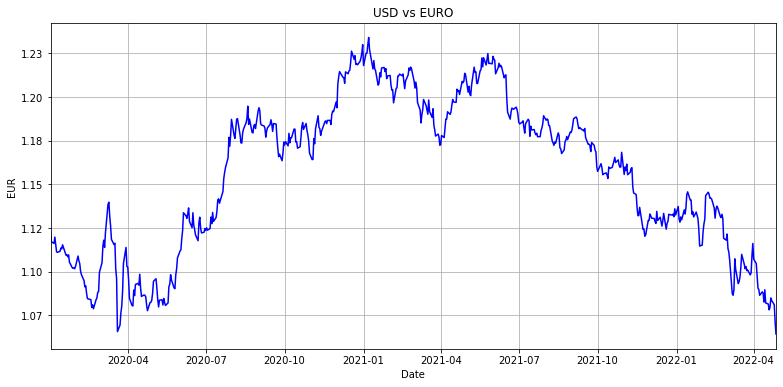

The Euro is another global currency that is dealing with Forex issues. The Euro is worth more than the USD but is weakening at such as rapid rate that it will be at a 1:1 ratio before the end of summer. The Euro strengthened at the outset of the pandemic as one of the world’s largest safe-haven currencies but has been dropping since 2021.

Germany is a major exporter which means that a weakening currency is a boost for the economy but many European countries are major importers. A weakening Euro means imports become more expensive and energy is already at record highs. Also, while Germany exports a substantial amount of high-end electronics, these products require scarce computer chips and have become difficult to manufacture during the pandemic. The chip shortage will ease soon but the damage is likely done to the German economy.

The Euro has dropped nearly 14% since the summer of 2021. If this keeps up then its value will fall below the US Dollar. Its unclear what effect this will have on the economy but it could cause investors to panic.

The Euro is currently at 1.06 which is close to a record low of 1.04 set back in 2016. If the currency begins to weaken this could mean that the continent will experience hyperinflation. Eastern European worries about a Russian invasion will be magnified by the economic turmoil of a falling currency and a slowing economic growth in a bid to cool off inflation. If the Russian/Ukrainian war continues and the pandemic continues to wreak havoc on the supply chain, investors could see the Euro weaken even further which will have unclear impacts on the largest economies in Europe.

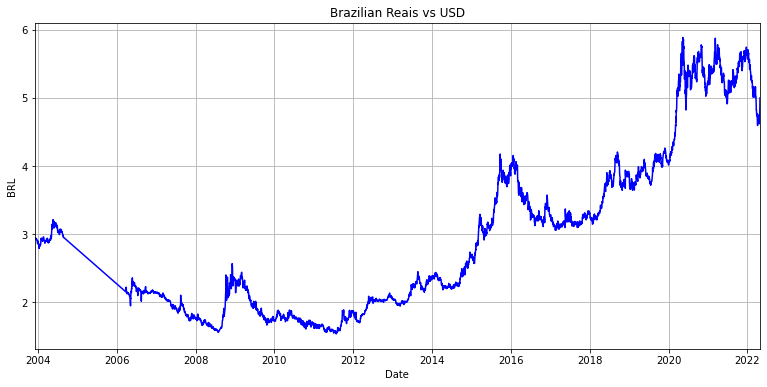

Brazilian Real

The Brazilian Real is one of the few currencies that is seeing its currency gain strength since collapsing after the beginning of the pandemic. The Brazilian Real has strengthened by 20% since falling to record lows during the pandemic.

Brazil is a major agricultural exporter so a weaker currency is good for exports. But a currency that is falling fast dents confidence in the economy and adds to inflation worries. The currency has begun to weaken in the last few weeks and is still near record lows but faith is being restored in the economy as interest rates are over 10%. They kept this rate high and were able to reverse some of the weakness in the currency. Now the Real is beginning to weaken but the government has restored some confidence in the currency.

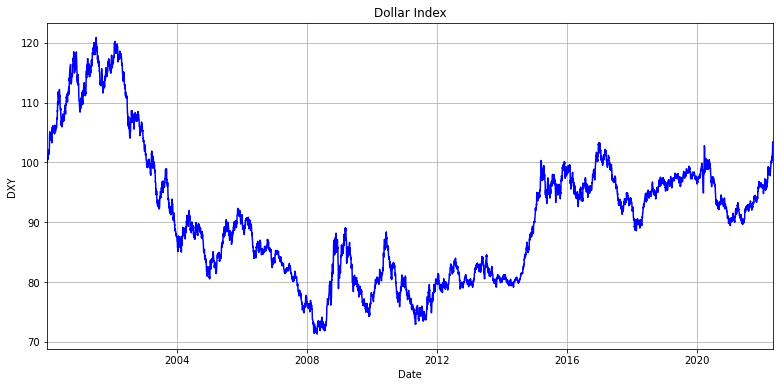

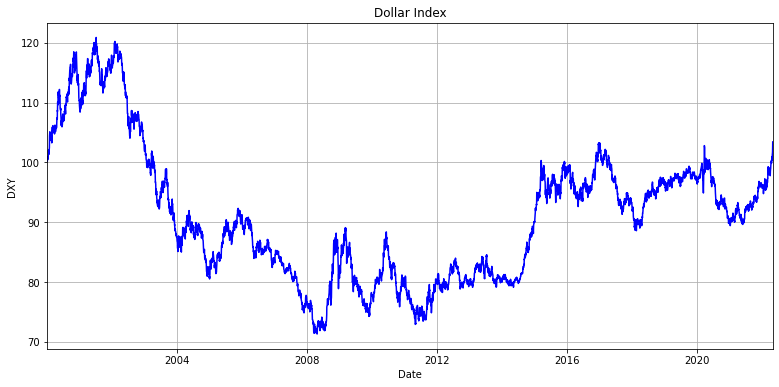

DXY

The DXY is a weighted index that compares the USD to multiple major currencies. This index indicates whether the Dollar is weakening or gaining strength as it rises or falls below 100. The dollar has spent most of the 21st century under 100 as the currency gradually weakened. As mentioned before, a gradually weakening currency means that exports become cheaper. A weakening currency also allows the US to compete in a world with weakening currencies.

The DXY is currently at 103.44 and rising. This is because the Euro has a larger weight than other currencies but the Yen’s depreciation also helps bolster the Dollar. The Russian/Ukrainian war will likely weigh on the Euro as the economic troubles on the continent mount in the future. The DXY index has risen to a 20-year high which will weigh on exports as the current trade deficit is still hitting record highs on higher energy costs. The US might intervene in the FX market to bring down the dollar or it may let the USD strength to combat rising inflation.

Other Currencies

Other currencies to note are the Turkish Lira and the Indian Rupee which are both at record highs. The Turkish President actually cut interest rates as inflation was growing out of control which caused the currency to collapse. This caused a wave of investment into the real estate sector as the currency doubled since the start of the pandemic. This wave became a tsunami as Russians began hiding their wealth in the country to protect their savings from the collapse of the Rouble. India’s currency has depreciated at an accelerated rate since 2011.

There seems to be a race to the bottom of the FX market by major economies around the world. The DXY is currently at a 20-year high right now but if the US starts to intervene in the market this could cause the USD to collapse. The US has not insulated its economy the same way the EU, China, and Russia have been doing for the last 20 years. If the USD collapses it will take a lot for the US to get back to being a safe-haven currency.

The one good thing that the USD has going for it, is that it has very little competition. The European Union has substantial barriers preventing major economies from decreasing their trade deficit and China is so unreliable that companies are forced to invest in the country through Hong Kong rather than through direct investment.

No matter what, the US government tends to overshoot its economic goals and they will have to be subtle about their plans to depreciate the currency during a recession.