Rising natural gas prices are adding to inflationary pressures around the world as the war in the Ukraine is reshaping Europe’s demand for energy supplies. Russia launched an invasion into the Ukraine as it was being encouraged by the United States to join NATO. The US began sending weapons and special forces to the Ukraine at the start of the war as the military and civilians began to fight the Russians. Europe has finally realized that Russia was a threat after years of proding from the United States and has said it will need to diversify its energy supplies away from Russia.

Germany is the largest importer of Russian energy but has banned coal and eventually agreed to ban oil after the war was well underway in the Ukraine. The Ukraine stopped a pipeline that cut through continental Europe and carried approximately 8% of Siberian gas to Europe in May due to disruption of supplies. Germany still imports natural gas through the Nordstream Pipeline that is located underneath the Baltic Sea and natural gas also travels through Belarus and under the Black Sea. Germany has purchased 3 LNG vessels and an option to buy a 4th vessel to remain moored offshore to act as floating LNG storage and import terminals. These ships will allow Germany to import natural gas from the US, Norway, Qatar, and other LNG exporters and bypass a LNG terminal in Poland.

The United States has built up its LNG export capacity over the past decade by dredging ports so larger ships can access these ports, adding LNG terminals, and building pipelines that lead to the Gulf Coast. Europe has done little to develop its LNG import infrastructure as it has relied on cheap natural gas from Russia, nuclear power plants, and coal to supply its energy needs. France’s nuclear power went offline coincidentally around the same time Russia invaded the Ukraine and Germany has hinted it may revive more coal power plants to meet energy needs. Germany and Italy have said they will start paying Russia in Roubles rather than Euros or USDs which devalues their own currency as the Euro has plummeted to a near-record low against the USD. Finland, Poland, and Bulgaria, which all depend heavily on Russian natural gas, have refused to pay for natural gas in Roubles and their supplies have been halted.

Russia has cut prices on its crude, shifted oil shipments to China and India, and has skirted sanctions by creating new blends “Latvian Crude” or “Turkmeni Crude” that contain Russian oil. These new “blends” allow Russia to continue to exports its oil globally with little repercussions. Russia’s energy exports are critical to the world’s energy needs and will always find a home no matter what the US does to curtail exports. China has no doubt negotiated exemplary prices for Russian oil and gas which has kept China’s inflationary pressure down. India has taken advantage of the war in the Ukraine by increasing its consumption of Russian energy imports as well.

Europe is struggling to diversify its imports of energy which is causing turbulence in energy markets around the world. The EU will continue to diversify its energy imports by relying on US natural gas and oil as well as new export terminals being developed in Qatar. The US is currently the largest LNG exporter until Qatar can get its new terminals online in the next two years so American producers will stand to benefit the most from higher natural gas prices. American oil producers also are one of the highest crude producers in the world depending on official Saudi figures so they stand to benefit even further from higher oil prices.

While the EU tries to diversify its energy imports away from Russia, they will struggle as a number of factors will impact the energy market. Trouble in the Sahel, the region just below the Sahara but above the African plains, is in turmoil as militant attacks are driving military-led revolutions. Several nations including Sudan, Niger, Chad, and Burkina Faso have all either had attempted or successful military revolutions. Citizens in these countries are fed up with militants attacking civilians and shipping drugs across the continent from South America. This will spell trouble for Europe if Algeria is toppled in a Libyan-styled revolution. Algeria has struggled with militancy for its entire history but this issue has taken on a new urgency after the revolution in eastern Libya spread militants and weapons across northern Africa. If Algeria were to collapse, it would cut off a major natural gas supplier to Europe.

Another factor for EU imports of Russian energy is that the United States has allowed Venezuelan exports of crude oil to Europe. This allows President Maduro to stay in power despite numerous allegations of voter fraud, mass arrests, coordination between cartels and the ELN, devastation to the Amazon rainforest, and drug trafficking. President Biden’s action props up President Maduro and allows him to continue sending drugs to Europe and the US while paying China to gut the Venezuelan economy country economically with bogus construction contracts and military equipment.

If a war on continental Europe and a rise of militancy were not enough to drive up energy prices, America’s energy production is set to fall in the coming years as drilling has remained near all-time lows. American’s DUC inventory is near record low as many companies have said that the best DUCs are gone. These unconventional wells produce less oil and gas than previously thought as production declines rapidly. As producers see less oil and gas from each of these wells, production will decline rapidly in the next two years.

Waning Natural Gas Supplies in the US

Natural gas prices have been rising in the US to highs not seen since 2008. This rise in natural gas prices is due to higher exports to Europe as the EU tries to diversify its energy supplies away from Russia. This rise in energy prices has not resulted in a rise in the number of natural gas drilling rigs in the US. Natural gas prices dropped in the US as producers developed their shale gas reserves and flooded the market with excess natural gas. These reserves produced an enormous amount of natural gas that brought down prices so low producers actually burned off excess natural gas. Now that prices have risen, producers in the Permian and around the country, are trying to capture more of the background gas to export to Asia and Europe.

The number of natural gas drilling rigs has risen to 150 from 149 the week before. This is up from 68 rigs in July 2020 and is still higher than the 123 rigs in January 2020. The Henry Hub natural gas price is currently $8.71 MMBtu and is down slightly from $8.87 MMBtu the week before. This is up from hitting $0.0 MMBtu in July 2020 and is still up from $2.05 MMBtu in January 2020.

Oil and gas producers have struggled to add rigs as supply chains are just beginning to normalize after a devastating two years and the current administration is determined to reduce fossil fuels consumption in the next few years. Producers have drawn down their DUC inventory in lieu of drilling new wells as President Biden campaigned on banning fracing. These producers are unclear what the US’s position will be in the future as the Democrats could ban all energy exports similar to what they have done so California.

The number of total drilling rigs in the US is currently 728 with 576 oil rigs, 150 natural gas rigs, and 2 offshore rigs. This number is up from 714 rigs the week before where natural gas added 1 rig and oil added 13 drilling rigs. This is also up from 244 total drilling rigs in August 2020 but is still below the 922 total drilling rigs recorded in 1987.

Imports Versus Exports

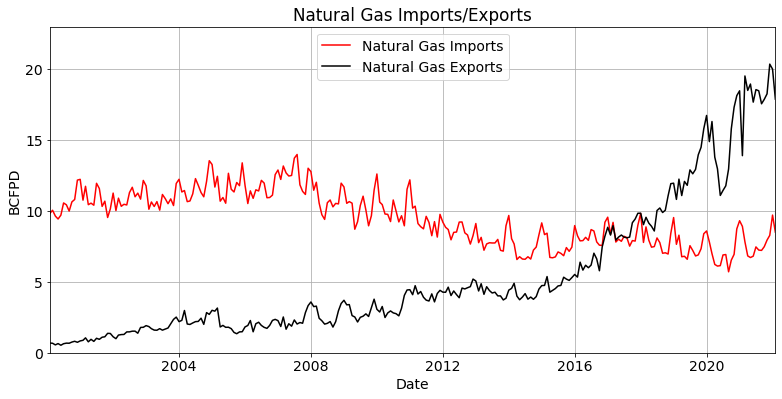

The US became a net natural gas exporter in 2017 as it boosted natural gas exports while reducing imports. This was possible due to an abundance of natural gas production from shale wells that drove down prices. Prices were higher in Asia than America so the US developed an abundant export capacity to reduce its natural gas supply. Production of natural gas will fall as oil production declines due to a slow down in drilling. DUCs have been able to keep production high but unconventional wells typically decline substantially within two to three years, much sooner than producers had originally expected. Its been about 2 years since many of these wells were put on production. This means that production should decline in about 3 years if drilling does not rise.

The US imported 8.5 BCFPD of natural gas in February which is down from 9.71 BCFPD the month before. Imports have risen from 5.71 BCFPD in September 2020 but they are down from approximately 9.8 BCFPD in 2020. The US exported 17.89 BCFPD in Febuary 2022 which is down slightly from 20.0 BCFPD the month before but up from 0.69 BCFPD in 2000.

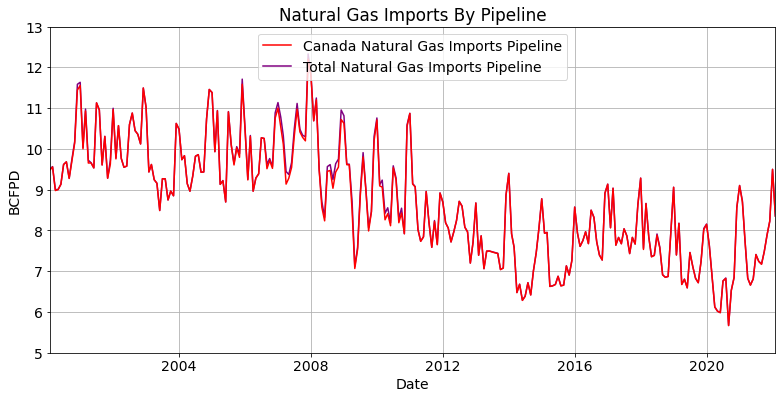

The US imports nearly all of its natural gas by pipeline from Canada and its LNG from Trinidad. America’s natural gas imports from Canada are approximately 8.35 BCFPD while its LNG imports from Trinidad are 0.15 BCFPD. This is because the process of freezing natural gas into LNG and transporting it by ship can be very expensive. Because pipelines are always cheaper than LNG terminals, Russia can export natural gas to Europe and China at a cheaper price than the US.

The US is Canada’s largest importer of natural gas but it also imports natural gas from the US as well. This is because Canada piggybacks off of US natural gas pipelines so the US can import natural gas to the Northwest while exporting natural gas to Toronto or Montreal without Canada having to build its own infrastructure.

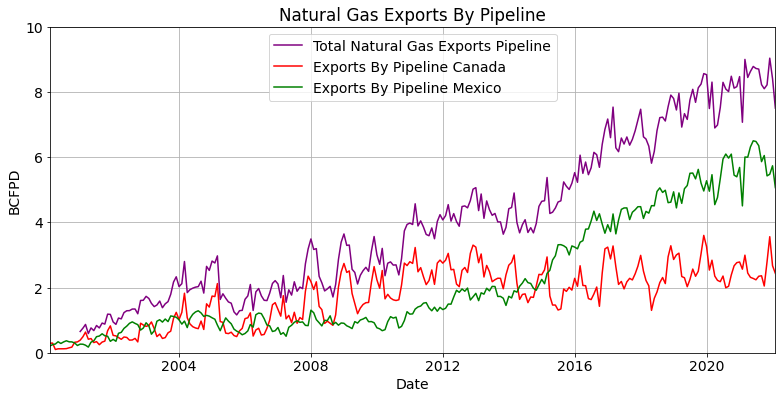

Mexico is currently America’s largest destination for natural gas by pipeline as Pemex struggles to supply energy to a country that should be energy independent. Mexico has large offshore oil and gas reserves while simultaneously having large shale reserves. The country is a net energy importer because producers struggle to deal with Pemex, which has a monopoly on the energy industry, as well as having to deal with oil thefts and threats from the cartels. Mexico also nationalized an extremely productive offshore well drilled in the Gulf of Mexico by Talos after it showed promise.

Total exports by pipeline are 7.5 BCFPD in Febuarary 2022 with 2.44 BCFPD going to Canada and 5.07 BCFPD going to Mexico. The total exports by pipeline are down from 8.4 BCFPD with exports to Mexico dropping from 5.73 BCFPD in January 2022 to 5.07 BCFPD in February 2022. There exports are up from nearly 0.0 BCFPD in 2000.

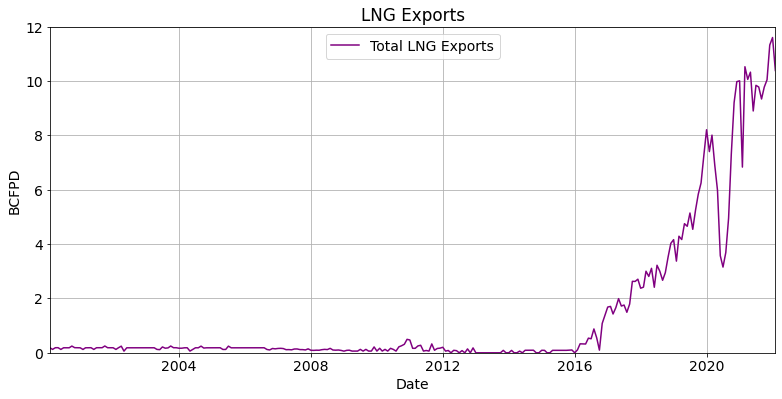

US LNG exports have risen since 2016 as the low cost of domestic natural gas offset the high cost associated in the LNG process. The US was able to sell the majority of its natural gas to Asia before Russia invaded the Ukraine. The US exported 10.39 BCFPD in Febuary 2022 which is down slightly from 11.6 BCFPD the month before but is still up from nearly 0.0 BCFPD in 2016.

American producers have diverted LNG cargos from Asia to Europe as prices have risen there since the start of the Ukrainian war. The US was exporting nearly 4.69 BCFPD to Asia in August 2021 before Russian forces entered into the Urkaine and the number of exports has dropped to 1.83 BCFPD in February 2022. The US exported 6.16 BCFPD to Europe in February 2022 which is down slightly from 7.13 BCFPD the month before.

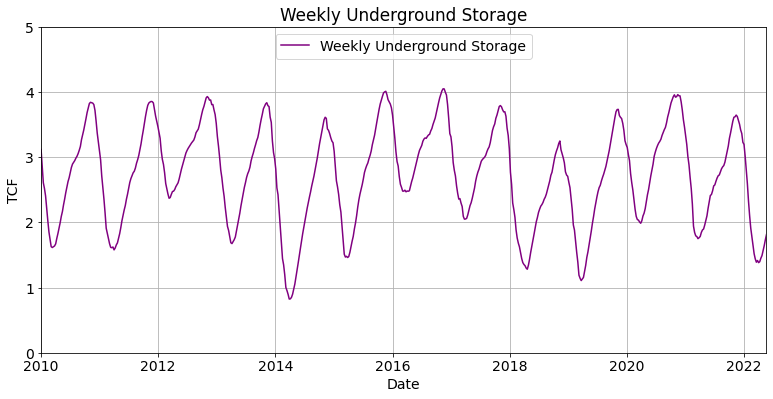

Underground storage of natural gas in the US has risen to 1.81 TCF in May 2022 which is up from 1.73 TCF the week before. This is down from a max of 4.05 TCF in 2016 and is expected to remain low as elevated prices prevent producers from leaving expensive natural gas in the ground. Underground storage rises in the fall as countries prepare for winter when demand is higher. If prices remain high then storage decreases as consumers bet that prices may be lower during the winter.

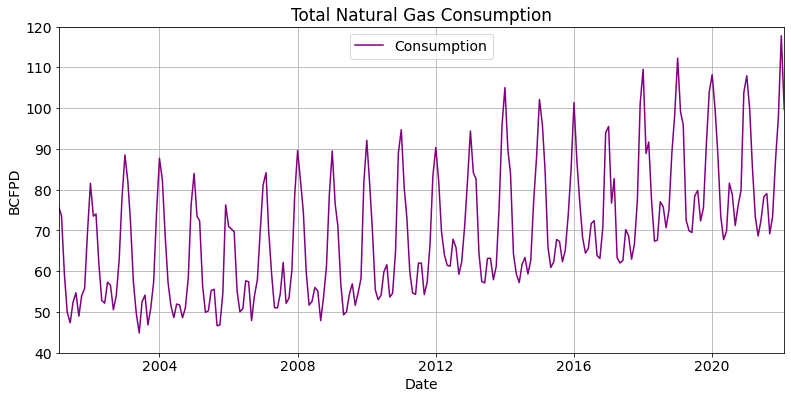

Natural gas consumption in the US has dropped to 99.67 BCFPD in February 2022 from 117.76 BCFPD, which was a record, the month before. Consumption drops off in the spring and summer as colder regions consume less energy to heat their homes. Consumption will continue to rise this winter as countries try to retire more coal fire power plants and demand for industry rises. Consumption may drop below 70 BCFPD in the summer as higher prices may put a dent into demand but demand will likely rise in the winter as LNG terminals come online in the winter.

But higher prices may not be the only thing putting a dent into natural gas demand. Demand my be impacted if prices get too high due to the Russian war in the Ukraine. The war is unlikely to come to an end as Russia continues to gain ground inch-by-inch in the east. It is unclear how long Germany will wait until after the Ukranian war to increase its energy consumption of Russian exports, no matter what the outcome. Germany will not ban Russian imports forever if it means that its economy will be impacted. There are several Eastern European states that have already taken advantage of the crisis to import discounted Russian energy supplies.

This European disorganization ensures that Europe will continue to send more money to Russia than it does to the Ukraine. By April 6th, the EU sent €35 billion to Russia for energy imports while it sent only €1 billion in aid to the Ukraine. These Euros will ensure that Russia will be able to continue its war in the Ukraine without any long-term impediment to its finances.

If the production from the United States continues to decline before drilling returns to normal, militants in Africa overthrow Algeria, or a disruption happens in the Middle East then prices will climb over the next two years. These waining energy supplies from the US and the coming winter may drive prices even higher in the future.