Employment in America has been red hot even before the pandemic caused the government to pump money into the economy. But as a recession looms, some companies may be more cautious in the future. The job market was thought to be at full employment before the pandemic took its toll on the economy. Generous unemployment benefits paid workers more to stay home than go to work caused a drop in the labor participation rate.

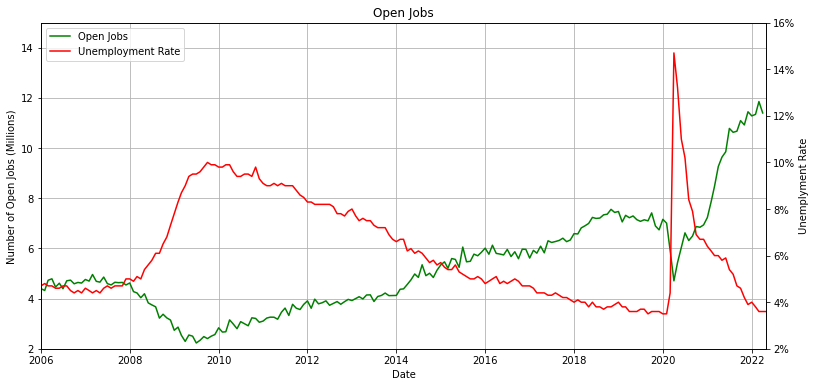

The number of open jobs skyrocketed as the Federal Reserve and Congress pumped trillions of dollars into the economy over the past two years while Americans slowly returned to work. Now employment may be peaking as tech companies and other industries may cut jobs or delay hiring as the economy may tip into recession. The Fed has been raising interest rates to combat inflation after an unprecedented number of stimmies injected into the economy.

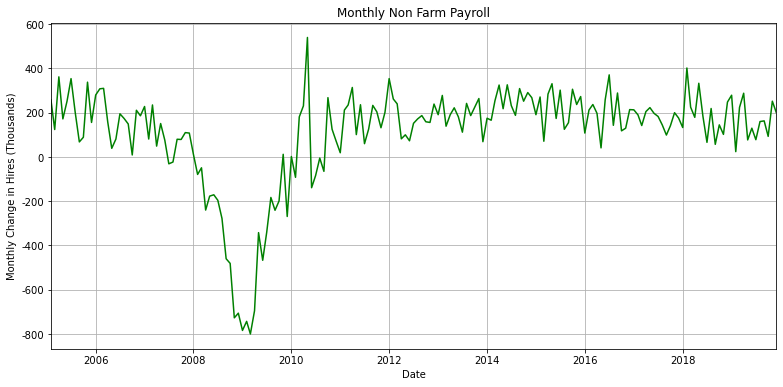

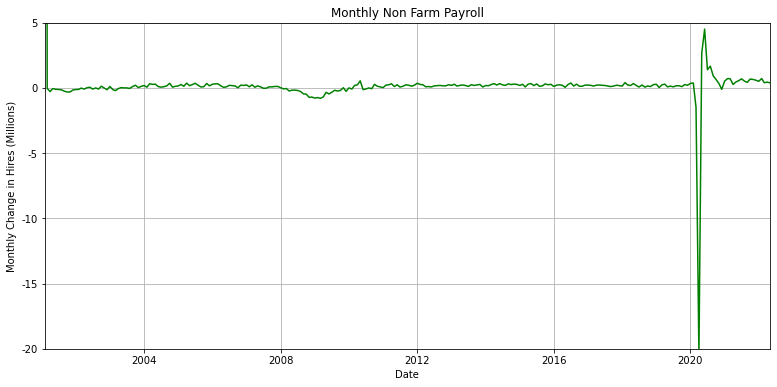

Monthly Change in Non-Farm Payrolls

During the 2008 Financial Crisis, millions of workers were laid off as the economy dipped into a recession. This spurred the government to unleash a massive stimulus to correct the economy. Monthly non-farm payrolls dropped by over 600k jobs each month as more workers were laid off than were hired.

2020 was a different type of financial crisis as the economy shed nearly 20 million jobs all at once rather than the 2008 financial crisis when workers were laid off slowly. Multiple industries laid-off workers in 2020 as covid restrictions and politicians shut down the economy. Workers trickled back to work as companies struggled to find both blue-collar and white-collar workers.

The US economy added 390 thousand in May versus 436 thousand in April the month before. While the rate at which the economy is adding jobs is slowing, this is still up dramatically from the approximately 200 thousand jobs that were added before the pandemic hit the economy.

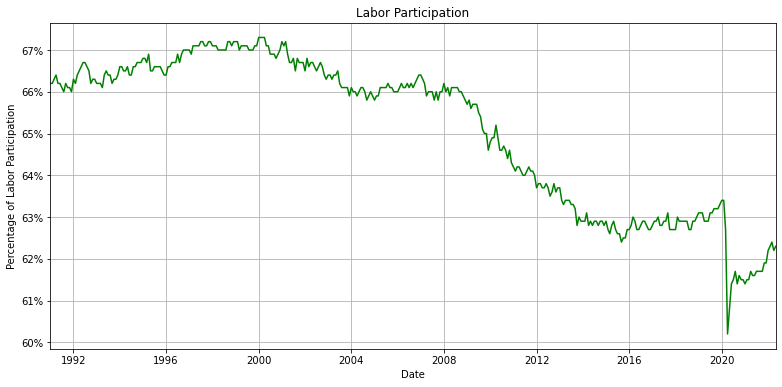

The massive stimmies caused inflation to turn white-hot and wages have gained as the labor force is still below 2019 levels. The labor participation rate has ticked up to 62.3% in May versus 62.2% in April. This is up from 60.2% in April 2020 but is down from just over 63% before the pandemic.

The labor market dropped from 66% participation to 63% participation during the 2008 financial crisis and never returned to previous levels even when the market was at full participation. Economists never expected the market to bounce back to the previous labor participation rate before the pandemic but it has bounced back by over 2% due to government stimmies.

Now the economy is struggling to add enough jobs due to a shortage of workers in almost every industry. The oil industry has bounced back from record low crude prices but has struggled to find workers. The leisure industry laid off millions of workers as the economy went into lockdown but has not been able to rehire those same workers back even for higher pay. These lack of workers has caused wages to rise at near-record levels.

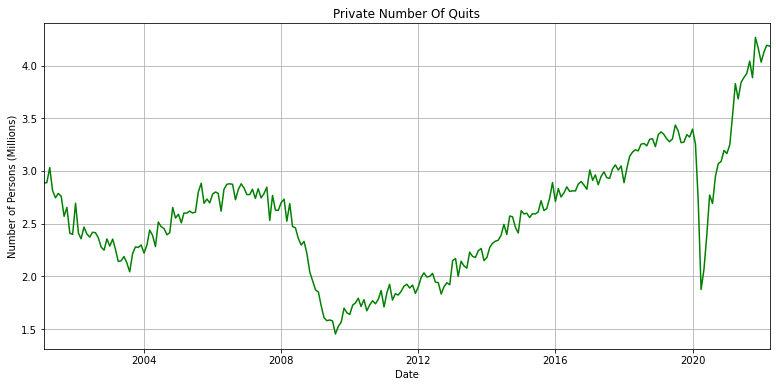

Quit Rate

The quit rate slowed slightly from record highs. Workers voluntarily quitting their job dropped to 4.18 million in April from 4.19 million jobs in March. This is up from just under 3.5 million workers quitting their job before the pandemic. This number is critical as its a measure of the health of the labor market as it gauges workers’ confidence in quitting their jobs for new ones. If the number of quits remains high, that means that there is little slack in the labor market and wages will continue to rise which will add to inflation.

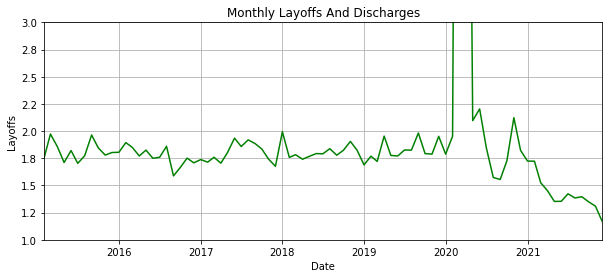

Layoffs

Layoffs continue to reach record lows as companies continue to struggle to find workers even as a recession looms on the horizon. Layoffs dropped to 1.18 million in April which is down from 1.33 million in March. This is down from 12.75 million in March of 2020 and continues to fall each month. Even a 2% oversupply or undersupply of workers can cause wages to fluctuate in companies’ or workers’ favor.

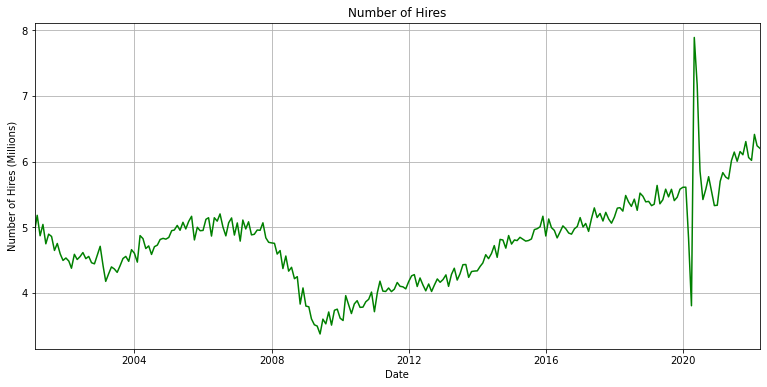

Private Hires

Hiring remained strong as 6.2 million workers were hired in April which is down from 6.24 million workers in March. These numbers are still near record high as hiring slowed during the pandemic but quickly rebounded.

Earnings continue to rise and have risen by 5.24%in May versus 5.46% in April. This is a staggering number if economists did not take into account inflation rising at officially 9% and unofficially at an even higher rate. Workers are making more money but can afford less services which will hit brick and mortar stores as well as high-earning tech companies. Consumers will continue to have to prioritize staples while reducing demand for unnecessarily spending.

Open Jobs

The number of open jobs fell from 11.86 million in March to 11.4 million in April. This still puts the number of open jobs at a near-record as the stimmies have pushed up the economy. Economists are closely looking at this number as it is an excellent gauge for the economy. If companies freeze hiring, that could indicate that the economy is about to slow and could set off a chain reaction throughout several industries.

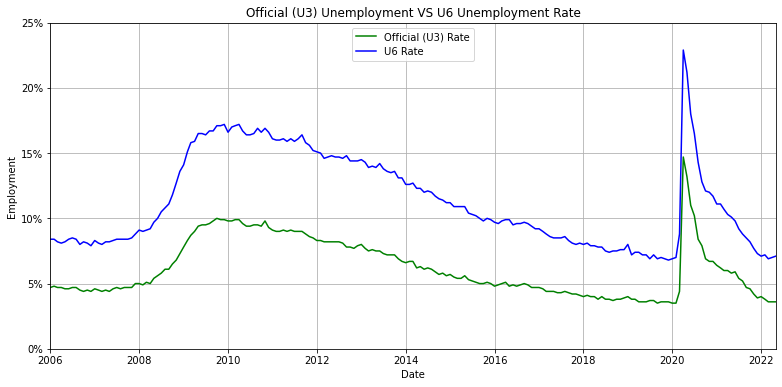

The official unemployment rate remained the same at 3.6% in May from the previous month while the economy added 390 thousand more jobs in May than it lost. This is a good indication for the labor market as the economy is still adding hundreds of thousands of jobs without workers officially quitting the labor market.

Unofficial Unemployment Rate

The official unemployment rate held steady at 3.6% but the U6 rate ticked up to 7.1% in May from 7% in April. This could be a temporary trend as the economy is adding 390 thousand more jobs than it is losing but it could also be a sign that workers are dropping out of the labor force. This is unlikely as the weekly continuing unemployment claims dropped to 1.31 million on May 21st compared to 1.34 million on May 14th and hiring remains strong.

Economists are closely watching these employment numbers as several industry leaders have said that consumers will run out of money in 6 to 9 months. Inflation is unlikely to be solved by then as the Fed will continue to raise rates to cool off the economy. If unemployment rises and the labor participation drops below 60% this will lead to stagflation, high inflation and low growth. This will spell trouble for the economy and the Fed will be unlikely to lower interest rates or to pump money into the economy as it will only raise inflation.