Oil prices have risen to 7-year highs and are on track to reach $100+/barrel prices next summer if more production is not brought online. Oil prices saw a historic drop to negative $40 a barrel and stayed deflated for much of 2020 due to an abundant supply of crude. Even after prices regained ground in 2020, a barrel of bottled water was still more expensive than a barrel of crude oil. But 2021 has brought higher oil and gas prices that look like they will continue to rise in 2022.

Higher oil prices cause havoc on everything from prices at the pump to pushing the Federal Reserve to tame inflation. Oil prices directly impact electricity, transportation, agriculture, plastics, and other sectors of the economy by raising the cost of transportation and basic supplies in manufacturing. Rising prices will cause higher inflation which will lead the Fed to raise interest rates and that will impact sales of real-estate and other household items. This will have knock-on effects throughout the economy and will impact steps the Fed will take to keep the economy stable.

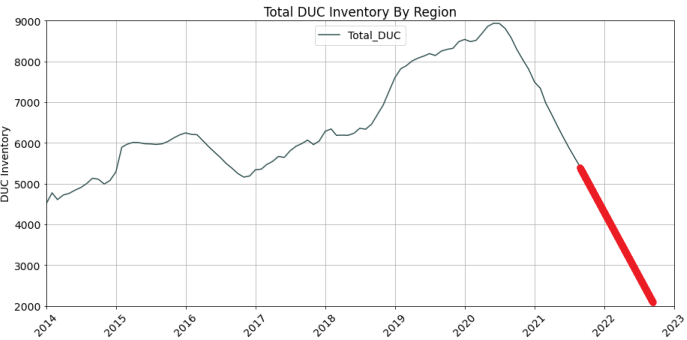

Drilling has ground to a historic halt which has led to rising prices. Wells that were drilled but left uncompleted (DUCs) allowed companies to keep oil in a kind of free underground storage and wait for higher prices to complete the wells. DUC inventory hit an all-time high at the beginning of 2020 when oil prices went negative and the number of DUCs dropped dramatically as drilling has essentially stopped. DUC inventory has almost been cut in half in just over a year and if this trend is extrapolated (in red), we can see that DUC inventory will hit 2000 in 2022 assuming the pace of the draw continues over the winter. A company will have to have a certain amount of DUCs on their leases because they cannot get frac crews out to location right after the drilling rig leaves or the company has to wait for the drilling rig to completely drill all wells in a location to avoid frac hits. If there are 500 rigs operating at 2 wells a week that is a 1000 DUCs a week minimum before frac crews can arrive on location and get set up. The minimum number of DUCs is unknown but if the last time there was $100 oil is any evidence then we can assume that the minimum number to be around 4000 DUCs.

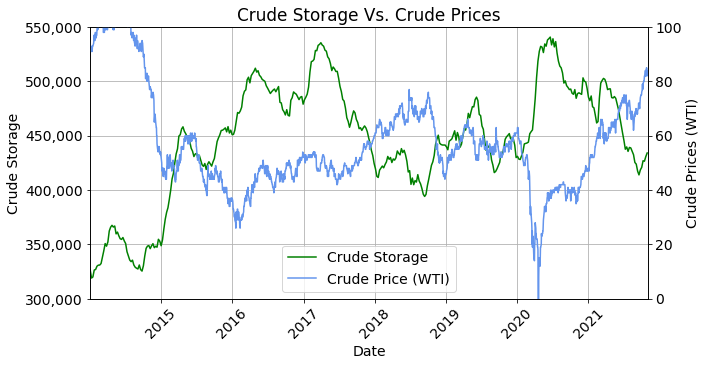

The amount of oil in storage has risen substantially since oil prices crashed from $100+ in 2014. Currently, crude oil storage (excluding the SPR) rises in the winter after the summer driving season and drops in the summer driving months as more gasoline is produced. These crude reserves vary depending on drilling, OPEC production, and supplies of gasoline. The graph below shows crude storage on the left axis and WTI prices on the right. As prices came off of historic highs in 2014, storage rose in the winter of 2014 into early 2015, began to rise again in the winter of 2015 into 2016, rose again in the winter of 2016 into 2017, and dropped in the winter of 2017 as OPEC continued to curtail production to support prices. Prices rose in 2018 as the SPR dropped to multi-year lows before OPEC started pumping again to keep prices down and reduce American production. This went on until 2020 when countries went into lockdown and Saudi Arabia flooded the US market by sending 12 fully loaded VLCCs to the American market. As a result of low prices, American producers cut back on drilling rigs and prices went from approximately $60 a barrel to -$40 (negative $40) a barrel.

Oil prices have had their best rally in years in 2021. Prices have spiked to above $80 a barrel, which was unheard of just a few years ago, and could go up to the mythological $100 a barrel in the summer of 2022. Oil industry professionals have talked about the return to $100 a barrel since the end of 2014 but this has been wishful thinking as prices have stayed subdued for over half a decade. But if drilling does not pick up soon and demand comes back in the summer of 2022, the mythological $100 oil could finally be a reality.

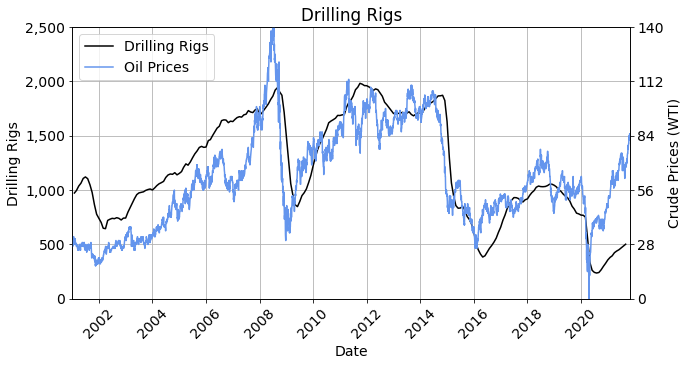

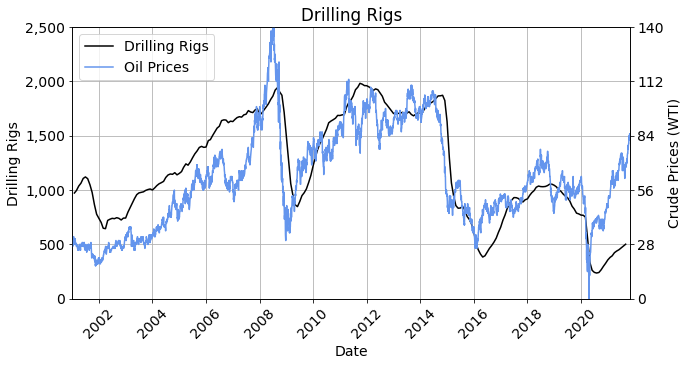

Even though oil prices have hit recent highs, companies have not started drilling. This is unusual because American companies usually react swiftly to higher oil prices. Below is a graph showing the number of onshore drilling rigs on the left and WTI crude price on the right. The number of drilling rigs has bounced from 2020 lows but has not kept up with prices. Investors fear that the low rig count, the drop in crude reserves, OPECs inability to start up production, and the drop in DUC inventory will lead to an oil shortage.

Companies cannot just decide to drill a well, frac the well, and then move on to the next location on a whim. Oil and gas leases take years to negotiate complex legal issues with the federal government and landowners. After the lease is chosen, geology has to come in to find a place to drill. This can lead to SEVERAL dry holes where companies invest anywhere from $2 million to $6 million dollars per land-based well or up to $100+ million for an offshore well. After a good location is found companies have to prep the pad, build the infrastructure to produce the oil and gas, schedule a rig, drill multiple wells on a pad, then schedule a frac crew to come out and frac the well when the drilling rigs are done with all the wells in a couple of miles from that location.vThis can lead companies to invest years into developing a field before they even produce one drop of oil.

Even if companies wanted to drill, the supply chain disruption has a substantial impact on their business. A substantial portion of steel casing is produced in China where steel production has been curtailed to reduce carbon emissions. Rigs cannot drill a well without this casing because they cannot protect fresh aquifers and problematic zones. Not only that, but if a rig fails to get the first cement to the surface then they will have substantial regulatory problems. The rig may have to run a packer downhole and pump through the packer to push cement to the surface. The rubber and steel components of a packer could be in short supply at any given point in the drilling process and the reliability of products will be in question until the supply chain disruptions are solved.

President Biden has signaled that he wants the country to diversify away from fossil fuels like coal, oil, and natural gas into what he considers cleaner energy like solar panels, wind, and biomass. If President Biden is intent on moving away from oil and gas in the long term then companies should stop investing in oil and gas immediately which will lead to greater pain at the pump. He wants to make this move quickly and many car companies want to go fully electric by 2030. It’s unclear what his short-term goals are for the oil and gas industry are now but it’s clear from his choice of Interior Secretary that he will increase regulations that will impede oil and gas extraction. But transitioning a complex economy like the United States into a new type of energy over the course of two decades can lead to complex problems.

Prices will continue to rise even if the US moves to 50% renewable generation in the next 10 years. It does not matter if a state or a country decides to convert all its power plants to renewable energy, prices for electricity are currently pegged to commodities like oil, gas, and coal and will not come down until there is an abundance of energy generation. This is especially true if most Americans get electric vehicles and tax the electrical grid.

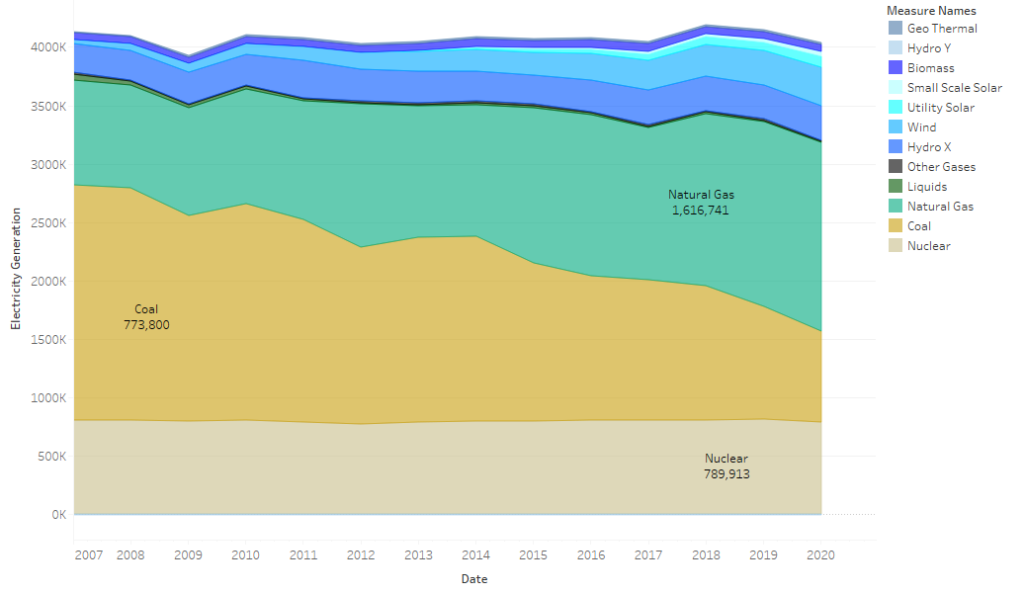

Renewable energy accounts for approximately 20% of the current electricity produced in the US and renewables are famous for having to overproduce vast amounts of energy to prevent blackouts. To move to 80% or 90% of electricity generation from renewables would require a massive financial investment that has not materialized. Natural gas has replaced energy generated from coal, but wind energy will not be able to take over for natural gas and coal anytime soon. Countries around the world are still building new coal power plants and China has ordered coal companies to do whatever it takes to produce or buy international coal for the winter dampening the hope of environmentalists’ hopes of a quick transition to renewable energy.

Nuclear, geothermal, and biomass energy has been relatively stable and is either not a clean source of energy or is difficult to scale up to future needs. Coal production has dropped dramatically but has largely been replaced by natural gas. The growth of wind energy has been impressive but unless we expand offshore wind, there are not a lot of places in the continental United States that can support substantial wind capacity investment to meet future demand.

Hydrogen seems to be getting traction in the media but there are limitations on both green and blue hydrogen. Green hydrogen is refined from freshwater, but the amount of freshwater needed to produce 1 kg of hydrogen could be up to 24 kg of freshwater and the energy equivalent of 1 barrel of crude oil is 50 kg of hydrogen. Currently, the US produced approximately 10 to 11 million barrels of oil a day. Some of this oil is due for export, this could be a general rule of thumb for future consumption. That could be approximately 1200 kg of freshwater for an equivalent of a barrel of oil and with 11 million barrels of oil a day in consumption, the US would quickly run out of water. Blue hydrogen is made from fossil fuels and will be limited if drilling and mining continues to decline.

If America does go fully electric by 2030 then we will need to consume vast amounts of electricity to power every car on the road. This will not come from solar panels, wind energy, or even nuclear energy. Many Americans claim that batteries will be the solution for the future but there are two problems with this theory. The first is that batteries do not produce energy on their own and the second is that environmentalists are predicting a glut of batters in landfills in about five years which will be worse than the temperature rising 1.5 degrees Celsius 60 years from now. This is even ignoring the fact that extracting and refining rare earth minerals is one of the most toxic processes on the planet.

America will need to find a new power source or make better use of the energy we have by reducing consumption. If President Biden wants to shift electricity generation rapidly over the next few decades, then companies have to know that they can invest in the short term and still get back their investment plus a healthy enough profit to warrant that investment. Until companies can get reliable supplies to drill a well and politicians make it clear how they plan on transitioning away from oil and gas, the rig count might stay at historic lows. The US can explore tidal energy, offshore wind energy, and hydrogen but until these new forms of energy are in place it is irresponsible to treat the oil and gas industry the same as tobacco companies.