The Federal Reserve has rolled out several stimmys to stabilize the economy since the pandemic began in early 2020. The economy saw a brief drop as businesses closed their doors, employees worked from home, and demand for services ground to a halt. This pushed the Fed to act by printing money in its $120 billion a month bond-buying program supporting foreign and domestic companies, multiple blanket stimulus payments to the general population, keeping interest rates at historic lows that have led to massive bubbles in the housing and automotive markets, and deficit spending that ballooned the federal government’s debt to unsustainable levels. Even worse, this level of spending is no longer driving employment and is hurting the economy.

It’s worth noting that the Fed is going to start tapering its $120 billion a month foreign and domestic bond-buying program. This 10% reduction of bond buying is a good start but the Fed will keep interest rates at near-record lows, will do little to push Congress to reduce deficits, and will keep financing debt that has spiraled out of control.

The 5 trillion-dollar deficits in 15 months, ultra-low interest rates, stimulus payments, buying foreign and domestic bonds, drawing down the account of the Treasury, and other stimmys have led to a bounce-back in employment but the Fed continues to allow large deficit spending and low-interest rates to overheat the economy and builds up unsustainable debt.

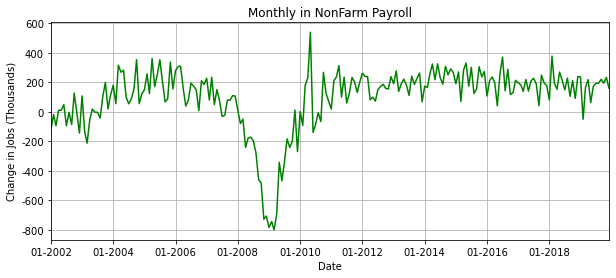

Wall Street and Main Street accepted this level of spending and stimmys because of the monthly drop-in non-farm payrolls as well as the drop in the stock markets. Monthly change in non-farm payrolls BEFORE the pandemic shows the effect the 2008 financial crisis had on monthly employment. The country saw a substantial drop in monthly payrolls during the 2008 recession when companies shed jobs and the market collapsed.

Since the 2008 recession, hiring has bounced back and was at near full employment in 2019. Unemployment was at its lowest point in decades and wages were going up as the economy was humming along before the pandemic came along. As the pandemic began, companies laid off employees when Covid restrictions were put in place. Employees worked from home which meant fewer people went out for lunch, no one drove to work, shops closed and the economy ground to a halt. This had a profound impact on the greater economy but hit the leisure and the mining industries the hardest. The graph below shows the monthly change in non-farm payrolls since 2002.

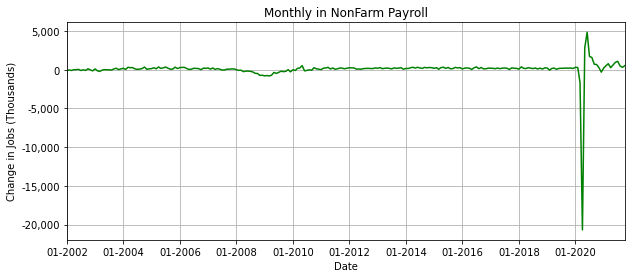

Monthly payrolls collapsed so quickly that the 2008 recession was barely a blip compared to the pandemic. This pushed the Fed to start its quantitative easing policy along with its plan to buy massive amounts of treasury bills so the government could sustain the current level of borrowing.

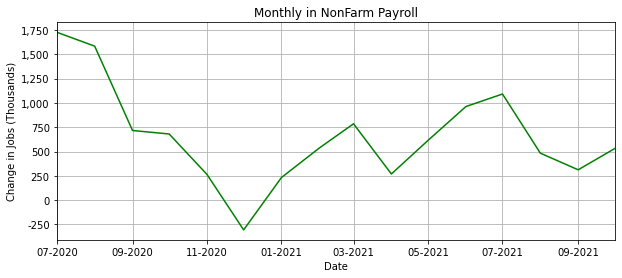

Jobs have come back since the pandemic began with companies hiring a number of workers in recent months. Hiring in 2019 was approximately 200k for most of the year and most economists thought the economy was at nor near full employment. But since the pandemic, spending has injected massive amounts of stimulus into the economy. Hiring fluctuates month by month, but most months hiring being above 500k a month and companies have complained that they cannot find enough candidates that they cannot hire more people.

The reason why the Fed continues quantitative easing and buying Treasuries is that they want the economy to stabilize. But there is not one sector of the economy that is not overheating. Housing, the stock market, corporate earnings, leisure, and services have grown substantially in just under 2 years. It has even grown to the point where they cannot find inventory or employees to drive the economy even further. The Fed’s view that the economy is not stable is misguided.

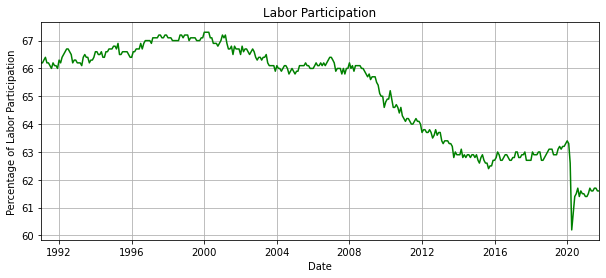

After 2008, labor participation dropped by 3% as people dropped out of the labor force. The labor force was slowly returning as the economy reached full employment at just over 63%. The labor participation has dropped below 62% and is unlikely to go above 63% anytime soon. This means that people are dropping out of the labor force but that could be attributed to Boomers retiring or that people have made so much money in the stock market and real estate market that they no longer need to work.

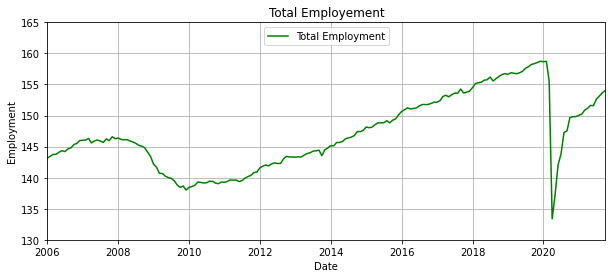

If the Fed was looking at total employment, then they could see that the economy is still down by approximately 4.7 million jobs. This may be true but the current trend shows that the number of Americans employed is rising rapidly as it rose from 133.4 million jobs to 154 million jobs which is a 20 million jobs gain since April 2020. This combined with the monthly non-farm payroll gains every month means that the economy will be back to full employment without more stimulus. If they let the economy grow at a steady pace then the number of jobs lost during the pandemic will be back to where it was in 2019 if they let the economy grow at a stable rate.

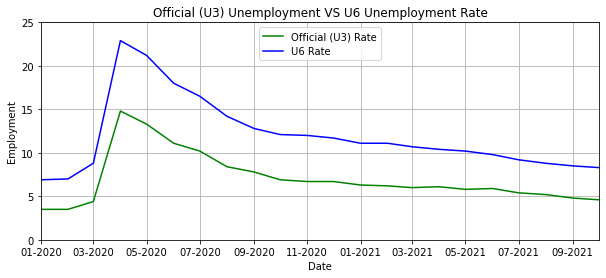

If we take a look at the official unemployment rate, the official U3 rate we can see that employment is close to pre-pandemic levels. Economists view the U6 rate as a better level of employment because it considers people that have dropped out of the workforce. Below is a graph that shows the U6 and the U3 rates compared to pre-pandemic levels which are considered full employment. The official U3 unemployment rate is near 2019 level but the U6 unemployment rate is slightly above 2019 level. This does not justify the Fed’s current money-printing policy especially since inflation has skyrocketed in recent months.

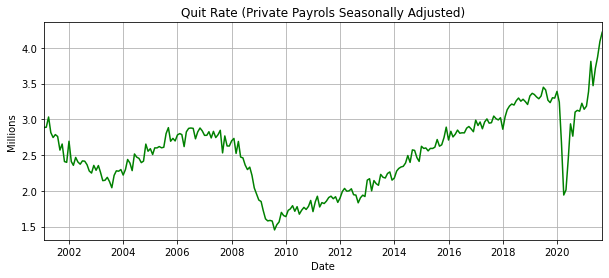

It’s also worth noting that the quit rate, which is a good measure of confidence in the economy and the jobs market, has reached all-time highs. This means that people feel confident enough to quit their current job and find employment that pays better.

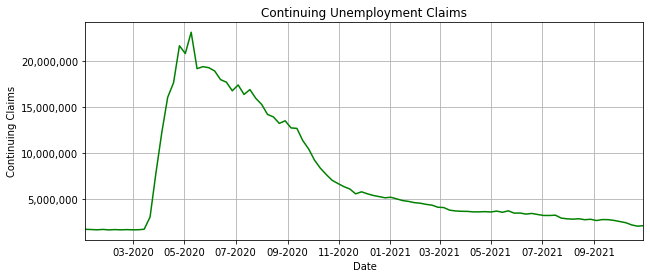

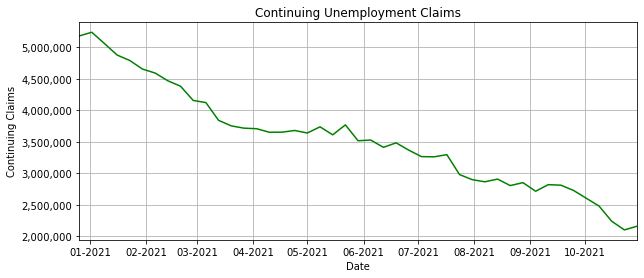

Another measure of employment is continuing unemployment claims. Continuing unemployment claims, people that already filed an initial claim and have experienced a week of unemployment, is near an all-time low. The pandemic saw millions of Americans enroll in unemployment with added benefits from states and the federal government. Unemployment surged and state and local governments disbursed benefits that allowed employees to make more money staying at home rather than going to work. That program that saw increased federal benefits to the unemployed was halted and while some states continued unemployment benefits, those have stopped.

If we just look at 2021, we can see the drop in unemployment just this year. If this trend continues, we can expect the market to be at full employment shortly and the constant stimulus the Fed is printing will overshoot their goal of full employment and overheat the economy while taking on unsustainable debt.

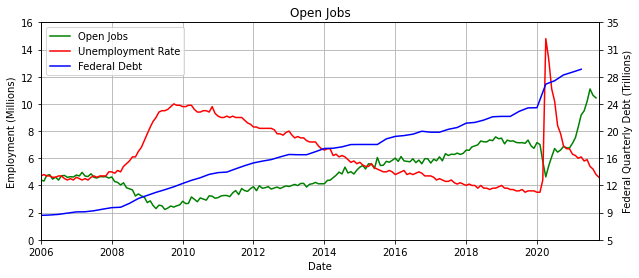

The Federal Reserve has been printing massive amounts of money to inject dollars into the economy which is fueling inflation. This has led to massive bubbles in every sector of the economy, record stock prices, and unsustainable debt. The debt has tripled since 2008 and it does not look like it will go down anytime soon. The graph below shows the Federal debt in blue, unemployment in red, and open jobs in green. Open jobs and employment in millions are on the left axis and debt is on the right in trillions.

Open jobs open outnumber job seekers by 2 to 1 and the economy is overheating because the federal government keeps printing more money to support the economy without any concern about the bubbles that it’s forming in the housing market, car market, stock market, and every single market across the country. The Fed is not concerned that we are near full employment and the economy can stand on its own two feet at this time. Below is a graph that shows total employment is almost at pre-pandemic levels. This shows that while employment is not back to what it was pre-pandemic, it does show that jobs have come back from the brief recession.

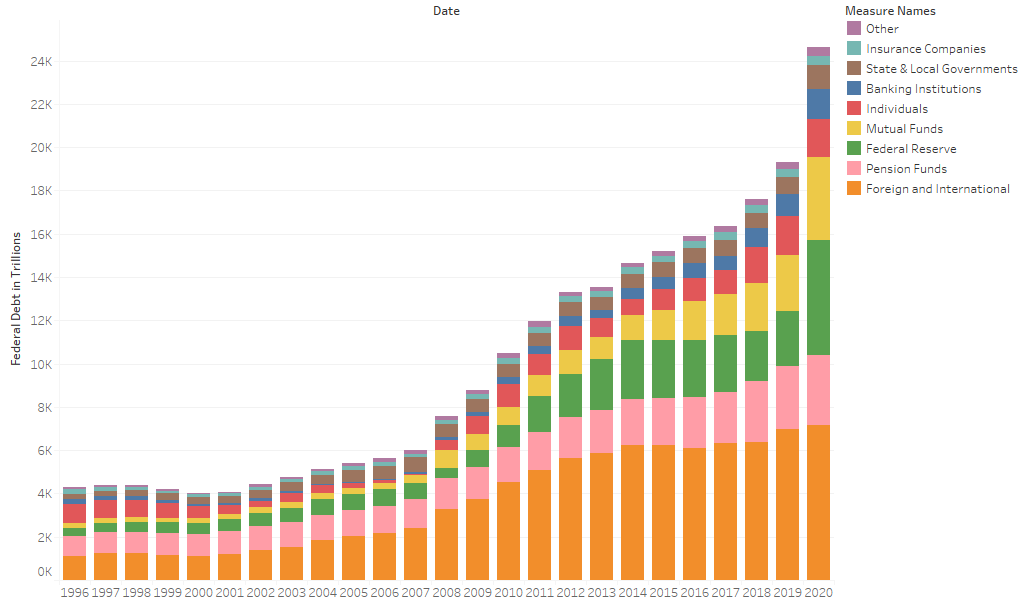

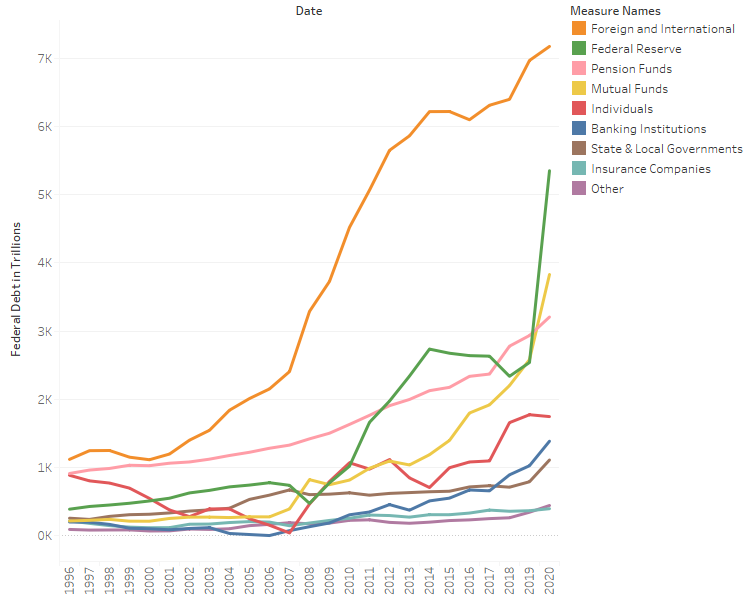

The government continues to take on more debt with the Federal Reserve being the main buyer of new debt. The Fed along with mutual funds have been the principal buyers of new US treasuries that allow the government to borrow more and support the economy. But how many more Treasuries can those institutions buy? The foreign market is supersaturated with foreign buyers of debt who now buy very little debt. China has stopped buying US debt and even decreased its holdings of US debt slightly. Japan has bought a bit more of American debt but not enough to make an impact on the record deficits that Congress is passing. They are the two largest countries with US debt but only make up a little over $2 trillion of the nearly $30 trillion of US debt.

In the graph below we can see the role the Federal reserve and Mutual Funds play in the Treasuries market. The Fed in green and Mutual Funds in yellow have bought $6 trillion since 2019 while foreign investors have gained a little of $1 trillion over the past 6 years.

Another question economists should be asking the Federal reserve is any of this stimulus even making a difference. Printing money recklessly helped stabilize the stock market, employment, and every other sector of the economy. But continuing to print money and run explosive deficits is not going to push employment any higher and will only inflate bubbles even further.

Housing is already unfordable for most Americans, new and used car prices are out of reach for the majority of the population, and the stock market has grown to such grotesque proportions that it is not feasible for Americans to start investing.

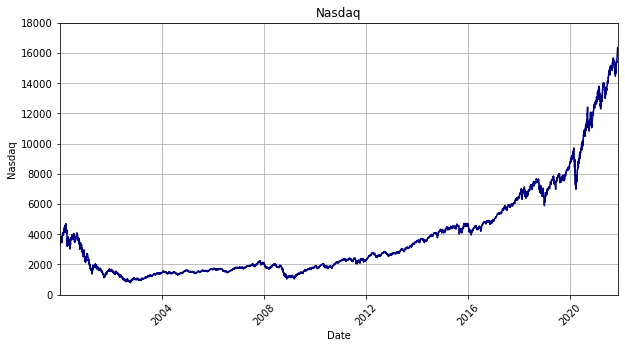

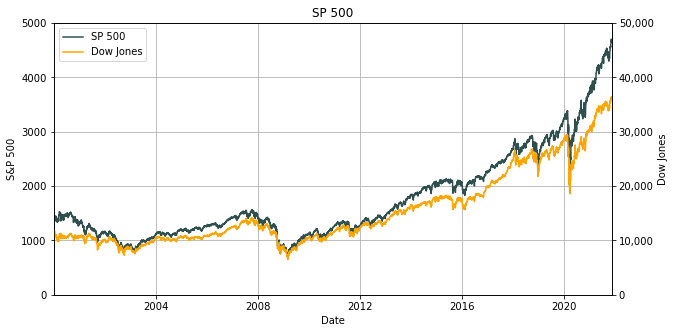

The housing market bubble is well documented with home prices in most major cities up by at least 25% in a year and doubling in popular markets. The SP 500 and Nasdaq are up by approximately 75% since 2019 and the Dow Jones is at a record high.

Commodities are sky high with oil and gas leading the way by returning to their highest levels since prices collapsed in 2014.

One explanation that economists have for the lower participation levels is the wealth effect. If someone has made millions of dollars with bitcoin or real estate, then they would have the ability to take time off work. Another theory is that Boomers have been dropping out of the labor force and that has pushed the labor participation rate down.

Also, expanded government benefits allowed Americans to stay home and make more money than what they would have made while working. This might have been true pre-pandemic but with the tight labor market and surging inflation, this is no longer true. Some jobs are open now that would allow people on benefits to work and make more money than they would on benefits.