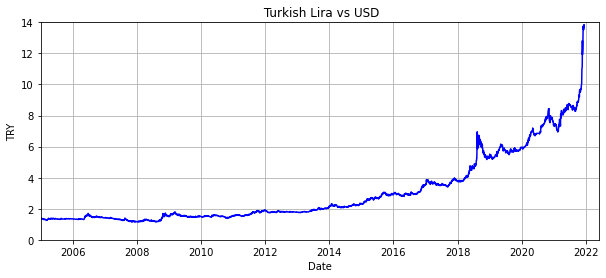

The Turkish Lira has been in the spotlight during the pandemic as the beloved president of the conservative AK party has replaced the head of the Turkish Federal Reserve repeatedly over the last few years so they could CUT their interest rate. The president defies conventional wisdom in that he believes that higher interest rates actually increase inflation. Higher interest rates bring up the cost of borrowing which does raise prices but it deters borrowing at the same time meaning that there is less money being spent on end goods like housing and the automotive sector.

The current value of the Lira has dropped over 55% in just two months after the Turkish Federal Reserve cut the interest rate 3 times since September and this slide in the currency shows no sign of slowing down. The situation has gotten so bad that foreigners have begun to flock to the country to buy property in cash to take advantage of the exchange rate to buy property for less than half its value. The official inflation rate is approximately 20% but an independent think tank puts inflation at close to 60%.

But Turkey is not the only country that is grappling with depreciating currencies since the pandemic began. Several countries around the world have seen their currencies weaken but have kept interest rates low to prop up their economies.

DXY

The DXY exchange rate, which trades the USD against a basket of major currencies, has been high since the taper tantrum period of 2013 and 2015. There have been brief periods where the dollar has depreciated in comparison to other currencies when President Trump complained that the dollar was too high but the USD remains resilient in the face of the pandemic. A depreciated currency means cheaper exports and discourages imports but a currency that falls too fast means that inflation spirals out of control and a lack of confidence in the economy. A currency that has a higher value means that it is more difficult to export goods but people have faith in the economy.

Safe-Haven Currencies

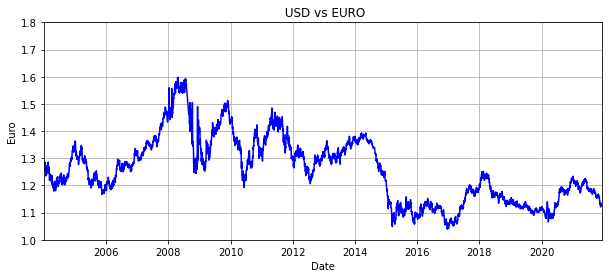

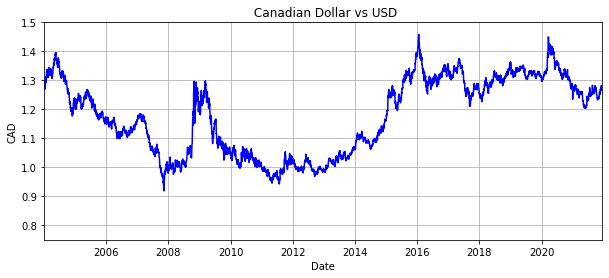

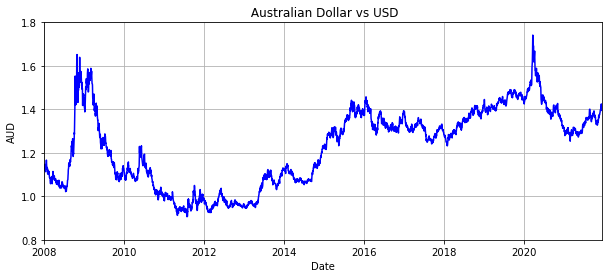

Major currencies have enjoyed relative stability during the pandemic. Countries like Australia that originally saw their currencies drop at the onset of the pandemic have seen their currencies regain their strength with respect to the dollar. Other currencies like the Euro and the GBP have done quite well during the pandemic even as lockdowns battered Western economies.

The Euro has maintained its value during the pandemic despite harsh lockdowns that are still ongoing on the continent. Investors have kept Euros during the height of the pandemic but as the Fed tapers its stimmys and raises interest rates the Euro will suffer and begin to decline against the dollar if it does not match interest rate rises. This could put pressure for the Euro to depreciate against the dollar which would, in turn, raise the DXY. It would make it cheaper for Europe to export its goods but an uncontrolled slide in its currency will spell disaster for member countries. This could also put pressure on European countries to raise interest rates and cool off their economy. This may help Germany’s runaway inflation rate but it could impact other European countries that do not want to raise interest rates that will impact their economies. Germany’s interest rate is at zero after going negative years ago and its inflation rate is 5.2% but more inflation may be coming through the pipeline.

The Canadian Dollar initially depreciated against the USD at the outstart of the pandemic but has been steady recently. It has even been appreciating against the dollar in recent months and will likely maintain its current level even if more variations of the Covid virus begin to appear. The Canadian inflation rate is currently 4.7% right now but will likely go higher as natural gas prices rise during the winter.

The Australian Dollar experienced a shock at the start of the pandemic but has fully recovered any lost ground against the dollar. Australia is a major commodity exporter which supplies China with raw iron ore, natural gas, oil, coal, and other minerals. The pandemic and the initial drop in commodity prices were a hit to the country but as commodity prices have surged, the Australian currency has strengthened with them. Inflation fell to 3% from 3.8% in Q2 as natural gas prices have eased in Asia but may go up if the theory of the commodity super cycle turns out to be true.

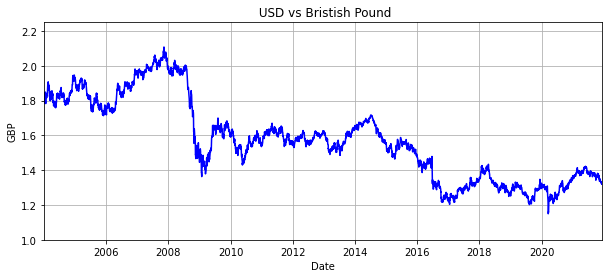

The British pound has maintained its strength throughout Brexit, the pandemic, and anything else that comes it’s way. The currency shows no sign of dropping and will likely continue to remain stable over the next few years even if the pandemic continues. The inflation rate in the UK jumped to 5.1% from 4.2% the previous month and is above market expectations of 4.7%.

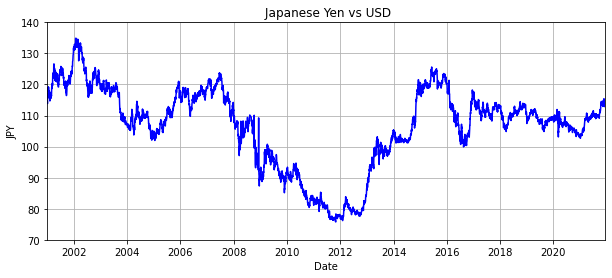

The Yen is another safe-haven currency that has remained stable during the pandemic. Investors have seen the Yen depreciate slightly but the currency can be unstable at times and continues to remain within an acceptable trading range. The Japanese inflation rate is always historically low and is one of the lowest in the world. This inflation rate comes in at just 0.1% YoY due to their stagnant population growth rate.

Unstable Currencies

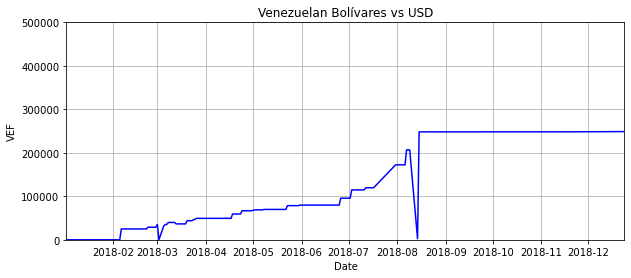

Venezuela was one of the original countries that saw its currency devaluate overnight in recent years. It went from being the richest country in Latin America to people filling trash bags with hard currency just to buy bread. Its oil reserves (the largest in the world), vast gold reserves, tropical island resorts, iron ore, nickel, coal, bauxite, blue gold, as well as hydroelectric power were not enough to save the country from former President Chavez and current President Maduro. It’s unclear what the effect the pandemic has had on the currency but recent violence on the Colombian border from state-sponsored drug cartels against the military indicates that it is not going well for the narco-state.

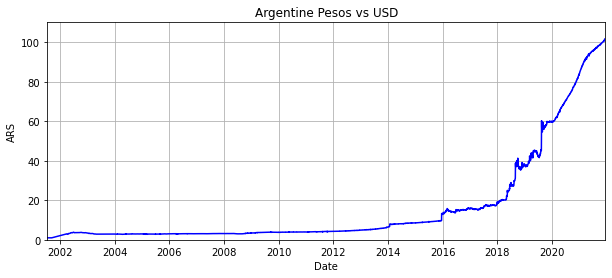

The Argentinian Peso may look bad on the surface but upon a closer look we can see that the situation in the country has become disastrous. The country has turned into a narco-state with drug money coming in to bribe then-President Cristina Fernández with suitcases full of millions of dollars and the Ndrangheta taking over drug-running operations in the country for now. The true value of the currency is approximately 200 Pesos to the dollar according to www.dolar.blue which is a website that gives the black-market rate in the country. Rent is paid in USD and people convert their meager savings into dollars as soon as they get paid. The vast shale deposits, massive agricultural sector, and extensive trade agreements could not save this currency from miss management. It’s also rumored that the Mexican drug cartels have also been appearing in the country and where they go violence is sure to follow.

The Argentinian inflation rate dropped slightly to 51.2% but remains critically high. This is surprising due to their low population density, massive agricultural production, and their vast shale deposits.

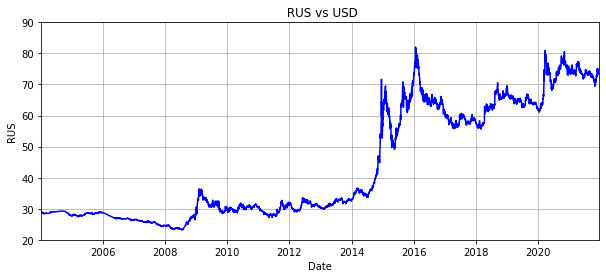

Russia is another country that saw its currency depreciate before the pandemic. Russia received a one-two punch after the Ukrainian Revolution and subsequent annexation of Crimea coupled with a collapse in oil prices which Russia was one of the largest producers of oil at the time. The Ukrainian government collapsed as a rebellion swept through the country and Russia moved quickly to take Crimea. Crimea houses a massive Russian base and it was unlikely that Russia would ever let the base go as it helps the country to dominate the Black Sea. This was followed by US and EU sanctions which helped to undermine Russia’s currency. This coupled with a drop in oil prices caused the currency to devaluate sharply. This caused friction among former CCCP countries as Russian exports became cheap overnight and imports became more expensive. Its trading partners like Kazakhstan could not export goods because the Russian Rouble was too low. The pandemic has depreciated the currency slightly but it has stabilized for now.

The inflation rate in Russia is currently 8.4% and boasts a high interest rate of 7.5% to keep up with its inflation.

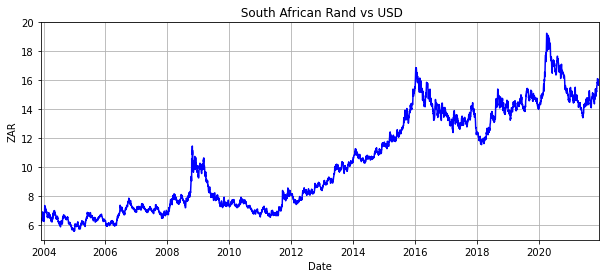

The South African Rand saw a major drop in its currency during the pandemic but has regained ground since then. The country has gained a lot of ground since the sharp depreciation but its currency is beginning to slide against the USD and the discovery of the Omicron variant and subsequent travel restrictions will not help the economy. South Africa has an inflation rate of 5.5% and an interest rate of 3.75% which is up for the pandemic but is still below pre-pandemic levels.

The Brazilian Reais has slid almost 40% since the beginning of the pandemic and has held steady since interest rates jumped from 2% to 9.5% in a single year. This has kept the currency in check for now which protects the economy as the pandemic rages on and the economy overheats. The drought in Brazil did not help agricultural production which is the main driver of their economy but their currency has stabilized at just under 6 Reais to the dollar. Brazil’s interest rate has been skyrocketing during the pandemic and it has risen to 9.25% to combat its inflation of 10.74%.

CNY

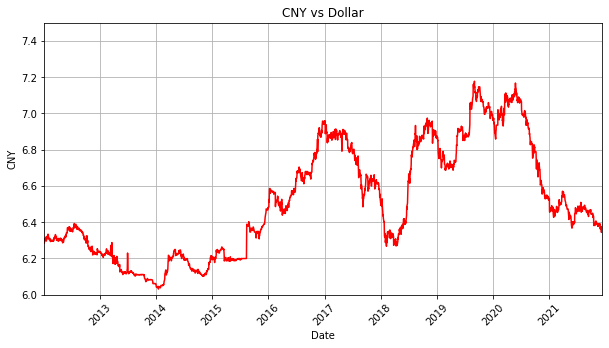

One curious currency is the Chinese Renminbi (RMB) otherwise known as the Yuan. China’s economy has been facing several headwinds. The tech industry is collapsing as the government started a crackdown on the industry and several companies began being delisted from US stock exchanges. Chinese real estate companies are in default and it looks like the beginnings of a 2008 financial crisis for the country. President Trump’s tariffs moved lower-end manufacturing away from the country years ago and while some of that has begun to move back as Vietnam has crackdown on the Covid virus, higher-end manufacturing has been hit by high-end manufacturing issues like chip shortages and supply chain issues. This is not to mention higher commodity prices which disproportionately affect the exporter, appreciation of its currency versus the dollar, and higher labor costs that will hit Chinese manufacturers.

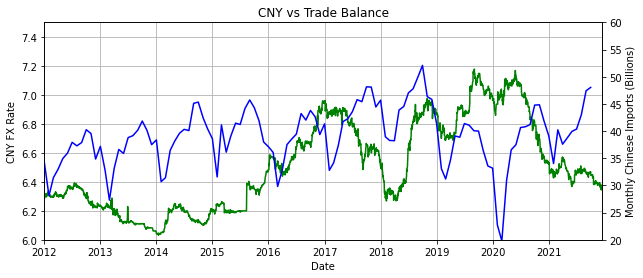

In spite of all this turmoil in the Chinese economy, the currency has actually appreciated against the dollar. Trade is up with the US and sales are set to jump during the Chinese New Year coming up in February. Trade is cyclical with China because of the holiday season in the US leading up to Christmas and the Chinese New Year when the country comes to standstill as people go home for the holidays. Trade rises in the last months of the year and drops after the New Year until after the Chinese New Year.

Even with the headwinds against the economy, the currency keeps rising. The Chinese have effectively pegged the currency to the USD even as the economy tries to eclipse the United States. The Hong Kong Dollar is pegged at 7.8 HKD to 1 USD and the Chinese RMB is in a “managed float” system where China keeps its currency between 7.2 and 6.2 RMB. With this peg, they have kept their currency stable through all the economic turbulence and the pandemic. This has allowed China to avoid the pitfalls of other BRICS nations which has supported confidence in the communist country.

USD

The DXY is currently up right now but rising interest rates overseas and a negative real interest rate domestically could push investors to move their money overseas. The current inflation rate is 6.8% and the current federal funds rate is near zero. This means that if you keep your money in cash in the United States you are losing 6.8% of your money each month. This forces the public to invest their earnings which is what is propping up the stock market, the housing market, the automotive market, and everything else.

The problem is that all of these indexes are at record highs and investors’ capital is going into riskier and riskier assets. As the interest rates begin to rise and a taper tantrum ensues, fewer people will buy houses due to the psychological effect higher interest rates have on the general public. More people would rather pay $50,000 over asking price than pay 1% more interest on a second home. This will not lead to another 2008 financial crisis but a housing correction may bring down home values if millennials and private equity companies limit their purchases of property.

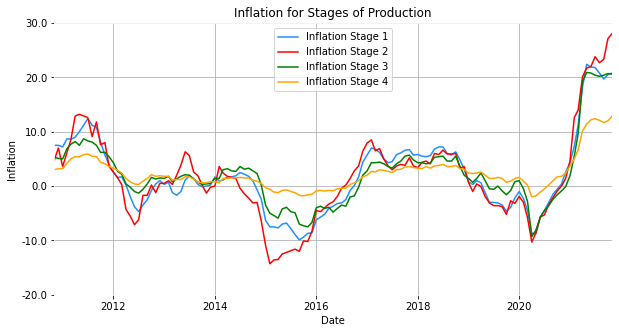

The Federal Reserve announced today that they will raise interest rates 3 times in 2022 to combat inflation which is at a 39 year high. But the Fed raising interest rates by 25 basis points (0.25%) three times will do little to combat inflation. Final inflation may only be 6.8% but if we look at the stage of production we can see that there is more inflation that will come down the pipeline.

Stage 1 is furthest up the inflation pipeline and is currently running at about 20.8%. Conventional wisdom is that manufacturers in China will eat some of these costs but since they are passing off the costs of rising labor and energy it is likely that America will see this inflation when goods finally get through the supply chain.

Stage 2 is even worse at 28.1% which feeds into Stage 3 which is at 20.6% and Stage 4 at a paltry 12.9% inflation. Stage 4 manufacturing feeds into the final demand.

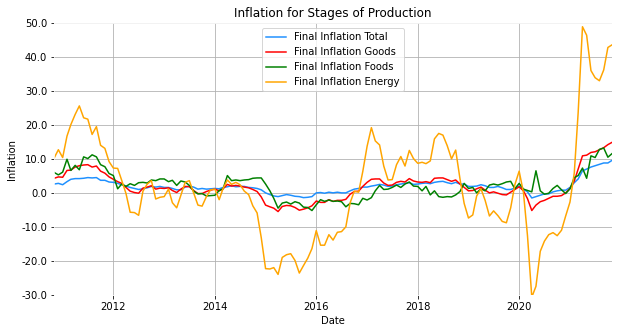

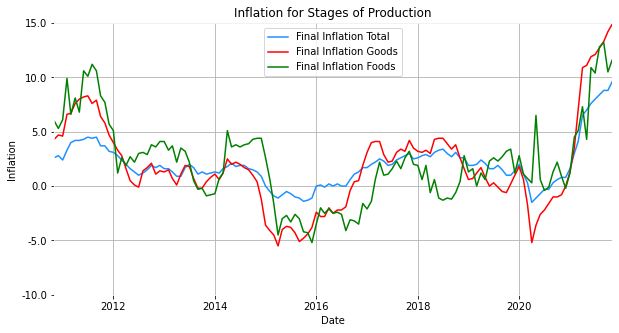

Final demand has been steadily rising in the US. The supply chain issues, rising energy costs, shortages of goods and services, and shocking labor prices have taken a toll on Inflation.

This view above shows what the final inflation, in blue, looks like now. As time goes on inflation will pass through each of the stages and keep rising. This is important because the Federal Reserve is still printing over $100 billion a MONTH in stimulus money plus they are keeping interest rates at zero right now before they raise rates in 2022. If the Fed and investors think interest rate rises of 75 basis points will keep inflation under control they are mistaken. Other countries are raising rates to keep up with inflation so their investors do not have a negative interest rate and the US will eventually have to raise rates to keep up with investors taking money out of the US economy.