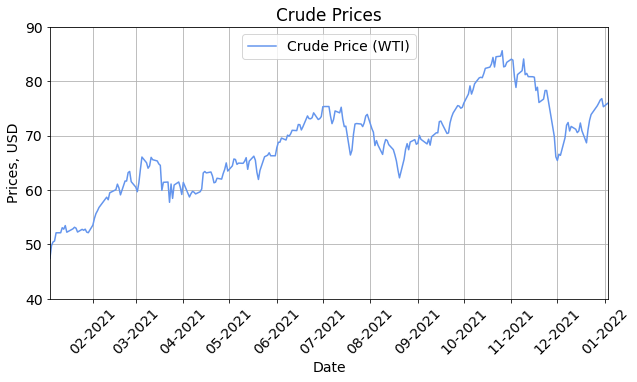

WTI has hit $80/BBL and looks set to rise even higher in the summer months. The turmoil in Kazakhstan, declining DUC inventory, and OPEC+’s assessment of rising crude prices in the coming months are driving up the price of crude oil and this will hit gasoline prices soon.

Kazakhstan is a major oil producer and is part of the OPEC+ agreement. They produce just under 1.7 MMMBPD (1.7 million barrels per day) of crude oil. The government rose gasoline prices for the public and a protest of higher prices turned into a protest on corruption and mismanagement of resources. Russia, an all-weather ally, has launched its paratroopers to quell protests and the government has announced that they will shoot protesters in the streets.

But oil prices were already on the rise before unrest erupted in Asia and look set to rise even in the winter.

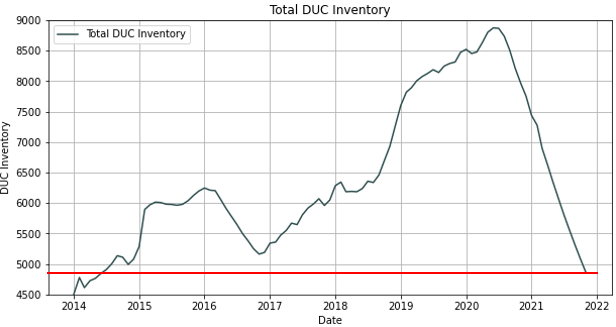

DUC INVENTORY

Total DUC inventory continues to decrease as producers frac wells that have been drilled and left as underground storage. Total DUC inventory has dropped below 2015 levels and new data will show that inventory has already fallen below 2014 when oil was $100/BBL.

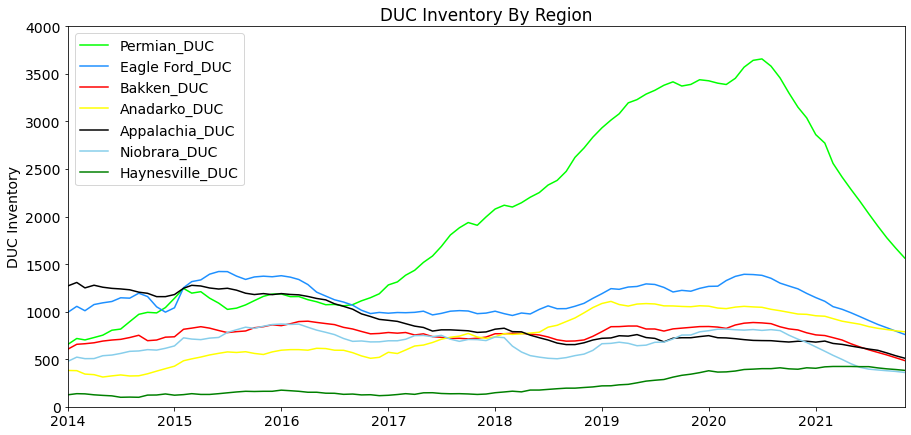

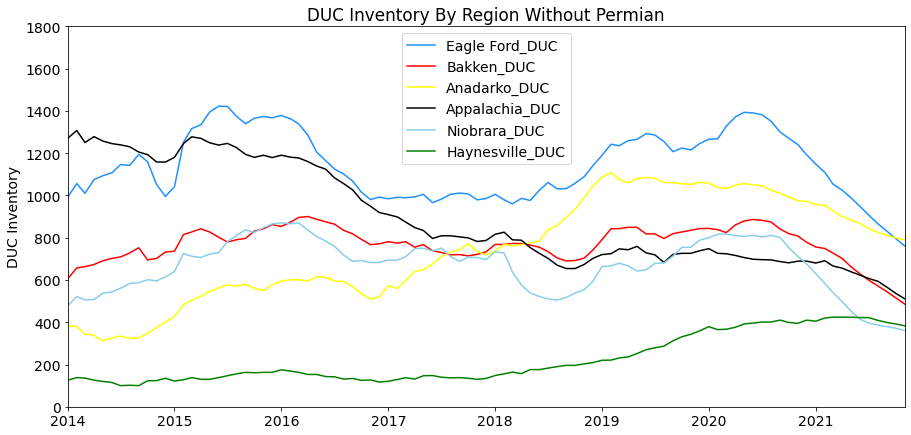

Permian DUC inventory has been dropping substantially since the pandemic began. The market will see substantial price gains once the Permian DUC inventory drops approximately 400 more wells. This is because the Permian is such a large producing region in the US, it will shake markets to know that the Permian is relatively out of DUCs. Each region will have a base number of wells since drilling operations necessitate the need for DUCs. Rigs need to drill all the wells on the pad before a frac crew can complete the wells and rigs need to drill all the planned wells in an area before fracing operations can commence so there are no mother/child interferences when drilling. Since the shale wells in the Permian decline much faster than the industry expected, a low DUC inventory will signal that Permian production will drop and will cause widespread panic among investors.

Bakken DUC inventory has decreased by about 100 wells since 2014, Eagle Ford is 200 DUCs below 2014 inventory levels, Appalachia DUC inventory is down by approximately 600 wells since 2014, and the DJ basin is down almost 200 wells from 2014 levels.

The Haynesville Shale has more DUCs than in 2014 but these are primarily gas wells. The Anadarko is in the same position with DUCs up by approximately 400 wells since 2014. These shale deposits are located on private Texas and Louisiana land which makes regulatory issues much easier to navigate vs Federal and state-owned land on the Delaware side of the Permian. Private land prevents most interference by government entities that are hostile to the oil and gas industry from curtailing production and completion of wells.

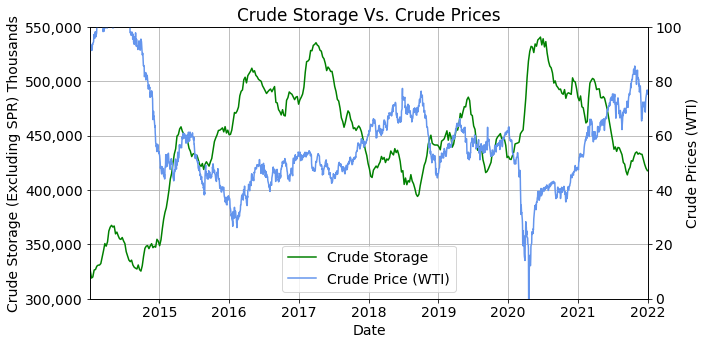

CRUDE STOCKS

Crude stocks are still up by approximately 100 MMBBL since 2014 when WTI was $100/BBL. If crude stocks do not rise in the next month, as they usually do in the winter, we will see stocks fall by approximately 100 MMBBL in the summer which will push prices higher into the mythical $100/BBL.

The difference between today and 2014 is that America is now a major oil and gasoline exporter. America was producing substantial amounts of crude oil in 2014 but was not able to export oil to Asia and Europe. Now America is producing approximately 2 MMMBPD more oil than in 2014 but exports are approximately 2.9 MMMBPD.

These export contracts have allowed America to become the largest natural gas producer in 2021 by barely edging out Qatar for the top exporter spot. Qatar is planning to add substantial export capacity and will regain the title within a few years. Also, Australia may mend ties with China which could add to its natural gas exports but currently, America is the largest natural gas producer in the world as well as a major crude exporter.

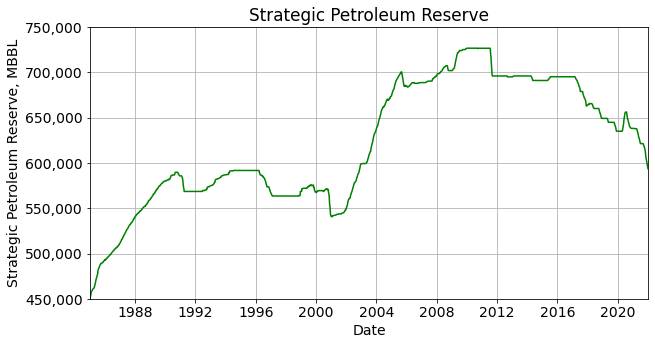

President Biden has tried releasing crude from the Strategic Petroleum Reserve but that has done little to soothe markets. The rise of the Omicron variant led to a drop in crude prices, but markets have shrugged off those concerns. The Strategic Petroleum Reserve has dropped below 2004 levels and it’s unlikely that President Biden can reduce the reserve without causing a panic. This leaves President Biden with few options to lower prices if crude stocks do not rise in the next few weeks.

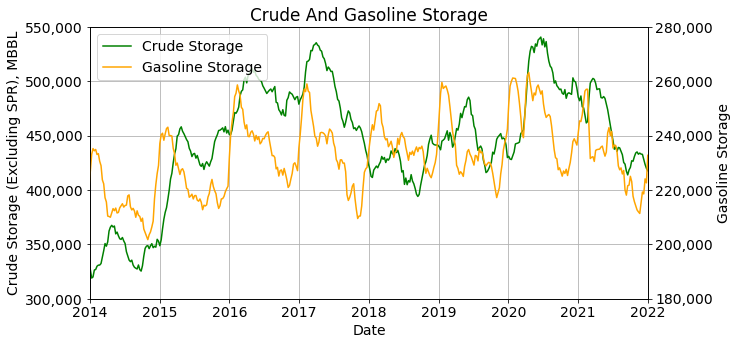

GASOLINE STORAGE

Gasoline storage rises by approximately 40 MMBBL between the beginning of December and the end of January. Gasoline stocks have risen by approximately 20 MMBBL and are set to rise by another 20 MMBBL in the next few weeks. Refiners will then pause crude purchases as they do seasonal maintenance. This will cause crude stocks to rise in the spring before the summer driving season.

There are currently not enough rigs drilling new wells to keep up with the demand for oil and gas. The DUC inventory is being drawn down because frac crews are completing those wells and if crude stocks do not rise in the next few weeks, then the summer drop will cause havoc in the markets.

The unrest in Kazakhstan will likely be short-lived with Russia’s little green men swarming Almaty and the Kazakh President’s shoot-to-kill order will put down any protests for the time being. Even if unrest does topple the country this will only have a short-term impact. But the loss of production from a lack of DUCs will have a substantial impact on prices in the near future.