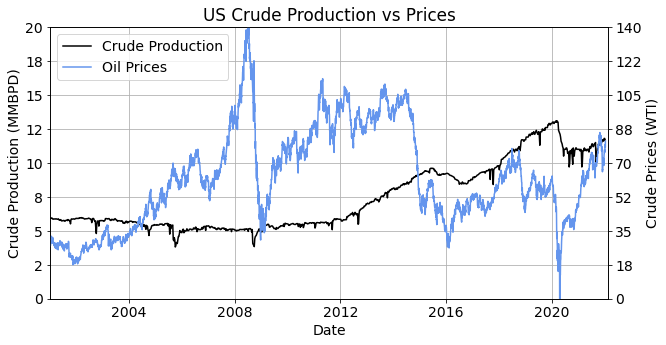

Gasoline prices are set to spike as crude oil prices are at their highest in 7 years. Crude oil prices crashed during the pandemic as Saudi Arabia flooded the American market by sending 6 VLCCs filled with 12 MMMBBL of crude to ports in the United States. This collapsed the price of crude as demand plummeted and prices dropped below zero and kept falling till they reached -$45 a barrel.

Massive layoffs in the industry stunted growth as drilling ground to a halt and production dropped by 3.4 MMBPD of crude. Crude production bounced back by 2 MMBPD but drilling has continued to remain subdued. Demand for crude has returned to normal but the number of wells drilled remains at historic lows. The rig count continues to remain below 600 and the number of DUCs (drilled but uncompleted) has likely dropped below 2014 lows when oil was $100/BBL.

These market forces are pushing crude oil prices higher which in turn will raise prices on gasoline, diesel, plastics, toys, cargo vessels, food, and every other sector of the world economy. If the rig count does not double in a few months and the number of DUCs reaches a critical level, then crude prices will spike in the US. OPEC+ may be able to fill the gaps in declining American production but will keep prices higher for longer.

Production

Crude production has dropped from all-time highs of 13.1 MMBPD before the pandemic to around the current production of 11.7 MMBPD. Current production is being maintained by completing wells that had been drilled years ago and not by the drilling of new wells.

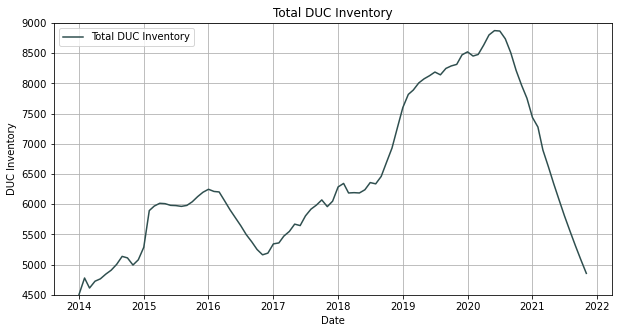

DUC Inventory

Wells that were drilled during a time of low crude prices were left uncompleted and these were called DUCs. These wells were used as a type of free underground storage. That underground storage is currently being drawn down by oil companies that had waited nearly a decade for higher prices. The graph above shows the number of DUCs up until December of 2021. If the line is extrapolated to today, then we can see that the number of DUCs has reached the lowest level on record and continues to decline rapidly.

DUCs are a necessity when drilling shale wells because multiple wells are drilled on each pad before frac crews can complete the wells. This is done to prevent frac hits on wells that are currently being drilled. A rig will have to drill all the wells in the immediate area before frac crews can complete the wells on a lease. This leads to a number of wells that are drilled but left uncompleted.

This is the reason why oil companies will always have a minimum number of DUCs. The bare minimum number of DUCs is unknown but will likely be a minimum of around 2000 but more than likely will be around 3000 or 4000 wells.

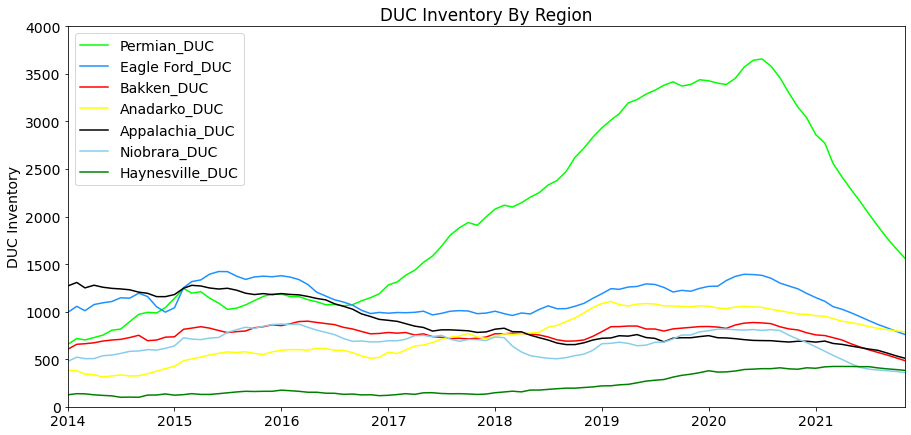

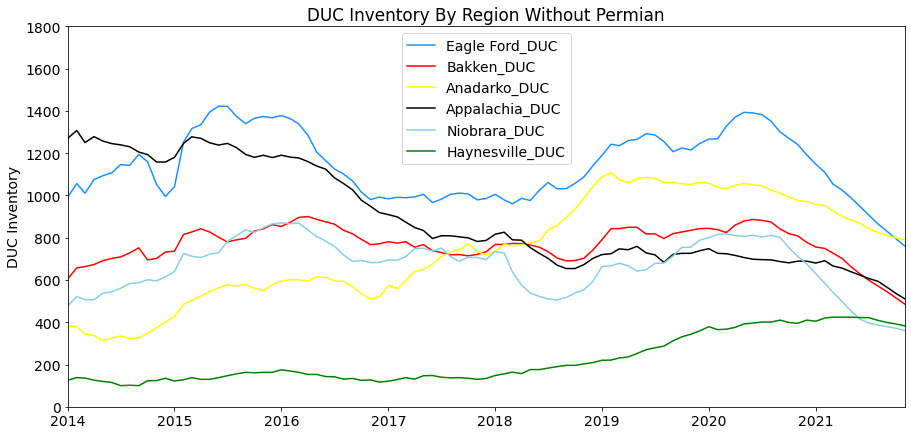

The number of DUCs in each shale field is presented above. The number of DUCs in the Permian has dropped dramatically and shows little sign of slowing down.

Looking at each shale field, it becomes obvious that the number of DUCs in almost every region has fallen since the pandemic started. Many of the shale fields have DUCs that are near or below 2014 levels. If the number of DUCs continues to decline there will not be enough inventory to satisfy demand. This will cause prices to spike as investors panic.

Above Ground Storage

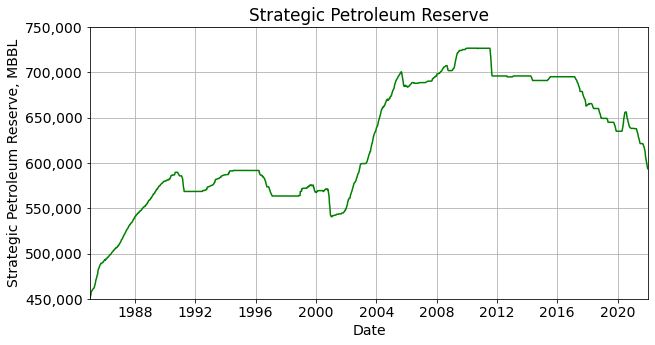

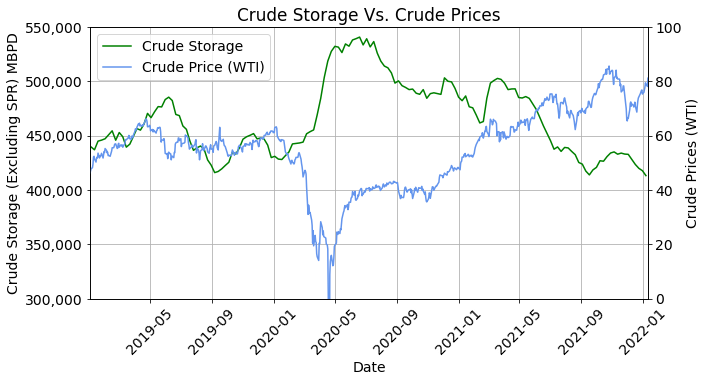

President Biden released oil from the SPR (Strategic Petroleum Reserve) in order to bring down crude prices. This had a moderate amount of success as crude storage rose briefly and WTI prices dropped. The SPR has been drawn down to lows not seen in 20 years and cannot be drawn down any further unless the President is not concerned with how the market will react.

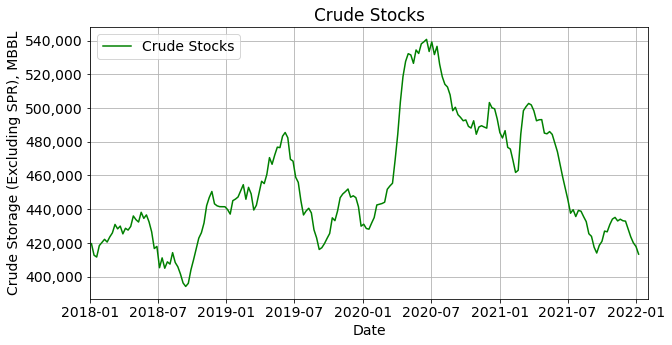

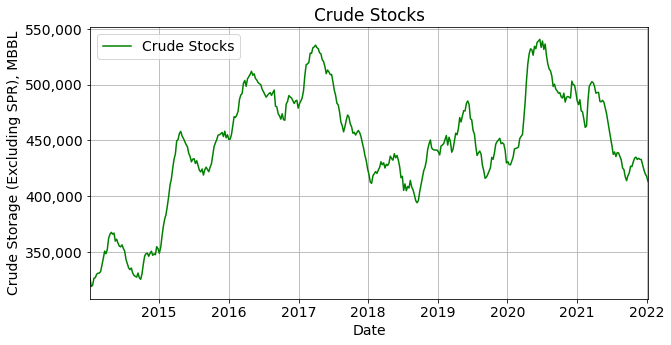

Crude stocks rose slightly at the end of 2021 when the SPR was being drawn down. This caused WTI prices to fall from their recent highs. But a lack of new wells and falling crude storage has caused WTI prices to jump to high a 7-year high during the winter when demand is lower. The SPR continues to be drawn down to levels not seen in 20 years. This is a risky strategy because crude could be needed during the summer months when demand is higher. A low SPR could shake confidence in the government’s ability to quell a price spike due to low crude production.

Crude stocks have also dropped which have pushed up WTI prices. Crude storage is near the low that was seen in 2018. If these stocks continue to decline and drop past levels seen in 2018, then prices will keep rising. DUC inventory is currently lower than 2018 so the current total inventory of crude oil is reaching lows not seen since WTI was $100/BBL.

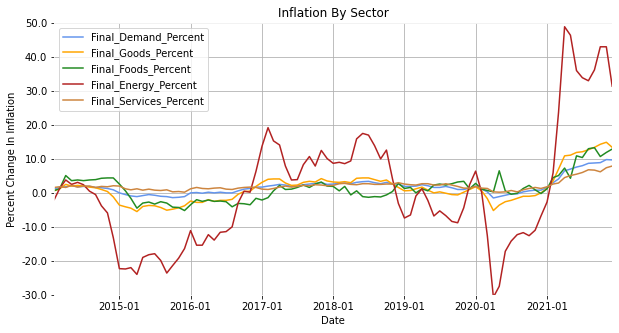

Inflation

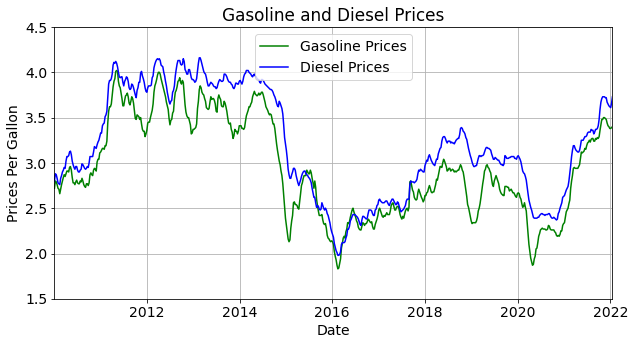

When crude storage passes the 2018 low in the spring or early summer of 2022, then prices will continue to rise which will keep inflation from receding. Gasoline prices are already starting to rise as a result of this drawdown in crude stocks. Gasoline prices in California have become unaffordable for average Americans and as diesel prices rise so will the prices of consumer goods. Long-distance truckers ship goods but are directly exposed to inflation as diesel prices rise. Cargo vessels that ship goods between Asia and the United States are also directly impacted by higher prices as it becomes more expensive to ship goods. Plastics become more expensive as crude prices rise and this impacts everything from children’s toys to Amazon’s packaging.

A major concern is that the Fed is officially communicating language about inflation that they do not believe to be true. The Fed has repeated that inflation was transitory even when it was evident that inflation was rising to unsustainable levels. Vehicles are being sold for $6,000 over what they were a year ago. Housing prices in major markets have doubled and have reached unsustainable levels for the average American. Crude prices are at 7-year highs which will push inflation even higher. And the Federal Reserve says it believes that raising interest rates by 1% will quell these price increases.

The Fed’s Core CPI strips out volatile inflation measures like food and energy so it allows the Fed to deny that inflation is actually happening. But even when the average American is experiencing the rising cost of food and housing. The Fed announced that they will raise interest rates a total of 1% over the next year from historic lows. This may slow the rise of inflation but with Owner’s Equivalent Rent being higher than the price of rent, employers struggling to get employees to even show up let alone paying them hiring bonuses, and continuing supply chain issues will continue to push inflation higher.

Energy plays a critical role in measures of inflation and if drilling does not begin to rise then this will only add to higher prices. Energy prices may reach $100/BBL if drilling does not pick up soon. The Fed will have to raise interest rates even higher to keep up with the pace of inflation which will impact riskier stocks and bonds throughout the economy which is already being seen today. President Biden has to find a way to work with oil companies to push production back to higher levels and increase crude stocks. If he does not, the Fed may be forced to raise rates higher than the stock market can afford.