Oil prices have been rising as conflict engulfs Europe and OPEC+ refuses American diplomats’ requests to raise production past their planned 400,000 BPD increase. These factors are pushing up crude prices as US storage is rapidly declining.

International Factors

Russia has been building up troops on the Ukrainian border and the US has responded by sending military technology to Europe and threatening sanctions against Russia. This has rattled many countries in Europe, especially those in the former Soviet Bloc that rely on Russia for natural gas or have strong economic ties. The US has sent tens of thousands of troops to Eastern Europe as Russia builds up over 170,000 little green men on different parts of the Ukrainian border. This tension has driven up crude prices in the US as investors anticipate that war in Eastern Europe would disrupt crude supplies.

Another factor that is driving up crude prices is Saudi Arabia’s refusal to increase production. OPEC+ scheduled a production increase of 400,000 BPD but is struggling to raise production beyond its current levels. Saudi Arabia has officially been under-producing to keep the current OPEC+ deal intact. The kingdom even rebuffed American envoys that are pushing the de facto leader of OPEC to raise its production from 10 MMBPD to its maximum capacity of 12 MMBPD.

Other OPEC members are currently underproducing as well. African oil production has stagnated as countries like Libya struggle to deal with a civil war that ravaged the country or Nigerian production being impacted by a fire on a crude ship that blocked exports. Venezuela is producing more crude with Iran’s help and China’s willingness to skirt US sanctions. Iran is also likely flouting US sanctions by feeding China’s insatiable appetite for crude. But these two countries’ true export capacity is unknown due to VLCCs turning off their transponders.

US Crude Storage

International factors are pushing up crude prices but the main driver for rising crude prices in the US is due to falling storage.

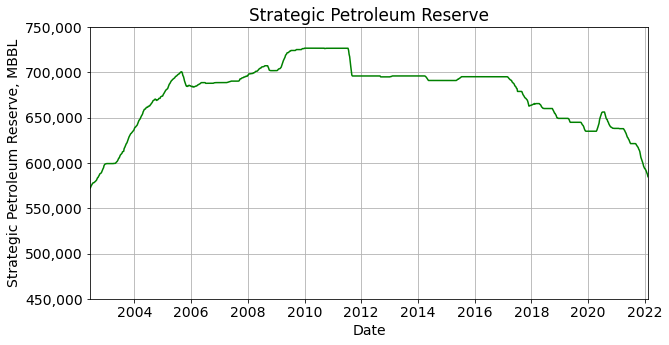

President Biden released 53 million barrels from the Strategic Petroleum Reserve (SPR) to blunt the rise in crude prices. The SPR’s release had a brief impact on prices as storage rose late into 2021. Storage rose slightly for a month but then began its decline shortly after the release and is at a 20 year low. The President could release more crude from the SPR but he risks stoking investors concerns that the US will not have enough crude to meet demand in the case of an emergency or conflict in Europe.

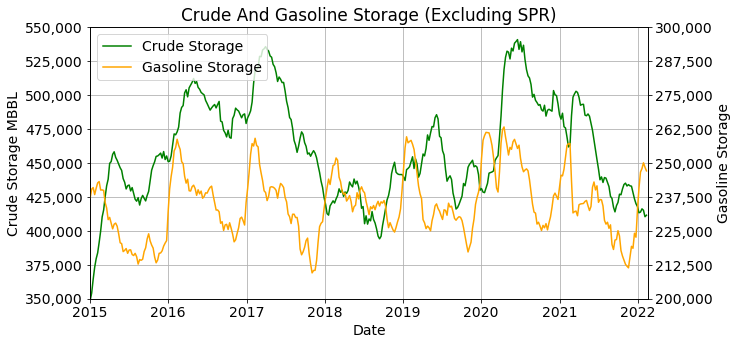

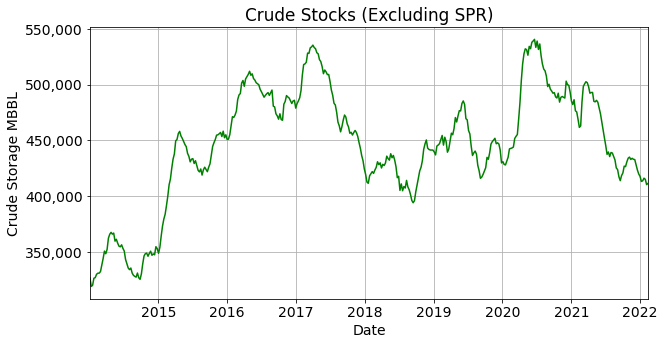

Crude storage dropped after a brief rise following the SPR’s release. Crude storage rose in 2014 when prices collapsed and producers stored crude in an attempt to wait for higher prices. Crude storage remained elevated before it dropped in 2017 due to improved market conditions. OPEC+ raised output to defend market share in 2018 which caused crude storage to rise in 2019. This year is different because OPEC+ does not feel that it needs to defend its market share. This is because Majors are cutting back in the US due to the political climate.

Above ground crude storage skyrocketed by 110 million barrels as pandemic curbs took their toll on the oil and gas industry in early 2020. Above ground crude storage dropped by 130 million barrels since oil peaked and is close to when oil was over $100/BBL.

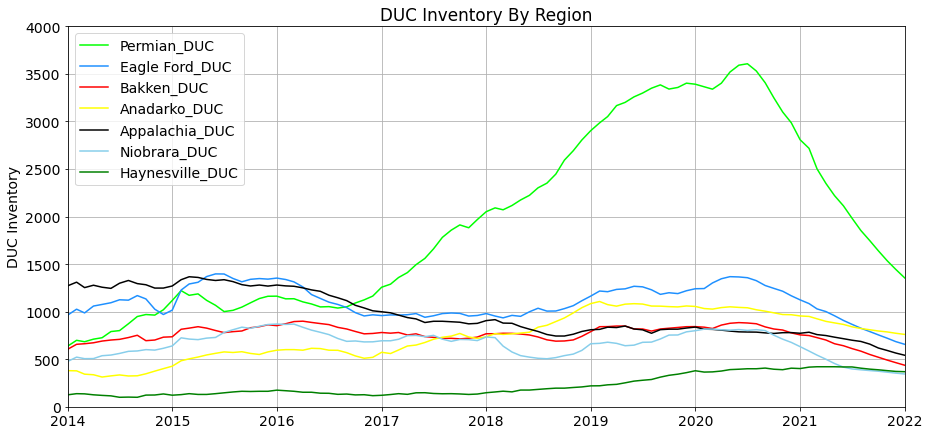

Wells that have been drilled but left uncompleted (DUC), has served the role of underground storage for producers. Unconventional producers typically have several wells per pad which differ from conventional producers that have a single well per pad. Some regions even have Drill Islands that have hundreds of wells on a single pad. These wells cannot be fractured while a drilling rig is on the pad due to frac hits during the drilling process. Even if a pad only contains three wells, all the wells on the pad need to be drilled before frac crews can complete the wells to prevent frac hits. This practice can create a bare minimum number of DUCs in a shale field.

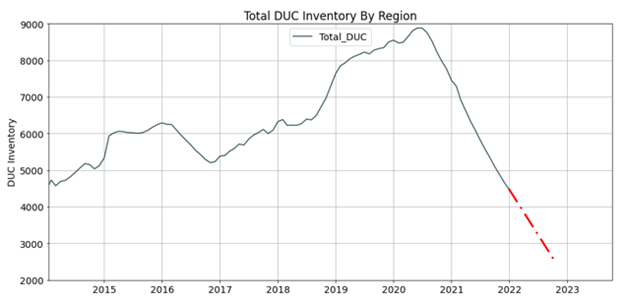

These wells represent substantial future crude production for producers. Each well can cost approximately $4 million and can produce substantial amounts of crude when they are flowed back. Producers initially overestimated crude production from these shale wells as production drops off dramatically in the first year or two. They continued to invest in shale fields until the pandemic hit crude consumption. Some producers have sold acreage on Federal lands in the Permian as they diversify away from acreage that can be affected by politics. Total DUC inventory is at 4466 wells which is just 6 wells higher than at the start of 2014. These wells are being completed as prices have risen to recent highs. This has reduced producers’ DUC inventory and has contributed to rising prices.

Total DUC inventory has declined rapidly from record highs during the pandemic. The dotted line in red shows the extrapolation of the current DUC inventory trend. This trend looks set to continue if shale fields do not hit the minimum number of DUCs and prices do not see a substantial drop of $20-30 per barrel. If this trend begins to flatten out, that could be an indicator that shale regions have hit their minimum threshold.

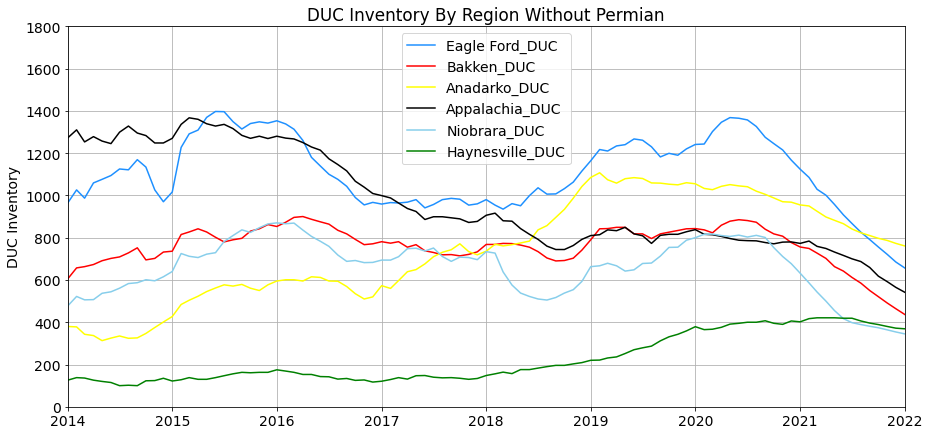

The graph above excludes the Permian Basin but highlights the number of DUCs in other shale fields. The Eagle Ford dropped by almost 800 wells since the peak in 2020, the Bakken dropped by almost 500 wells, the Niobrara shale region dropped by 400 wells, and the Anadarko basin dropped by 200 wells from pandemic peaks. But these are nothing compared to the Permian Basin’s drop of over 2200 wells. The Permian Basin’s DUC inventory is currently 1355 wells which is close to the 1000 wells that the Permian had in 2014 when oil was $100/BBL.

Crude storage rises at the end of the winter after refiners finish purchasing crude to refine into gasoline and then conduct scheduled maintenance work. Demand for crude drops as gasoline stocks reaches a peak for the year and refiners pause operations for maintenance for a month. If crude storage does not rise this spring it could indicate that prices will rise substantially in the summer. This year will probably be similar to 2018 when producers had an exemplary year but OPEC+ decided to defend market share at the end of the year when demand declines.

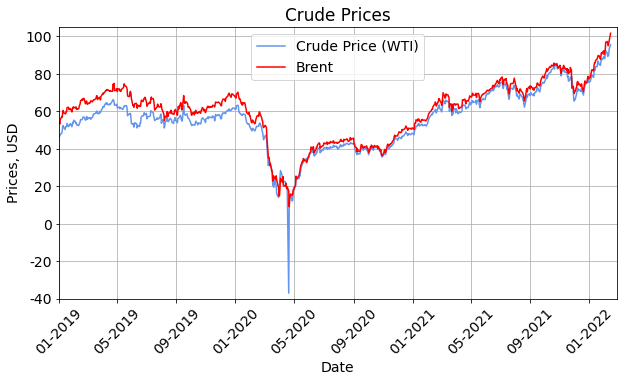

Prices

Crude prices have risen since they collapsed at the start of the pandemic. Saudi Arabia sent several VLCCs to the US in order to flood the market. This caused WTI crude prices to drop to -$45/BBL as producers scrambled to fill up makeshift swimming pools with crude as storage reached maximum capacity. Brent did not feel the impact of this crude glut as severely as the US, because OPEC only wanted to flood the American market. American producers were able to clear the glut by marketing crude at rock bottom prices to feed China’s independent and state-owned refiners.

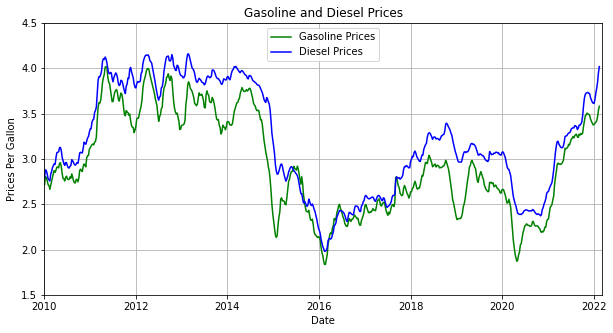

Crude prices have spiked in recent months which caused gasoline and diesel prices to rise to their highest levels since the market crashed in 2014. This has been a major headache for the Democrats as higher gasoline prices add to inflation. The Federal Reserve raises interest rates to cool off inflation but that cools off other sectors in the economy like the housing market.

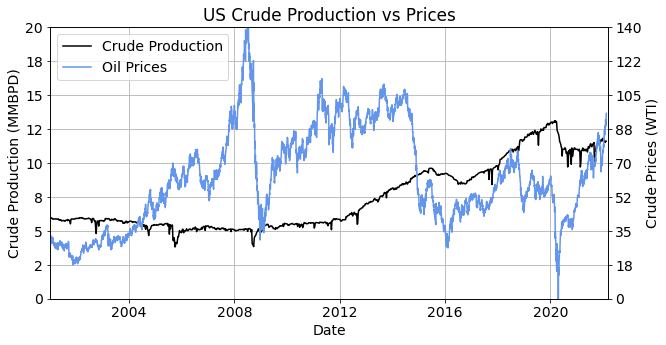

Crude production is currently 11.6 MMBPD which is a drop of 1.5 MMBPD since pre-pandemic record highs. Crude production dropped from 13.1 MMBPD in March of 2020 to 9.7 MMBPD in 2021. Production has bounced back as WTI remained above $90/BBL and Brent rose to over $100/BBL in intra-day trading.

Crude prices rise in the summer and fall in the spring. If they do not decline this spring, they could be rising from recent highs which will put summer prices at new records for gasoline and crude.

OPEC+ is unlikely to raise production unless sanctions on Venezuela and Iran are lifted, the Russian threat to Europe will not disappear even if troops are recalled, Europe will likely begin to diversify their energy sources away from Russia, and US producers may run out of DUC inventory.

Crude storage will likely rise in the spring when refiners close down for maintenance. If they do rise, this will spook investors and cause crude prices to fall. If crude storage does not rise in the spring when refiners close down operations for maintenance, then crude prices will rise in the summer from recent highs. This will have a multiplier effect because WTI will not be rising from $70 or $80 per barrel but from $90 a barrel.

OPEC+ and Russia could easily cause prices to fall if they decide to defend their market share or even signal that they will produce at maximum capacity. Africa could ramp up production, the US could waive sanctions on Venezuela or Iran, and American producers could ramp up production. While all these possibilities are true, US crude storage is unlikely to rise by another 110 million barrels as it did during the pandemic so prices are likely to remain elevated for longer.