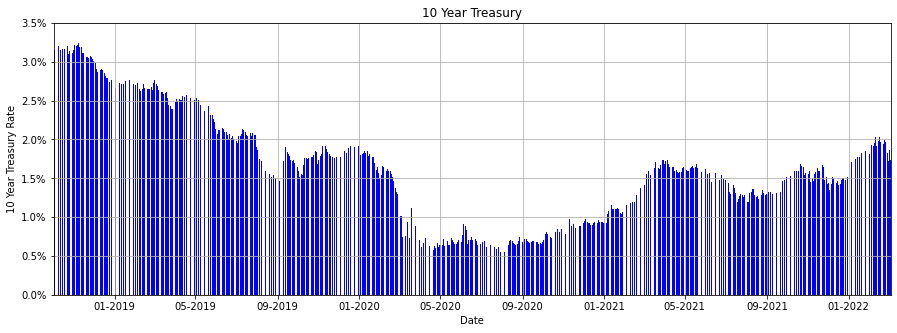

The recent market turbulence caused the 10 year treasury rate to drop from 2.05% to 1.74% in just two weeks. This drop signals that investors are nervous that the factors that are impacting the market will continue in the future.

The stock market dropped in January due to the Federal Reserve announcing they will be raising interest rates, the Russian invasion of Ukraine caused the market to plummet in February, and the rise of oil prices caused the market to fall even further in March. Inflation is bound to be an issue in the future with oil, Nickle, corn, soybeans, and every other commodity near record highs. This will cause the Federal Reserve to raise interest rates just to keep inflation under 10%. Investors will react to these rising interest rates by pulling out of riskier stocks which will cause havoc on the market.

The 10 year treasury dropped significantly from 3.05% before the pandemic to a 0.52% low during the pandemic. A lower 10 year treasury yield means that investors are willing to invest their funds for a decade at a lower rate because they lack confidence they can get a better return somewhere else. As the economy and interest rates rise, investors feel that they can reliability invest their capital in other sectors of the economy to get a better return.

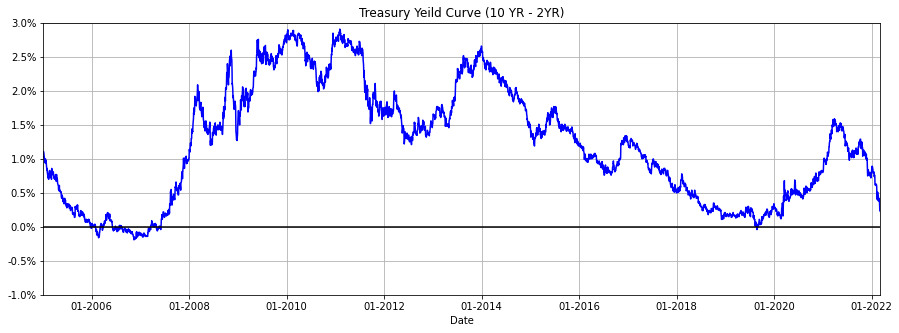

One measure of the health of the economy is the yield curve. The yield curve is the difference between the 10 year treasury interest rate and the 2 year treasury interest rate. If the economy is doing well, treasury interest rates rise to compete with rising stock markets and bonds. If the interest rate for the 10 year treasury drops, it signals that investors believe that the market will be lower in the future.

The yield curve has predicted economic turbulence over the past 30 years. This yield curve went negative in 2000 before the market dipped, in 2006 before the 2008 financial crisis, and the market panicked in 2019 when the yield curve briefly went negative.

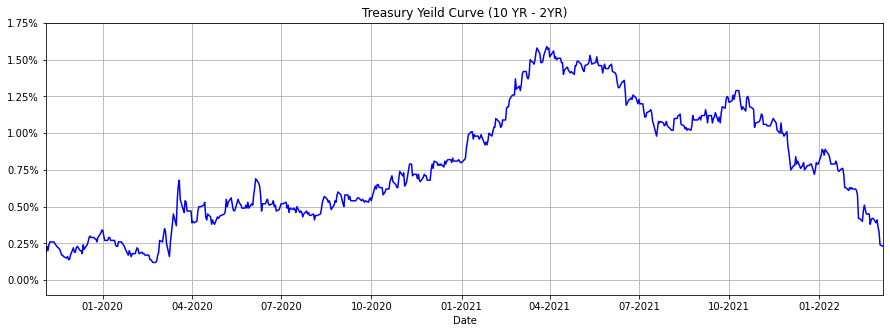

This measure of the health of the economy is currently tracking lower. The yield curve dropped in 2019 right before the pandemic but bounced back after the economy rebounded. Stocks rose and so did the competition for higher interest rates. The yield curve sits at 0.23 and it is near the low point it hit at the outset of the pandemic.

This time around the economy is reeling from headwinds on multiple different fronts. The stock market dropped in January when the Fed announced in December that inflation went from transitory to a long-term trend. The announcement that the Fed would raise rates made the rally in the stock market come to a halt.

Stocks began dropping after the Fed’s announcement but stocks were hit hard after Russia’s invasion of the Ukraine. Investors are concerned that Russia, a major commodity exporter, will be unable to export oil, natural gas, wheat, and several minerals.

The Russian/Ukrainian is not the only thing driving up commodity prices. Commodity prices have spiked as oil prices hit $130/BBL, the cost of grain is over $7.5/bushel, and wheat is $12/bushel. The drought in South America and the Russian/Ukrainian war drove up food prices across the world. Soybeans, wheat, and corn have all ballooned in recent weeks.

These price increases coupled with the war in the Ukraine, the Fed raising interest rates, and the shaken confidence in the stock market mean that the yield curve could be signaling a recession is on the horizon.

The Federal Reserve will have to not just combat housing inflation or rising energy prices but will have to get food inflation under control. Food inflation will not only impact the US but will devastate economies that have not bounced back from the pandemic. Mexico will be particularly vulnerable to rising wheat prices. China will need more corn and soybeans to restore their hog population that was decimated after a devastating outbreak of African Swine Fever. America will struggle to export enough corn and soybeans to make up for a poor harvest in South America which will add to inflationary pressures here at home.

This rising inflation will be different than the price of new automobiles rising by $15,000 or the cost of gasoline reaching record highs. The Federal Reserve will be forced to act and the market will overreact. The rising interest rates will push investors to panic and the market will decline. If inflation does not subside, investors will have to get comfortable with change in the market or will cause the bubble to burst.