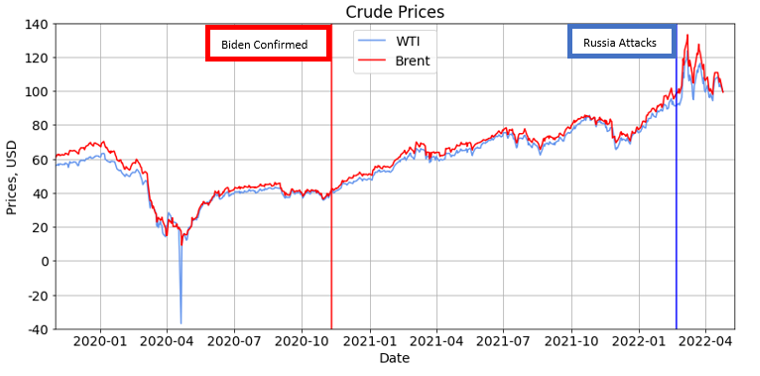

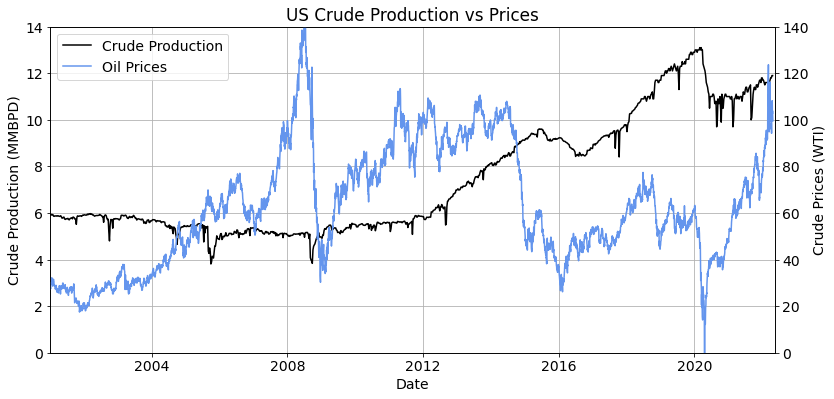

Oil prices continue to remain above $100/BBL as inflation runs rampant and the Federal Reserve plans to raise interest rates by 50 basis points to cool off the economy. Plastics, food, clothing, materials, transportation, and every sector of the economy is directly impacted by rising oil prices. Oil prices had been rising for months as President Biden was elected in 2020 which caused American producers cut back on production. Prices rose sharply after Russia invaded the Ukraine and western countries began threatening an embargo and have remained at elevated levels. The cause for rising oil prices and sustained elevated costs continues to signal that prices will remain high till the end of the year at least.

Deflecting Blame

The Democrats have claimed oil companies are not “doing their part” to tame oil prices while interrogation hearings are meant to punish oil and gas companies so they will combat higher gasoline prices. President Biden’s agenda when he ran for office was to end consumption of oil and gas by raising fuel standards, expanding renewable energy, and banning fracing in shale fields throughout the country.

The country has been shocked by the repercussions of the administration’s current energy policy goals as crude prices have risen to highs not seen for almost a decade. President Biden attempted to deflect blame on the war in the Ukraine but prices had risen since the day he was elected and had doubled within 6 months of him taking office. Also, the supply chain did not have any impact on crude prices during President Trump’s administration as they stayed at approximately $40/BBL.

President Biden was confirmed to the Oval Office on November 10th, 2020. Crude prices began to rise immediately after his confirmation as investors knew his policies aimed at reducing production without reducing consumption. The oil and gas industry received confirmation that President Biden’s administration would attempt to curb production based on his pick of Interior Secretary. Having an Interior Secretary that is intent on reducing production would cause any company to reduce investment for future production and this would directly cause oil prices to rise.

President Biden was blunt in his criticism of the industry but did not anticipate that Saudi Arabia would be so critical of his presidency that they would refuse to meet with American envoys or the President himself. This political fallout combined with rising oil prices, stable production, and declining reserves has caused prices to climb to levels not seen in nearly a decade.

Oil and gas companies have plans to raise production but not enough to keep up with demand as crude storage and the SPR continue to decline. Oil companies are unclear what consumption will be in the future in this political environment so they have held off on new investment within the US. If the standard vehicle consumption is regulated up to 50 MPG, then oil and gas companies need to reduce spending on production today. If car companies refuse to sell gasoline-powered vehicles then executives would be doing their stockholders a disservice if they spend money on production that will not come online for 3 years.

Crude prices will continue to remain elevated if storage continues to decline and investment does not rise in the near term. The administration fears that this summer will bring even higher prices as Germany has dropped their protest of banning Russian crude and the summer driving season already looking promising.

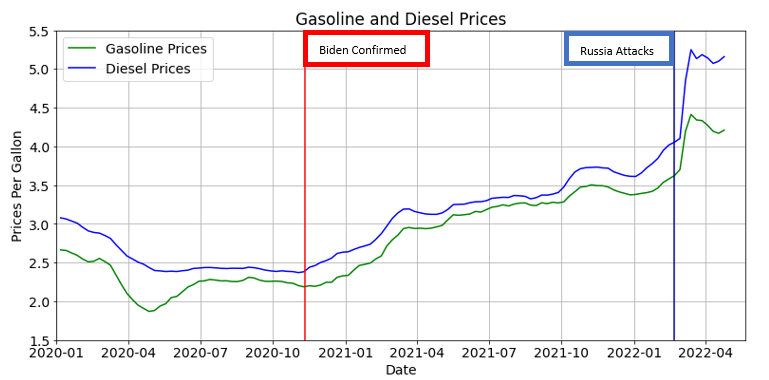

This will lead to higher prices at the pump. Diesel and gasoline prices hit record highs after Russia invaded the Ukraine but these prices were already on their way to highs not seen since 2014.

Prices spike in 2022 as Russian troops crossed into the Ukraine and have remained elevated on this political fallout. While this is true, prices began rising directly after President Biden was elected. The Democrat’s policies of reducing oil and gas production when renewables only make up approximately 20% of the energy mix in the US was bound to have political fallout. If the Democrats used taxes from the oil and gas industry to expand tidal and wind energy to make up for the loss of fossil fuels then this drop in storage would not have had as big of an impact.

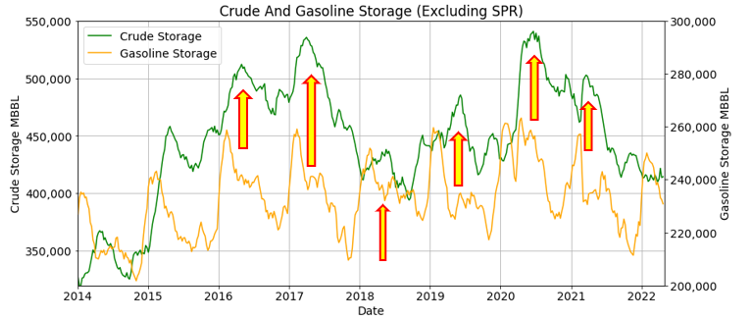

Crude Storage

Crude storage rises every year in the early spring as refineries go offline for scheduled maintenance and gasoline storage spikes. 2022 is different as crude storage has not risen during the spring as consumption has driven demand and production has not been able to increase supply. Crude storage has remained steady during a time when it should have been rising. This indicates that the demand will continue to outpace supply in the summer.

Gasoline storage is already declining before the summer driving season begins in late May. This means that crude storage may drop faster in the summer than in previous years. President Biden’s administration has realized this fact and announced that the government will tap the SPR to release 1 MMBPD during the summer starting in May. The administration’s announcement that the Strategic Petroleum Reserve will be tapped in the summer of 2022 to reduce crude prices may increase crude storage during the summer or at least keep storage from declining but this move could have long-lasting effects on the market.

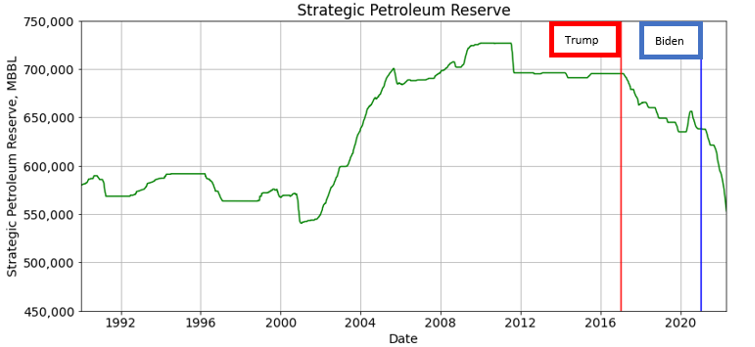

Strategic Petroleum Reserve

Draining the Strategic Petroleum Reserve could have the opposite effect of calming markets as the SPR reaches record lows and investors worry that America could not meet consumption during the time of an emergency. The SPR is designed to insulate the economy from shocks like the 1973 Arab embargo during the Arab-Israeli War when major Middle East producers cut off the US. President Trump began tapping the SPR when he was in office and lowered storage before it slightly rose during the beginning of the 2020 pandemic. Markets had little reaction to reducing the SPR as prices were already low from the collapse of oil prices in 2014.

The drawdown of the SPR kept crude prices from crushing the economy in 2021 as President Biden attempted to combat rising political anger against higher inflation. The SPR declined to 2002 lows and is set to decline to lows not seen since the reserve was created. Current storage at the SPR is 553 MMBBL and is expected to drop by at least 180 MMBBL during the summer under President Biden’s current plan. At the current consumption of approximately 18 MMBPD of crude and production of nearly 12 MMBPD, this will lead to approximately 2 months of current supply and demand of crude oil.

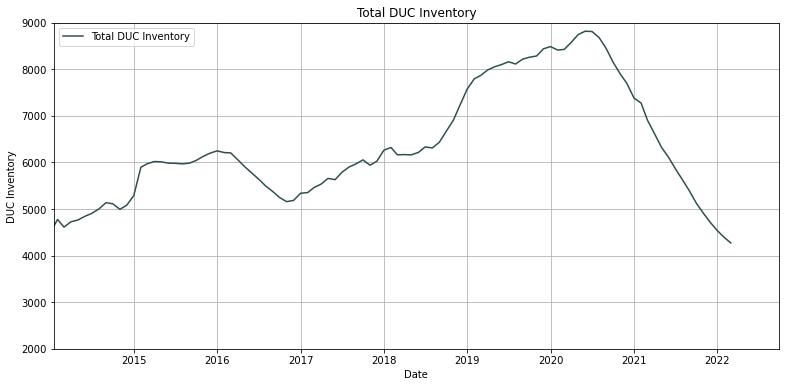

DUC Inventory

The SPR can cover an economic shock assuming production remains at current levels. The number of drilling rigs has risen dramatically since the start of the pandemic when they fell to record lows. The rig count has risen to 698 rigs which is up from 440 rigs just 1 year ago and a low of 244 seen in August 2020.

These rigs might be able to create new wells that will keep up with production and is close to the 800+ rigs seen in 2019 just before the pandemic. However, this is still just under half the number of drilling rigs in 2014 when rigs hit 1900+ and prices were over $100/BBL. These rigs have not been able to keep up with consumption as storage has declined since the start of the pandemic. The number of wells that have been drilled but left uncompleted (DUC) has declined rapidly in the last 2 years.

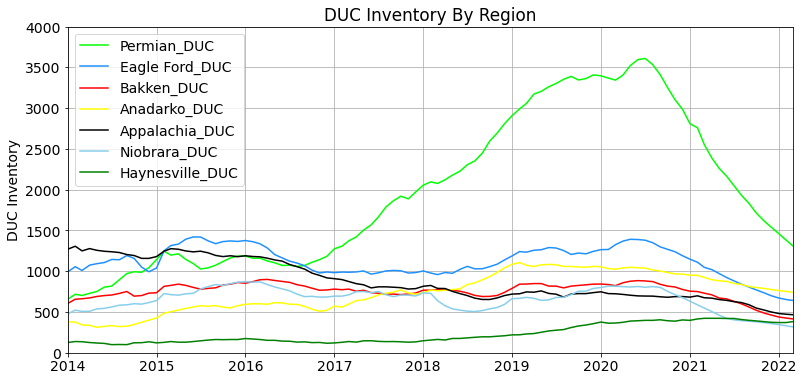

DUC inventory hit a record low of 4273 which is below the 4505 that it hit at the beginning of 2014. The number of DUCs continues to decline rapidly as production is held stable by companies tapping into their inventory. Some CEOs say that the DUCs that are expected to produce the most oil have already been completed and are flowing. It is unclear when companies will run out of DUCs as not all wells can be completed while drilling is ongoing but it is clear that the number of DUCs is below 2014 when oil was $100/BBL and they are still declining.

The Permian accounted for the lion’s share of the reduction of DUC inventory but other shale fields are also experiencing declines as well. The Permian DUC inventory declined from over 3600 DUCs in 2020 to 1309 DUCs today, the Eagle Ford declined from 1392 to 642, and the Anadarko Basin declined from 1049 to 740. Other shale basins saw similar declines but no shale field has fallen below 300 DUCs. Shale basins need a minimum number of DUCs in a field due to Mother/Parent relationships in a field, drill islands, and frac crews not being able to get on a pad while drilling is ongoing.

The rate of decline in the DUC storage has been slowed slighting but is still near record lows. The trend line has become clear in March 2022 and will level off in the future as drilling increases. The previous trend line showed a sharp decrease in inventory as producers opted to drawdown their DUC inventory in lieu of investing in production. This allowed companies to tap into shale wells that were already drilled and did not need much more investment.

The number of drilling rigs has bounced back and the decline in DUC inventory has slightly abated. This slowing of the decline in DUC inventory might also be due to some fields hitting the minimum DUC inventory. If the slowing decline of DUC inventory is due to the industry hitting the minimum number of DUCs in each field then Americans will see substantially higher prices in the future. The DUC inventory will likely stabilize in the near term below 4000 DUCs and if the rig count continues to rise then companies could even replenish the number of DUCs but this will only stabilize high prices.

Solution

Oil prices will remain high even with a rising rig count as the DUC inventory, crude storage, and the SPR all near record lows. DUC inventory is unlikely to rise in the near term and crude storage may rise in the beginning of the summer, but the extra crude from the SPR will probably be exported to Asia or Europe.

President Biden’s administration is stuck between sluggish production, record-high exports, and rapidly declining storage. Democrats need to decrease oil and gas prices to save consumers from higher diesel and gasoline prices as they try and tame inflation with higher interest rates.

President Biden cannot count on Saudi Arabia’s help with higher exports without the kingdom extracting a heavy price on the administration’s policy goals. Even if the war in Russia ends today, the rancorous relationships between the EU and Russia is unlikely to subside anytime soon.

Russia will likely keep fighting in the Ukraine even as losses mount. Fighters from around the Middle East including Iran, Syria, and Libya have already been found in the conflict and their numbers will likely grow as the war drags on for months if not years. The administration tried to look toward Venezuela for future oil production but uproar in the US pushed them away from such a policy move. The administration also cannot approach Iran as demands in the Nuclear Deal are already beyond the scope of what the President is willing to sacrifice.

Germany finally dropped opposition to banning Russian crude imports to the EU. America’s exports will attempt to make up for the loss of crude as the EU tries to diversify its imports of energy. President Biden’s policy goals are still a decade away from being enacted and his relationship with producers is disappointing at best. He could remove the current Interior Secretary and install someone that is more approachable to the oil industry while taking flak from the environmentalists in his party. This will be tough for his reelection campaign but will help tame inflation while saving the housing market as it collapses under the weight of higher interest rates.

The administration could attempt to use taxes on oil to reduce consumption and imports while using the tax money to fund its lofty environmental goals. The Biden administration could accept higher prices and tariff crude imports up to $100/BBL and exports over $100/BBL. This would set a standard for prices and help the environment at the same time. This would have the benefit of bringing much needed review that could be used for environmental projects, stabilizing energy prices, and setting an expectation for future prices so American producers could confidently invest in American energy infrastructure.

The current administration is struggling with inflationary pressure but has few options due to market forces and geopolitical pressure as well as declining inventories. Adding wind turbines and solar panels will help reduce the reliance on crude oil but those goals are still a decade away from completion and will do little good in the short term.