Home prices continue to reach records as interest rates climb to highs not seen since the 2008 financial crisis. The Federal Reserve is beginning to transition between Quantitative Easing (QE) and Quantitative Tightening (QT) so it can push interest rates higher in order to combat inflation. QE was able to combat recessionary pressures that occurred as businesses laid off millions of workers during the early days of the pandemic. While QE was able to stave off a recession, this loose monetary policy continued for 2 years as low-interest rates and a record number of stimmies caused inflation to reach highs not seen since the 1980s.

Home Price Growth

The Case-Shiller National Home Price Index measures the growth rate of single-family home prices in the United States. Home prices grew by 19.8% YoY in February which is a higher rate of 19.1% YoY seen in January. The index has a base value of 100 which was started in the new year in 2000 and has measured home price growth for over 20 years. Median new home prices rose to $436.7k in March which is up from $421.6k in February. Median existing home prices rose to $375.3k in March which is up from $359.3k in February.

Home prices are set to tick higher as more buyers rush into the market to lock in low-interest rates. The Case-Shiller Index takes into account deals that have already closed so there is a lag of a few months which distorts this index. The number of home buyers should decline in the coming months but home prices may remain high due to a lack of inventory and high investment from private equity companies.

Interest Rates

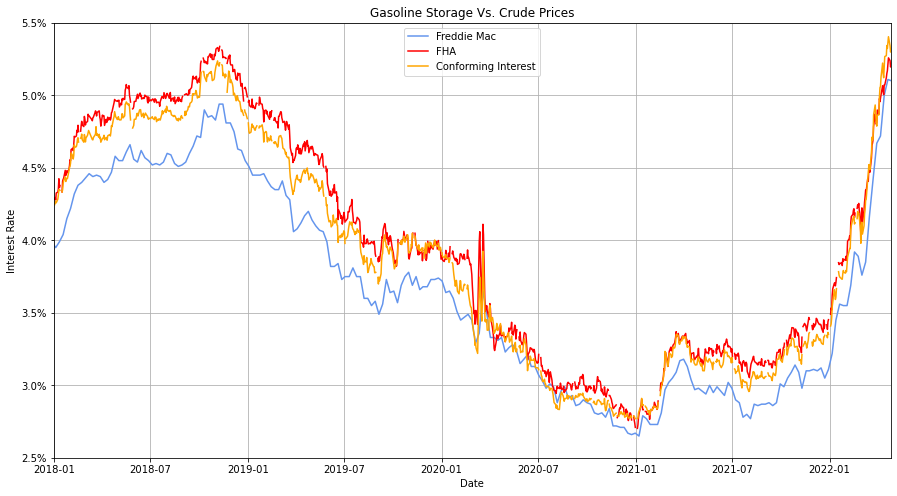

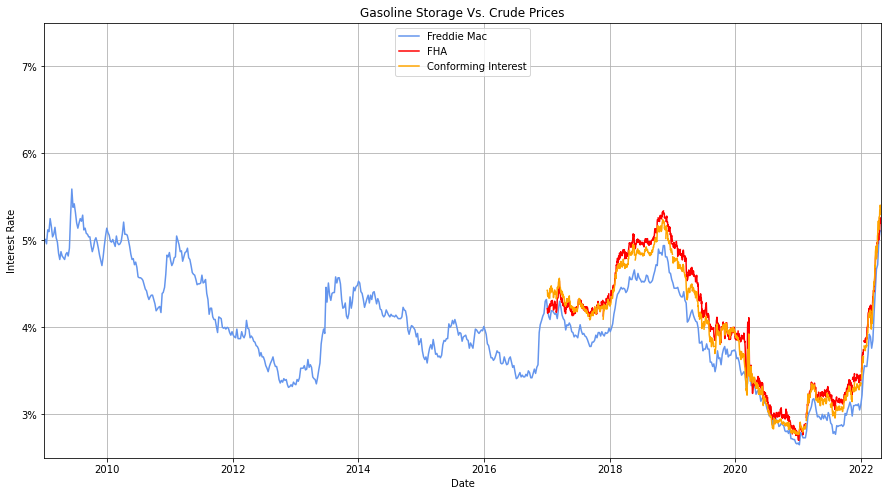

Interest rates reached lows not seen since the 2008 Financial Crisis as the pandemic spurred the Federal Reserve to boost the economy. Rates reached an average of approximately 2.7% at the end of 2020 in an effort to spur home buying. These low rates had the desired effect as millions of people and private investors bought homes at a record pace.

Rising interest rates picked up speed in 2022 when the Fed announced that inflation was no longer transitory even as inflation was reaching 7% and was rising quickly. Inflation is currently at 8.6% but this figure neglects to consider several factors that keep this rate artificially low. Keeping the official CPI artificially low is an attempt to reduce Social Security payments which rise with official inflation numbers or i-bond interest payments that also pay interest rates based on the CPI.

To combat inflation, the Federal Reserve raised mortgage interest rates to an average of approximately 5.4% which is up from an average of approximately 2.7% during the height of the pandemic in 2020. This is the highest it has been in a decade and is close to a 2009 high of 5.59%. A higher interest rate prices out several home buyers as a 2.5% interest rate rise on a $300,000 could add more than $700 a month when prices rise to 5.4%. This prices out buyers who struggle to obtain a mortgage as banks refuse to lend to borrowers on a lower economic scale. This leads to a lower number of home buyers and eventually reduces home prices if private equity companies refrain from buying up excess supply.

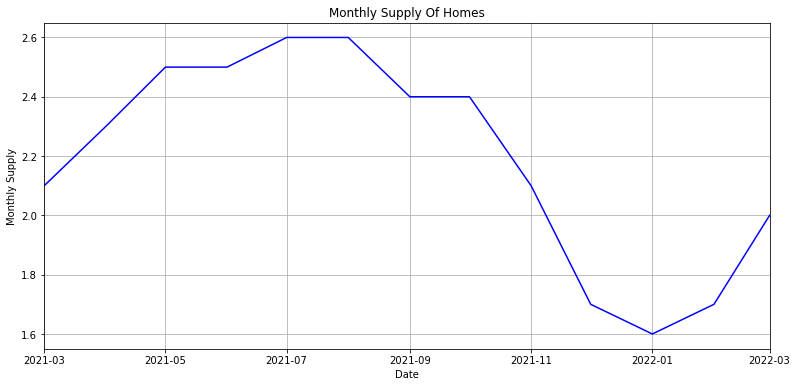

Monthly Supply

The monthly supply of homes ticked up from a record low of 1.6 months in February to 2 months in March. This is still well below a healthy monthly supply of homes and highlights the imbalance that has occurred in the housing market since interest rates fell below 3%. Housing starts are rising by 3.9% YoY and residential permits are up 6.6% YoY which is below historical norms but still above what they were during the height of the 2008 Financial Crisis.

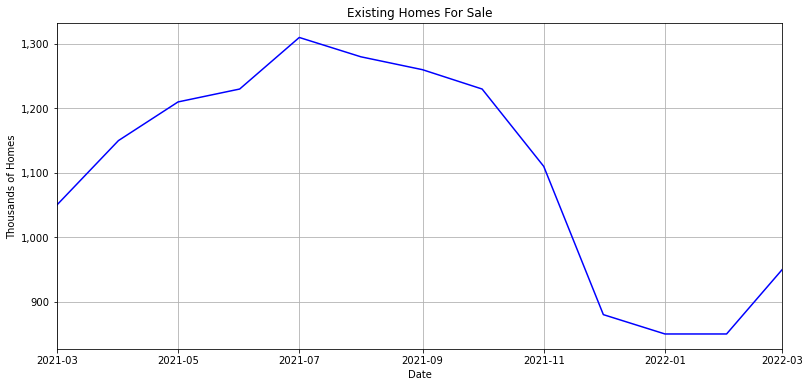

Existing Home Sales

Existing home inventories rose to 950k in March from 850k in February. This is down from 1.310 million homes near the end of 2021 but has been rising in the past few months. Existing home sales fell 4.5% YoY in March and are down -2.7% from February.

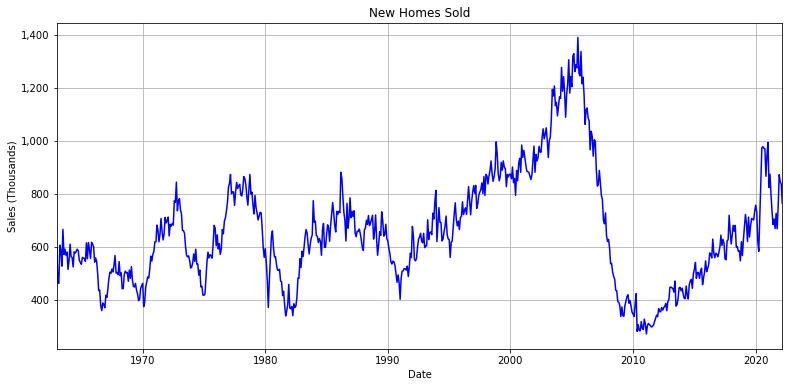

New homes Sold

New home sales fell to 763k in March from 835k in February. This is down from approximately 1.4 million homes in 2005 before the housing crisis crippled the economy and is below 993k homes sold at the beginning of 2021 as the current housing market peaked. This number is expected to continue to decline as interest rates continue to rise.

Existing Homes Sold

Existing home sales have dropped to approximately 5.77 million homes in March which is down from approximately 5.93 million homes in February. This is down from 6.49 million homes at the beginning of 2022 which could be an indication of a larger trend or it could be that there are not enough existing homes for sale. Since the monthly housing supply is extremely low, the housing market is still relatively healthy but a trend could be forming as many buyers are priced out of the market.

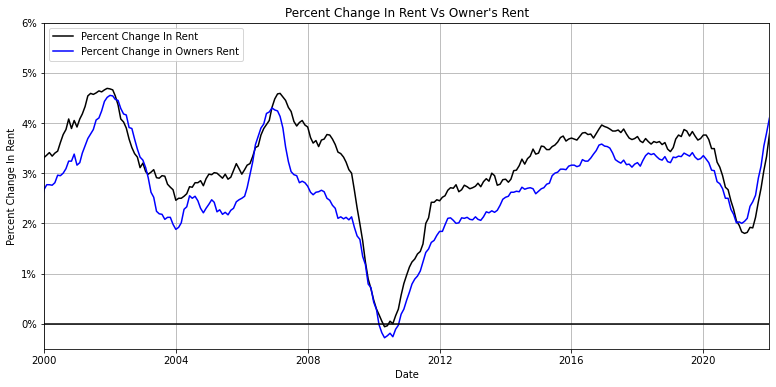

Percent change in rent

Rent has been rising as home prices continue to rise across the country. The CPI is calculated using an Owner’s Equivalent Rent rather than the actual rise in home prices. Owner’s Equivalent Rent (OER) is what a home would rent for vs the actual change in home prices. Rents typically rise at a slower pace than home prices as many states and cities have a cap on the amount rents can rise over a year. OER undermines the official CPI inflation but helps the US save on Social Security payments as well as interest payments on bonds.

Owner’s Equivalent Rent is rising at a faster rate than actual rental prices because owners of rental properties are confident they can charge more for their property. This is because QE flooded the market with dollars while lowering interest rates to historic lows. which led to higher home prices. This rise in OER will only add to inflation at a time of rising commodity prices, salaries, and services.

These barometers are an indicator that inflation is unlikely to subside unless the Federal Reserve completely collapses the economy. The Fed raised interest rates by 50 basis points which is in addition to 25 basis points it raised last time it met. This will do very little to combat the effects of QE as Americans are still spending at record amounts and home prices continue to rise in the future. If rising interest rates are any indication in the change in home prices, home price growth will continue to rise albeit at a slower pace. This will dash the hopes of investors and the Federal Reserve who hope that inflation will come down in the future.