The Federal Reserve continues to raise rates to combat inflation that has grown out of control. The Fed has wavered on its commitments to raise rates by 50 basis points at each meeting this year but its sudden shift from Quantitative Easing to Quantitative Tightening indicates that it is prepared to fight inflation. Some of the challenges the Fed is facing is the excess liquidity and a white-hot housing market brought about by QE. The Fed is also struggling with higher energy prices as gasoline and diesel prices have skyrocketed.

Recent Price Changes

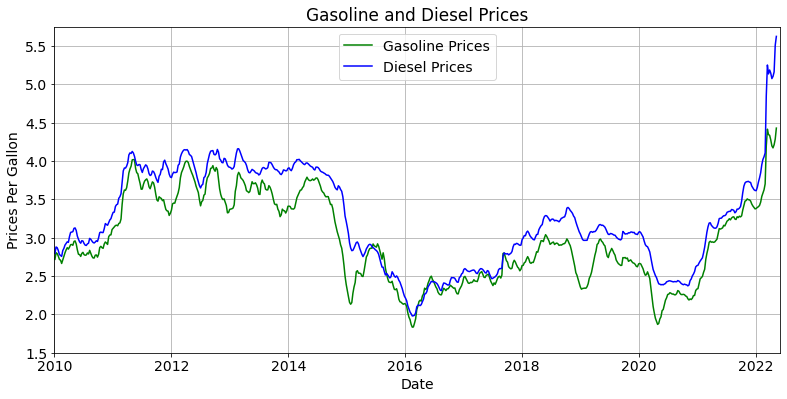

Prices for crude, diesel, and gasoline have skyrocketed since President Biden was elected. Energy traders have watched the administration appoint politicians that were intent on shifting the country away from fossil fuels without providing an alternative energy source capable of powering the energy hungry country. This policy move combined with declining storage and the war in Russia has caused prices to rise.

As a result of higher crude prices, gasoline and diesel prices have risen dramatically since falling in 2014 and early 2020. Diesel and gasoline prices have risen to record highs and continue to rise even further as crude prices have stabilized at approximately $100/BBL. These prices are beyond what they were in 2014 when crude prices were hitting records and look to continue to rise as crude prices slightly retreat.

Crude prices began to rise immediately after President Biden was elected. The vertical red line above indicates when President Biden was elected. Crude prices rose immediately after the announcement as the President ran on banning fracing throughout the country. Prices began to rise even faster as the administration began appointing anti-oil politicians to the Interior Department and throughout the government. These price increases culminated in hitting near-record highs not seen in nearly a decade as Russia invaded the Ukraine.

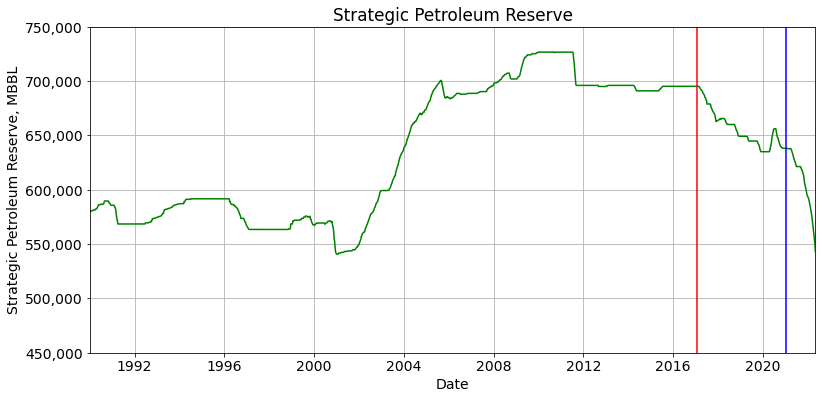

The first vertical line shows when President Biden was elected to office and the second vertical line shows when Russia invaded the Ukraine. It was clear at the beginning of 2022 that Russia was serious about attacking the Ukraine but by then crude prices had already doubled since President Biden was elected into office. President Biden has blamed the increase in crude prices on the Coronavirus, the supply chain, and the war in Russia. Crude prices remained low for the last year of President Trump’s term even as drilling struggled to come back online. Crude traders were sure that the oil industry would benefit from President Trump’s second term and hedged against rising prices.

Storage

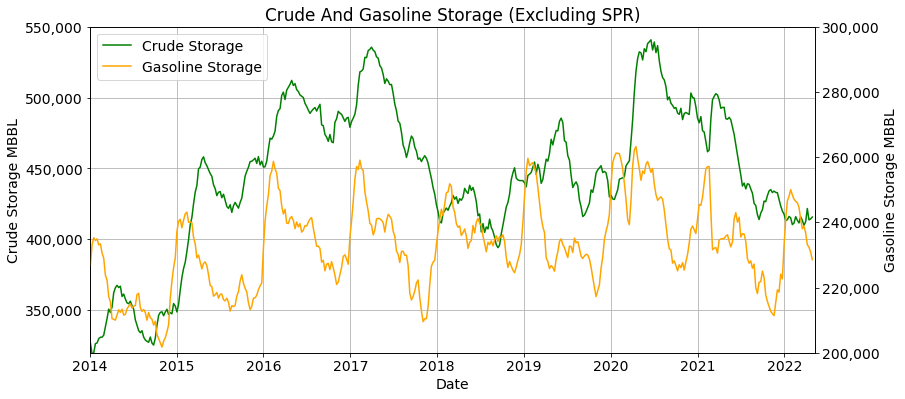

Political pressure to stop drilling in shale fields has reverberated across the industry as storage has been tapped to make up for lost production. Crude storage dropped from approximately 540 MMBBL in June of 2020 to 424 MMBBL on May 6th. This is in addition to the US drawing down the SPR in late 2021. This drawdown caused a bump in storage of nearly 30 MMBBL before continuing to decline in 2022.

If it were not for President Biden tapping the SPR, crude storage would be the lowest it has been since 2014. Even now the president has to drawdown the SPR to keep with demand and storage stable during the summer driving season. The first (red) vertical line shows when President Trump took office and the second vertical line (blue) shows when President Biden took office. Each president was responsible for drawing down the critical storage reserves but the rate of decline has accelerated during President Biden’s term.

President Biden has decided to unleash 1 MMBPD of crude into the open market to keep prices down. This crude may make it to the American market or could be shipped to Asia and Europe as crude exports continue to rise. This may blunt price increases domestically as demand rises in the summer but it may actually cause prices to accelerate.

Crude traders may be concerned about America’s ability to weather a shock to the energy market if something were to happen to Middle Eastern or South American energy production. If drilling does not rise quickly in the next few months the US could see higher energy prices for the next few years.