The Reverse Repo (RRP) market is operated by the NY Fed’s Open Market Trading Desk where financial entities lend money to the Fed, usually overnight, at a rate of 80 basis points each night. This program is an excellent way for the Fed to drain excess liquidity from the financial markets. These entities can also store their excess cash with the government and get reimbursed with higher short-term interest rates than they would with the government bond market. These financial entities are paid in government-backed securities or Treasuries with promises to be paid back at a later date.

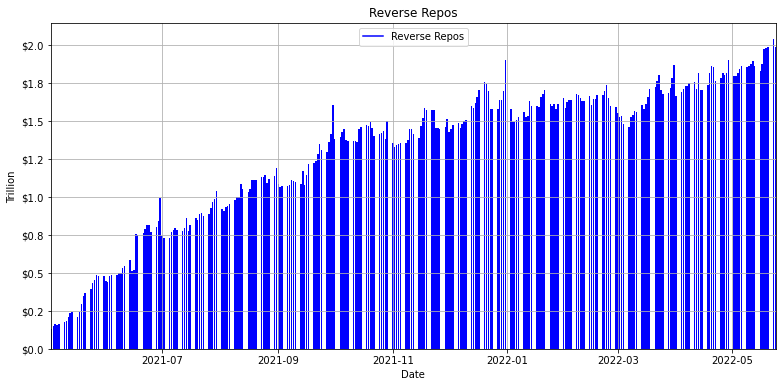

The RRP market has traditionally been quite small. The market rarely had more than $200 billion as banks preferred to lend out excess cash where they could earn interest. The Fed has built up its balance sheet to over $9 trillion today from just over $4 trillion before the pandemic. They did this by asking for money from the Treasury Department and then spending this money on US government debt and Mortgage-Backed Securities (MBS).

This pumped trillions of dollars into the economy which caused inflation and a need for financial entities to find a place to store their excess cash. The Federal Reserve is reducing its balance sheet through Quantitative Tightening (QT) at the same time the government is trying to rely on substantially higher tax revenue and money from the Fed’s QT. This has allowed the government to increase the size of the General Account of the Treasury and reduces the need to issue more debt and short-term Treasury Bills. This pushes investors to find new places to store their short-term cash.

The RRP market has drained excess liquidity from the market as these entities have placed their cash here. The RRP also allows Government-Sponsored Enterprises (GSE) to store their cash before making payments on debt while making a small amount of interest from these overnight deposits. The most common GSEs are agencies like Freddie Mac and Fannie Mae but also include the Farm Credit System or just entities that issue Agency Bonds.

These GSEs affect the RRP market as they regularly put money into the market on the 18th of every month after they receive their principal and interest mortgage interest payments from home lenders. These GSEs then withdraw their cash on the 24th of the month to pay back holders of Mortgage-Backed Securities (MBS).

The RRP market has climbed to $1.99 trillion today from approximately zero dollars in March 2021. While the RRP market is down from $2.04 trillion last week, this market has climbed substantially since the economy was flooded with dollars.

The RRP will grow as the government shrinks the bill supply by 15% through QT. As the Fed’s bond portfolio begins to shrink it is unclear how much money will flow into this RRP market but economists will begin to comment on this if the RRP remains above $2 trillion.

The RRP usually spikes at the end of each quarter and will likely reach record highs at the end of Q2 in June. Investors begin to lend to short-term borrowers once liquidity is drained from the market. The RRP market will drain its funds and will flood the market with cash again. If this happens, the RRP market may buffer any recessionary pressures that affect the market in Q4 as spending is set to drop during a period of near record-high inflation.