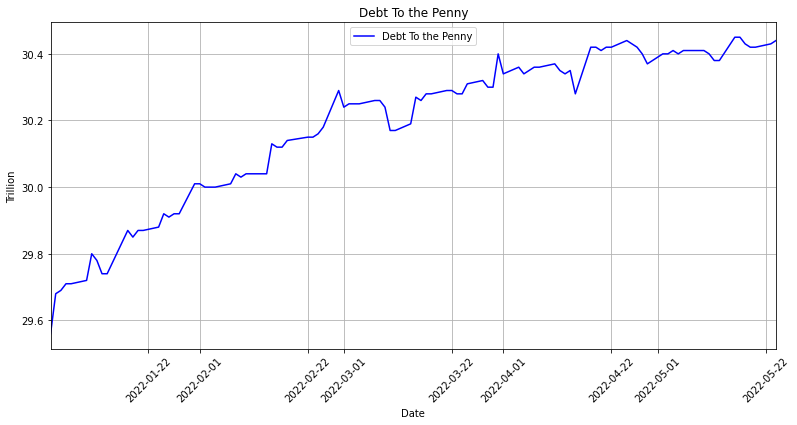

Federal debt has remained at approximately $30.44 trillion for the last few months as tax collection has risen in recent months. The debit is up from $28.43 trillion at the end of 2021 and is up from just over $23 trillion at the beginning of the pandemic in 2020. The last 2 years has seen $7 trillion being added to the current federal debt. This number is staggering compared to even the 2008 financial crisis. The Federal Reserve bought most of the new debt that was issued during the pandemic and its balance sheet rose to $8.9 trillion.

The Fed has been reinvesting the proceeds of maturing securities into new bonds to keep the total amount stable. It has now said that it will begin to passively unload these investments as they mature by not reinvesting the proceeds. In the long run, Chairman Powell will likely want to hold onto Treasury securities while letting Mortgage Backed Securities (MBS) roll off its balance sheet because rising rates will likely cause the Fed lose money on new MBS.

Money has been created out of thin air to buy the debt of the Federal government and when these bonds mature, that money will disappear just as easily. The Fed electronically credits money to the accounts of bond dealers who sell mortgage backed securities or Treasurires. The Fed creates bank deposits, reserves, that show up in the account of the seller that are erased when the bond matures. Rates will rise as these securities and Treasuries are dumped on the market due to more competition for less investors.

The Federal Reserve will begin QT in June at a rate of $47.5 billion a month. This is a sharp turnaround from December when Chairman Powell said that inflation was transitory. Before the pandemic struck, the Federal Reserve was in the middle of Quantitative Tightening (QT). It did this by letting assets fall off its balance sheet as the economy rebounded from the 2008 financial crisis from 2017 to 2019. The Fed was letting $50 billion a month roll off its balance sheet in 2019 and that amount was split between $ 30 billion in Treasuries and $20 billion in Mortgage-Backed Securities (MBS). Now the Fed will start scaling back its purchases of MBS and Treasuries by $95 billion a month in September. This is nearly twice the speed during the last round QT that occurred from 2017 to 2019. The $95 billion will come from $60 billion in Treasuries and $35 billion from MBS.

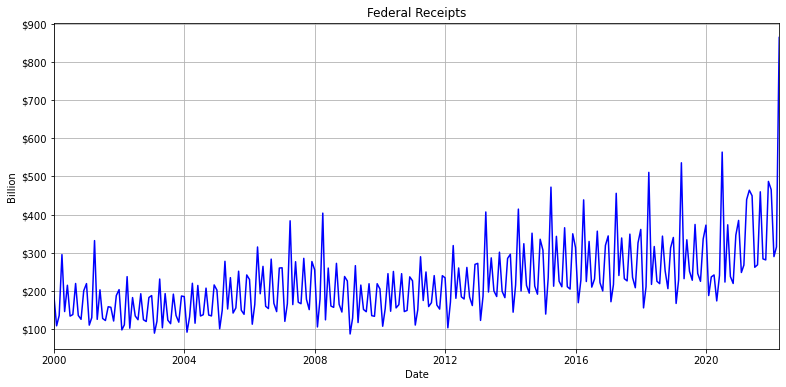

Federal Receipts

The Federal government recorded a record inflow of cash totaling $864 billion in the month of April. This is up from $315 billion the month before and a huge increase from the $87 billion collected in February 2009 during the pandemic. While this spike represents a major increase from the months before, the government should not assume this will be the norm.

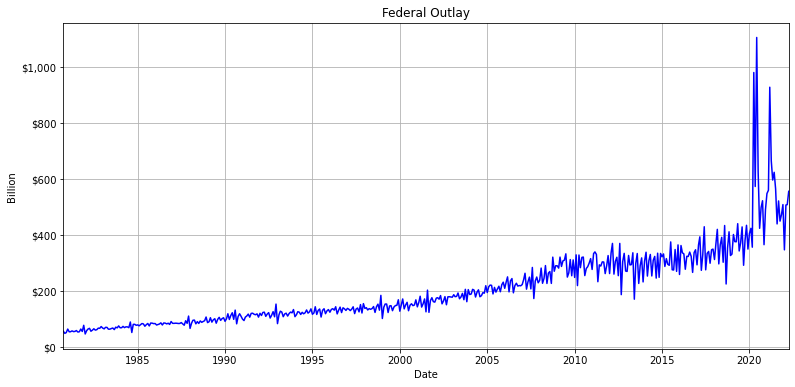

Federal Spending

Federal spending totaled $555 billion for the month of April which is up from $508 billion in March. The Federal government spent over a trillion dollars a month during the pandemic to support the economy. This spending included multiple stimmies that covered multiple personal checks sent out to everyone in the US (including prisoners and non-citizens), PPP loans, ultra-low interest rates, and other spending.

The Fed is paying out approximately $400 billion in interest each quarter as it takes on more debt but inflation is rising faster than interest payments on that debt. Inflation has been rising at officially approximately 9% but the federal government has been collecting more in revenue as workers make more money.

The $555 billion a month in spending is dramatically higher than the $400 billion a month spent before the pandemic in 2020. The level of spending was unsustainable before the pandemic but the current level of spending that is over $100 billion more than normal is causing inflation to rise at dramatic levels. The Federal Reserve hs been raising rates that could potentially push the economy into recess to combat this higher inflation. The Fed is also seeing high demand for short-term treasuries as major investors look to find stable investments for their capital.

The Federal government will have to raise funds to continue this spending in the long-term. This new revenue could include higher taxes for business which would make them less competitive internationally or closing tax loopholes for the rich would be politically difficult especially when President Biden’s poll numbers are barely remaining above 40%. One thing the Biden Administration has been doing to raise money is selling up to 1 million barrels of oil a day from the SPR.

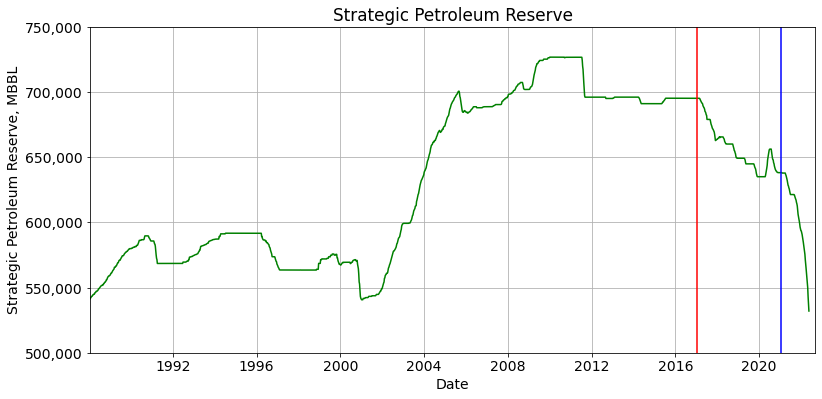

Strategic Petroleum Reserve

President Biden has begun to draw down the SPR as crude prices skyrocketed and inflation has been crippling the economy. The administration has been trying to flood the market only to see the extra crude being shipped to Europe and Asia.

President Biden has said that he will draw down the SPR by 1 million barrels of crude oil per day during the summer. This has failed to curb higher crude prices as prices have risen by $7 in a single week. Industry officials say will push gasoline prices up to $5 a gallon in the summer but this is unlikely to change even if President Biden does try to flood the market. This is a major revenue source for the government as crude prices are hovering just below $120 a barrel.

President Biden is desperate to bring down inflation or change the narrative as Americans are running out of savings. Officials and industry leaders have said that consumers will run out of money in 6 to 9 months as they have been dipping into their savings to make ends meet. One of the largest price increases has come from higher oil prices which impact transportation, plastics, and a range of other items.

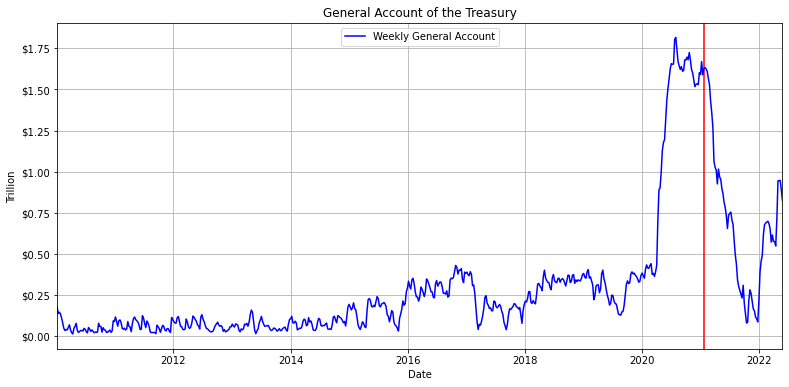

General Account of the Treasury

The Biden administration is in no need of money as it is receiving record amounts of cash in taxes and has built up the General Account of the Treasury (GTA). President Biden drew down the GAT when he got into office in January 2021, the red line above. After the Presidnet drew down the treasury to nearly zero. Congress passed a stop gap bill to continue to fund the government until they could decide a budget even as the account was drawn down from record highs.

President Biden flooded the economy with dollars and that combined with the impact other simmies boosted inflation. The Federal government will continue to run deficits even as inflation is raging throughout the economy but may struggle to find new sources of revenue if a recession were to happen. The government would not be able to lower interest rates or pump more dollars into an economy where the government admits the inflation is already 9% let alone actual inflation. Hopefully the government can find a way to reduce waste during the coming recession which will reduce spending an in turn reduce inflation. If this were to happen then the dollars can go where they are needed most without pumping random dollars into the economy to keep it afloat.